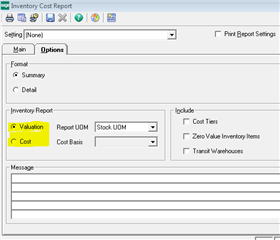

What is the difference between the Inventory Cost report and the Inventory Valuation report? Why is there an option for both Cost and Valuation in the Cost report?

The differences between the Inventory Cost and Inventory Valuation reports are primarily functionality.

- The Cost report is a snap shot of the cost or valuation at the point in time at which the report is run. If Valuation option is selected the report will calculate the value of inventory based on the cost tiers only (looking at timCostTier table), so this is the actual value. If Cost option is selected a Cost Basis must be selected and Sage 500 will calculate the value of inventory by multiplying current quantity on hand and selected cost, so this is basically an estimate.

- The Valuation report allows the user to determine the inventory value according to a specific date range with transaction date and post date selections. This function is primarily used to reconcile the inventory value with the General Ledger or Inventory Transactions report since it contains historic and transnational information on cost tier activity against an inventory item.

Cost related tables used for costing report:

timCostTier

Cost related tables used for valuation report:

timInvtTran

timInvtTranCost

timInvtHist

timInvtFiscPerHist

timInvtCalPerHist