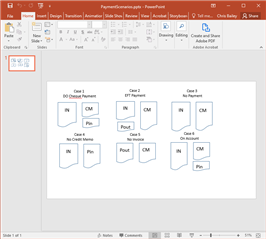

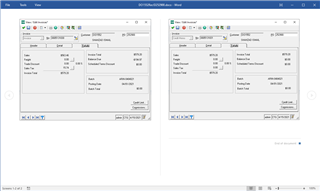

I have been able to successfully import an Invoice batch of customer statements from a subsystem into Sage 500 AR and then post this batch. This batch consist of driver account invoices (fees and charges) and offsetting credit memos (redeemed CC script, etc.). Naturally these driver accounts statements individually balance enabling the posting. I was able to proceed to the point where the credit memos need to be applied. This then presents a problem, since the batches include the EFT payments, cheques and on account credits, so in some cases the credit memo amount exceeds the invoice amount. This is a "no go" in Sage. Alternatively we can't just leave the credit memos unapplied because process would not be complete and we eventually want an aging of these receivables in Sage.

It has been suggested that I split out the EFT payments, cheques, redeemed CC script and on account credits and post them as a separate Payment batch. I prefer the first approach because it keeps everything together, however, in that we have hit a roadblock in Sage, the second idea has merit. Has anyone else attempted to do this and had some success?