The 2020.1 Release theme is all about “AWARENESS”, ensuring you know and connect to services that you have purchased and make you aware of services you need to connect to. Productivity and Sustainability are the words that come to mind for this release.

You may be asking yourself as the business owner or user of Sage 50:

- How does Sage aid me and my business in being more productive in my business or day-to-day tasks?

- Does my business have all the “bells and whistles” for sustainability—are we compliant, what have we purchased from Sage that we are not using and “what’s new” in Sage 50 that I need to know about?

We are answering these very questions in the latest release.

From In-Product Discovery [IPD] to CCPA & W-4 Compliance to an added and updated HR Forms module from our partners at Aatrix, Sage 50 is ensuring that you are in the know!

In-Product Discovery [IPD]

In-Product Discovery or [IPD] is a tool inside your Sage 50 product that will help you be more aware of what you currently are connected to. For instance, if you have purchased Office 365 and need assistance with Getting Started you can simply click on the Microsoft Office 365 tile > Click on Activate and then receive a seamless walk-through to activate that connected service or feature. You will see when you perform a specific task that there may be a pop-up or a Gold dot that will show you a simpler or more efficient way of performing a task. All the components of IPD will aid you in connecting to the cloud connected services that are included in your subscription of Sage 50.

At Sage we are shouting from the roof top IPD is here – and it’s time for you to use what you are paying for!

“Stay Ready, so you don’t have to get ready” = Compliance!

Let’s talk about Compliance! Have you ever heard the phrase—“Stay Ready [for anything], So that you don’t have to get ready [for something]! Well that’s Compliance in a nutshell. It’s important for you and your business to be compliant. You have worked hard at your business, and as a provider of one of the most important aspects of your business accounting, you look to Sage as a trusted advisor, so it’s our job to aid as much as we can in the area of compliance.

There are 2 legislations and/or laws that you need to be aware of:

- The California Consumer Privacy Act (“CCPA”) is due to come into effect in January 2020.

- IRS W-4 Form Updates are due to come into effect in January 2020.

The CCPA grants California residents new rights regarding their personal information including: 1) Right to request information about a business’ collection, sale, and/or disclosure of the consumer’s personal information; 2) Right to access personal information collected; 3) Right to deletion of the consumer’s personal information; and, 4) Right to opt out of the sale of the consumer’s personal information.

The CCPA impacts any business with an annual revenue greater than $25M. With penalties ranging between $2.5K and $7.5K per violation.

How can Sage help you?

Education, education, education! Training is available in the format of live webinars, interactive e-learning, and as a bundle that includes both:

- Live Webinar: A virtual, instructor-led training offered in a live format each week. This will also include a Q&A session at the end of each webinar. Plus, get access to a pdf of the course material you can refer to after the training.

- Interactive eLearning: This eLearning subscription can be accessed at any time for the next year from the time you subscribe. Plus, get access to updates and a pdf of the course material!

- Bundle: Choose this package to gain access to a single live webinar session and to receive access to the eLearning subscription for one year. Both assets cover important information you need to prepare for the CCPA. Plus, get access to updates and a pdf of the course material!

We have several customers that have already taken advantage of the training education for CCPA and have found it extremely useful. If you are interested in CCPA training, visit our CCPA Sage University page to sign-up.

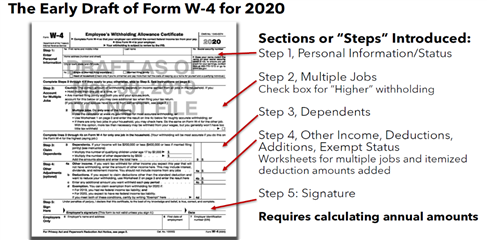

W-4 Form Updates:  The U.S. Internal Revenue Service (IRS) will release a new W-4 tax form that eliminates the concept of Allowances for employees, as a result of legislation passed by Congress with the passage of the Tax Cuts & Jobs Act of 2017. Therefore, the process for computing Federal Income Tax when payroll is run for employees has been altered significantly with the additional information given by employees on the revised W-4 Form.

The U.S. Internal Revenue Service (IRS) will release a new W-4 tax form that eliminates the concept of Allowances for employees, as a result of legislation passed by Congress with the passage of the Tax Cuts & Jobs Act of 2017. Therefore, the process for computing Federal Income Tax when payroll is run for employees has been altered significantly with the additional information given by employees on the revised W-4 Form.

Several new payroll fields on the “Withholding Info” tab of Employee Maintenance records were added and changes to the Payroll Tax Calculator were made to remain compliant with Federal Personal Income Tax Computations for calendar years 2020-2025.

Please make sure you are on the latest version of Sage 50 to ensure these updates populate for you and your business.

The IRS will be hosting webinars directly; here are a few links if you need additional information.

IRS W-4 Resource Links:

W-4 Form Draft: https://www.irs.gov/pub/irs-dft/fw4--dft.pdf

FAQ: https://www.irs.gov/newsroom/faqs-on-the-early-release-of-the-2020-form-w-4

Don’t hesitate to reach out directly if you have questions regarding these 2 legislations or updates; we are happy to help you.

Aatrix – the HR & Compliance Engine!

To date, our Desktop Payroll users typically must hunt for necessary Human Resources forms for properly documenting employee activity, and traditionally, Sage 50 never offered these forms, including entries on the revised W-4 Form used to compute proper Federal Income Tax Withholding.

Do not fear Aatrix is HERE!!

Sage has had a formidable partnership with Aatrix for at least a decade! We have partnered with Aatrix to launch a Human Resource Forms and Compliance Engine that offers a comprehensive set of forms for employee and payroll management. When you take advantage of this service [a nominal fee] you receive easy access to over 80 Human Resource forms to track and document employee activity, which is the best way to avoid costly unemployment claims and other employee related liabilities!

As a Desktop Payroll user, you now have access to a comprehensive list of Human Resource forms which uses the existing application that generates Federal and State Payroll Tax Forms.

Additionally, you can customize any one of the provided forms to your own company’s look and feel, remove fields that may not apply, as well as insert your custom header logo or letterhead into any forms.

And you thought that was it… well that’s not all – what if I told you that Sage 50 now has mapping technology powered by Aatrix that has reduced our Desktop Payroll users steps to create 1099s from 42 steps to 7! That’s right only 7 Steps to complete your 1099s!

Sage 50 US 2020.1 now directly integrates 1099 information with the Aatrix Tax Forms engine, and simplifies the process for you by eliminating the need to manually map the information to the required fields.

Now that’s an ENGINE!

I encourage you to watch the video to learn about the features you asked for that we delivered. The 2020.1 video shows you exactly what we changed based on your feedback. Click to view the following video: https://youtu.be/BUX6YXBqAWo.

Stay tuned for the next release; and don’t forget—keep the ideas coming. Post your feedback, suggestions and ideas here: Sage City Ideation. We pride ourselves in delivering what you need for your business!

Well that’s all folks!

Sage. Perform at your Best.

-

Joe88

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

-

Michelle Lopez

in reply to Joe88

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

Comment-

Michelle Lopez

in reply to Joe88

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

Children