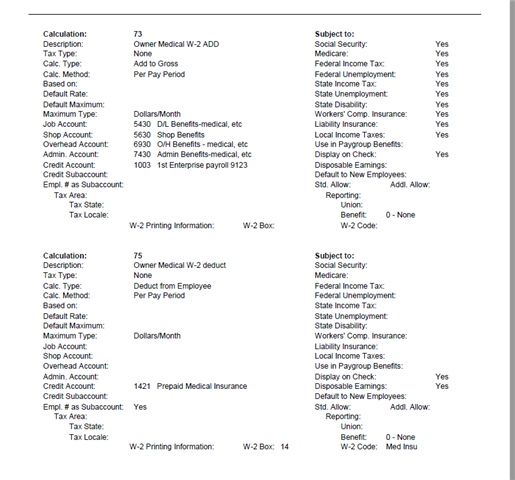

I have been told that an officer of our company will be receiving income on an annual basis from an Officer Life Insurance policy that was purchased for him. Has anyone dealt with this? If so, how is it disbursed to the employee? Is it ran through payroll as a "bonus" check and show up on his W2? Or is it ran through AP and generate a 1099R? Any help would be greatly appreciated!!

Sage Construction & Real Estate

Welcome to the Sage Construction and Real Estate products Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Sage 100 Contractor General Discussion

PS 58 costs