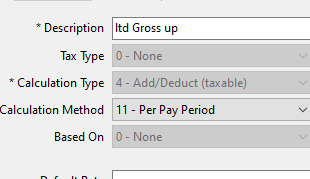

How can I calculate life insurance as taxable wages and part of the total gross wages that the 401K calculates? This would be the same for the employee match? For Example an employee makes $500.00 per week. Life Insurance is $11.31 per week. I need the 401K to calculate say 5% of 511.31, instead of 500.00. Total should be 25.56 per week, not 25.00?

Sage Construction & Real Estate

Welcome to the Sage Construction and Real Estate products Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Sage 100 Contractor General Discussion

life insurance considered gross wages and then deducted, but need 401K calculated off of the total