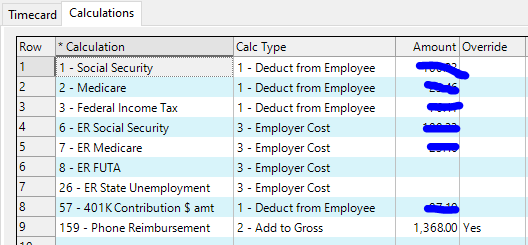

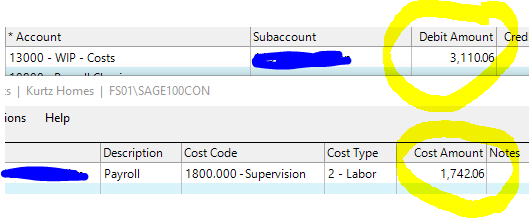

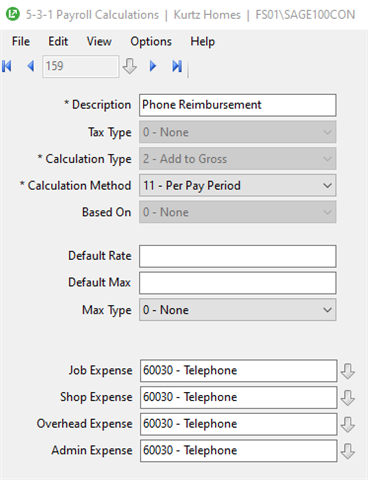

Whenever I reimburse an employee for a non-related expense through payroll, it adds the amount to the WIP account (which it shouldn't) - but then creates a job cost without the amount added in. This makes my general ledger WIP amount for that job out of balance with the job costs. How can I set up a reimbursement payroll calculation so that Sage won't inlcude the reimbursement in WIP? And how can FIX my WIP account that is out of balance with Job costs? The sensible thing is to debit the expense (telephone, in this case) and credit WIP. The problem is, it then insists on creating a job cost, but #1 - the job cost doesn't need fixing and #2 - it doesn't fix the problem of WIP being out of balance with job costs. Sage correctly won't allow you to save a transaction when the job costs don't balance to the WIP amount - but it does this on it's own in payroll. This should not be allowed.

Sage Construction & Real Estate

Welcome to the Sage Construction and Real Estate products Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Sage 100 Contractor General Discussion

Journal entry error when reimbursing employee through payroll