We are excited to announce that the latest edition of Sage 50cloud Accounting is live today! With this release, Sage 50cloud 2022.0 - U.S. Edition, you’ll see enhancements to save you time and help you stay compliant such as:

- Support for state family leave withholding

- Improved banking services integration

- Help when encountering connection issues when accessing your shared company

- Updates to 1099 references

Continue reading for more on what this release offers and view our release videos below to dive into these enhancements.

Support for State Paid Family and Medical Leave

In 2020, the federal government implemented a temporary Paid Family Leave program under the Families First Coronavirus Response Act as part of COVID-19 support programs. Some states have adopted their own permanent Paid Family Leave programs to help cover costs incurred due to current and future medical issues. These states include Connecticut, Washington D.C., Massachusetts, New Jersey, New York, and Washington, with additional states coming in the future.

In this release, we’ve developed new functionality that allows for this new withholding as part of other state taxes withheld. We are expanding the fields available to accommodate state specific family leave withholding, both for the current states as well as allow us to include additional states in the future. For a simple experience, when setting up a new company, users can select a Family Leave state during the Payroll Setup Wizard to populate new Family Leave withholding fields for both employee and employer. This process will setup the new Sage maintained payroll formulas to calculate each states specific withholding amounts.

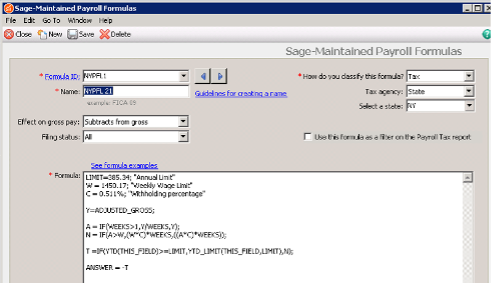

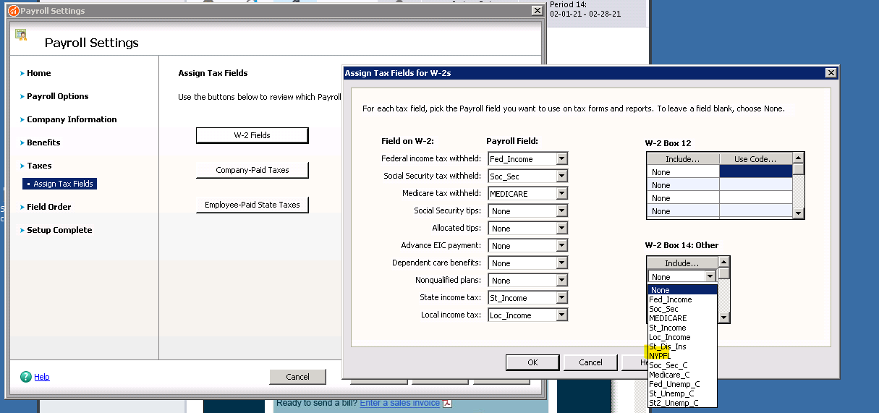

Pre-installed Sage Maintained Payroll Formulas.

Example showing New York Paid Family Leave when setting up W-2 Payroll fields.

To learn more about this functionality and view articles specific to your state(s), check out our State Paid Family and Medical Leave (PFML) Enhancements in Release 2022.0 Knowledgebase article. Note that we had previously provided a workaround for calculating withholding in New Jersey. Because many customers have been using these calculations, we will be rolling out the new functionality for New Jersey at the year end. This will allow users to make a clean transition to the new functionality at the beginning of the new year.

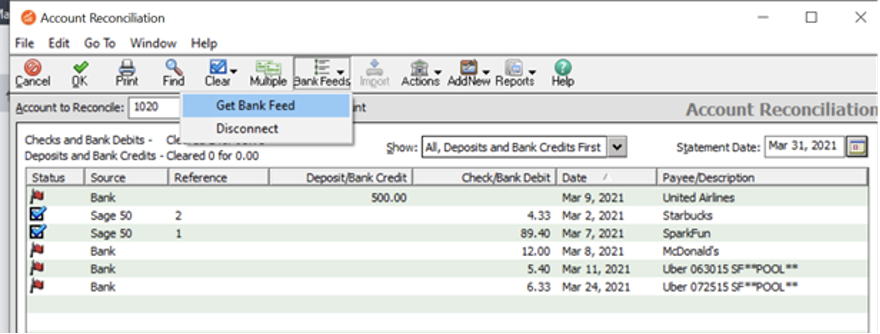

Improved Banking Services Experience

With this enhancement, we’re delivering you a better experience when connecting directly to your bank accounts. Direct connections, also known as Bank Feeds, allow you to download bank transactions and reconcile accounts, eliminating the cumbersome process of downloading and uploading transaction files. In this release, we’ve made updates to enable a faster, more reliable connection. New users will have a simple onboarding experience when adding banks to quickly be able to download their bank transactions. To take advantage of the update, existing users will need to migrate to the new service. Existing users will be walked through a simple, one-time conversion to the new services.

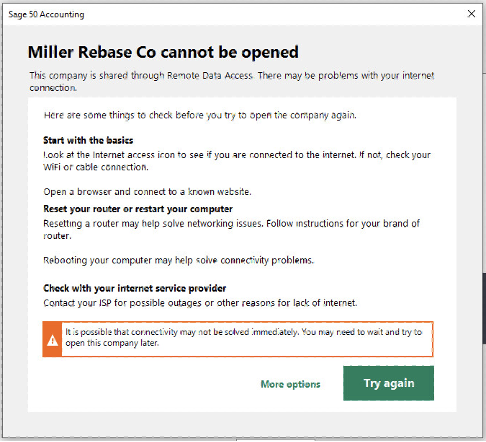

Know When You Are Offline, and Keep Doing Your Job

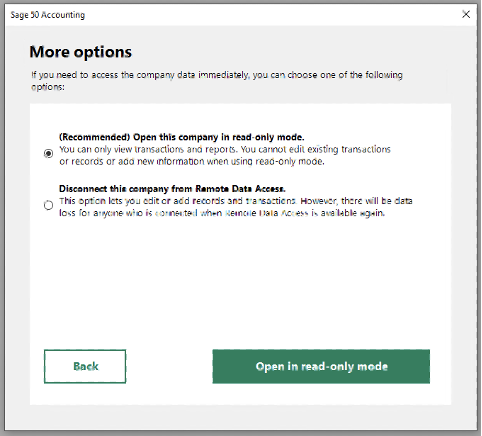

We’ve all been there, especially this past year. You’re hard at work on a shared company when suddenly something happens to your internet or connection. In this update, we’ve released a feature to help you through it. This new feature will show you what the problem is and give options on steps to remediate the issue. If you are experiencing a lost internet connection, you’ll receive guidance on how to fix the problem. If the problem is related to a Sage services outage and if a fix is not immediately available, you can now access your company files while offline, in read-only mode. If you need immediate access to your company, there are also options to open the company for editing purposes.

Updates to 1099 References

For 2020 tax reporting, the IRS redesigned Form 1099-MISC and changed the box designations. They also reintroduced Form 1099-NEC to be used for reporting non-employee compensation. Although we addressed the reporting changes last year for the 1099-MISC and 1099-NEC to ensure that the filing was correct, we did not have enough time to make these changes in the descriptive fields in Sage 50. In this release, we have now changed the 1099 default settings and box designations reflect the correct forms on which this data is reported.

We’ve Rebranded Sage ID: Sage ID Now Referred to as Sage

You may notice with this release that we’ve updated a few screens and banners to remove the term Sage ID. Instead of being asked to enter your Sage ID, now you’ll be prompted to enter your Sage email address, or your Sage account details. We’ve decided to deprecate the name “Sage ID” because the login experience across your Sage services is a fully integrated and built-in part of your experience. You’ll still get the simplicity and security to access all your connected services with a single login. And you’ll see enhancements such as new self-service features and authentication protocols for enhanced security. We’re just no longer using the name ‘Sage ID’.

Looking Ahead to the Future

Your feedback is invaluable to the Sage team and is at the heart of our product releases. We will continue to add product enhancements based on your feedback in the next release. Until then please keep sharing your feedback, suggestions, and product ideas in the Sage City Sage 50 Ideas area.