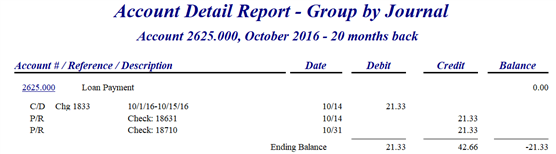

In 2016 we made a payroll check with a deduction of $21.33 for a loan repayment. But we neglected to make a journal entry to debit the account and because it is in a prior year we are unable to make any new entries. I viewed knowledge base article #18022 on how to post a correcting journal entry to a prior year but am unclear how exactly it works. My utility settings are already set to make prior year changes and this is how far i've gotten:

The system will not let me post as you can see the unposted balance is off. I clicked on the "Account?..." for further detail and currently the account shows the negative -$21.33 (the account is normally negative). I just need to add an entry to this account (2625) that was missing from October 2016. Please provide step by step instructions. Thanks!

Currently using sage BW 2018