There are two types of job-related transactions. One is done within the Project and Job Costing module ( in PJC transactions folder). The other one is done outside of PJC module and it’s a job-related transaction.

Now we are going to talk about these two types of transactions, then, we’ll show you how to reverse them from PJC.

- Let’s do a PJC Costs transaction in PJC Transactions folder. Users can use the PJC Costs screen to post miscellaneous cost transactions without affecting Accounts Payable for any project category or resource category in a contract.

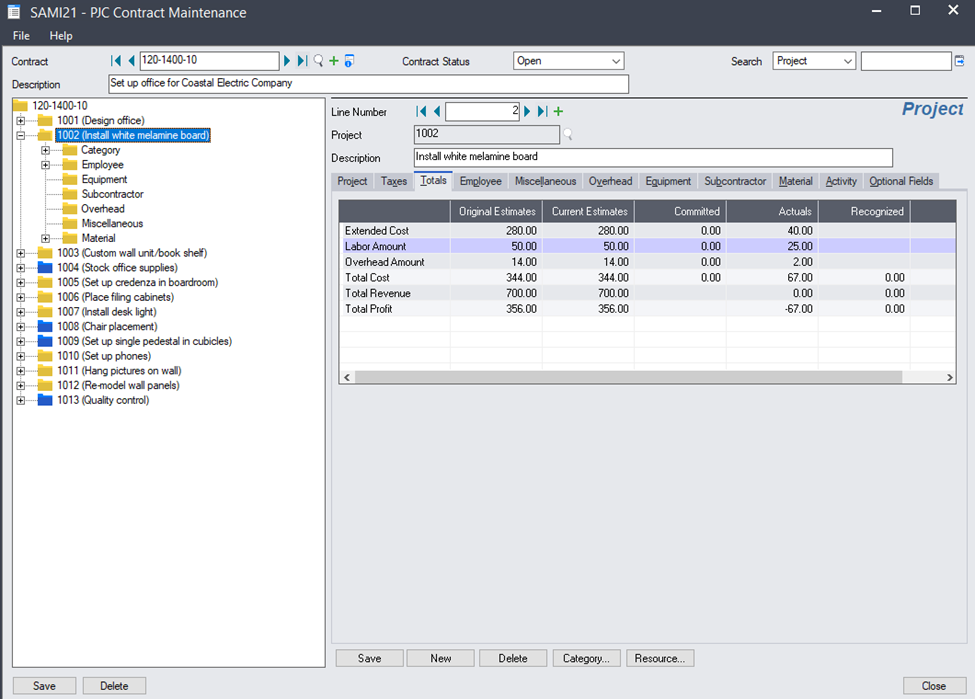

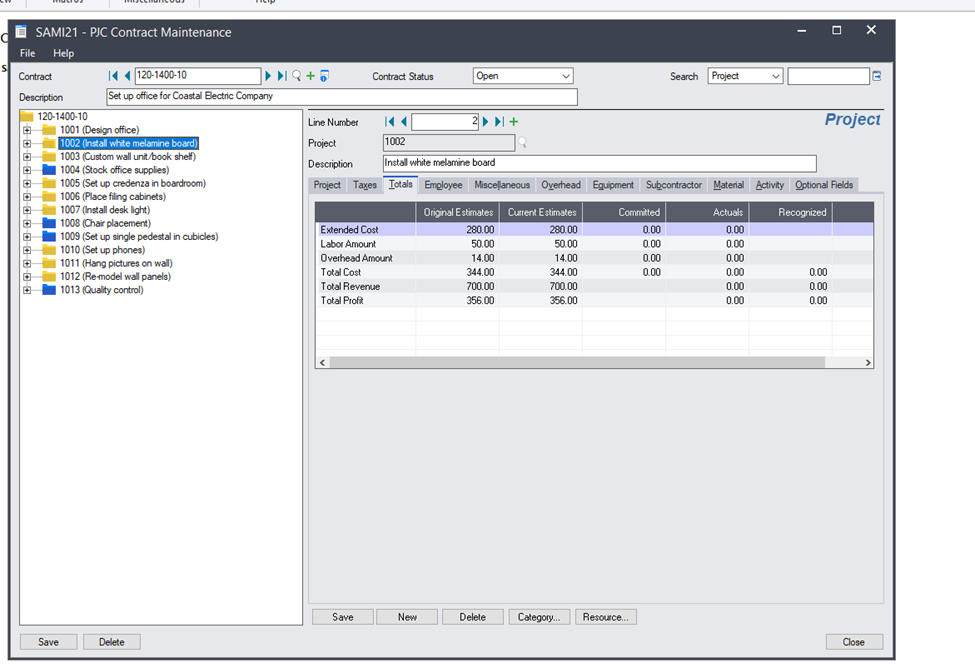

2. After the PJC Costs transaction is posted, the Actuals column of this job in PJC Contract Maintenance will be updated by the PJC cost transaction.

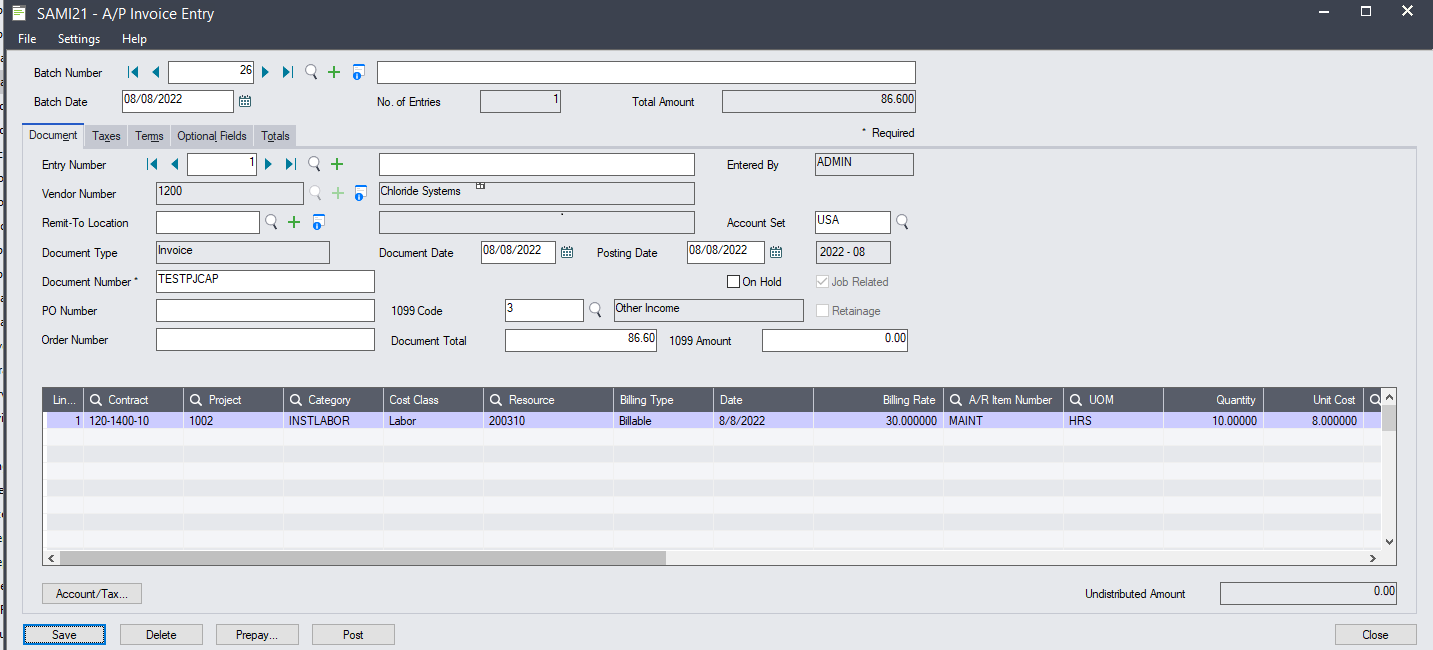

3. Create an A/P job related invoice for the same job called TESTPJCAP.

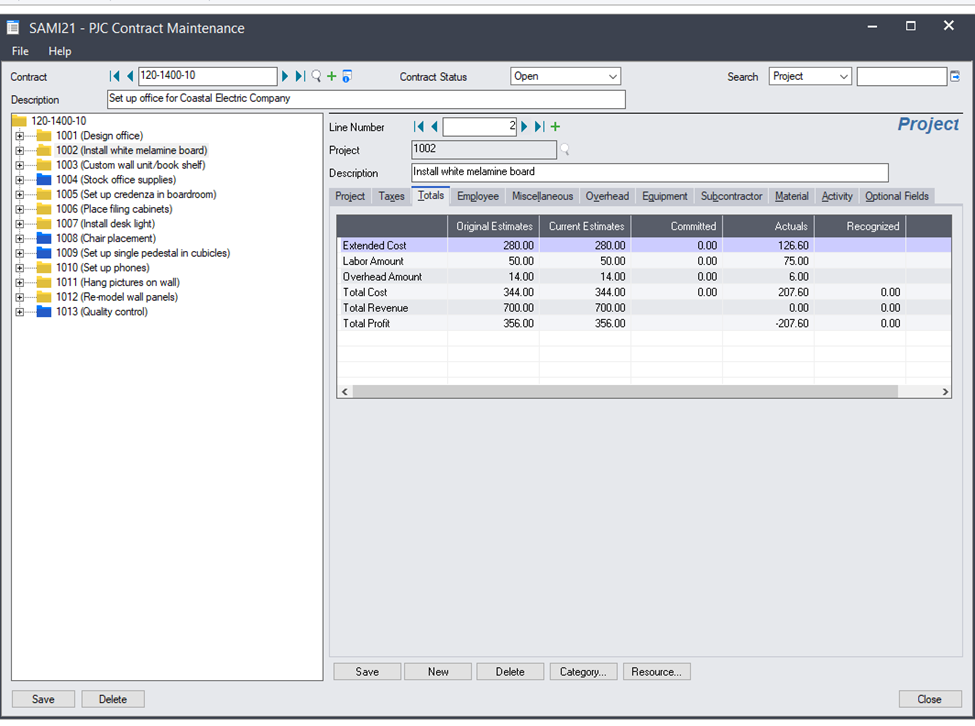

4. Create an A/P payment against the AP job related invoice and the Actuals column in PJC Contract Maintenance will also be updated by the job related AP transactions.

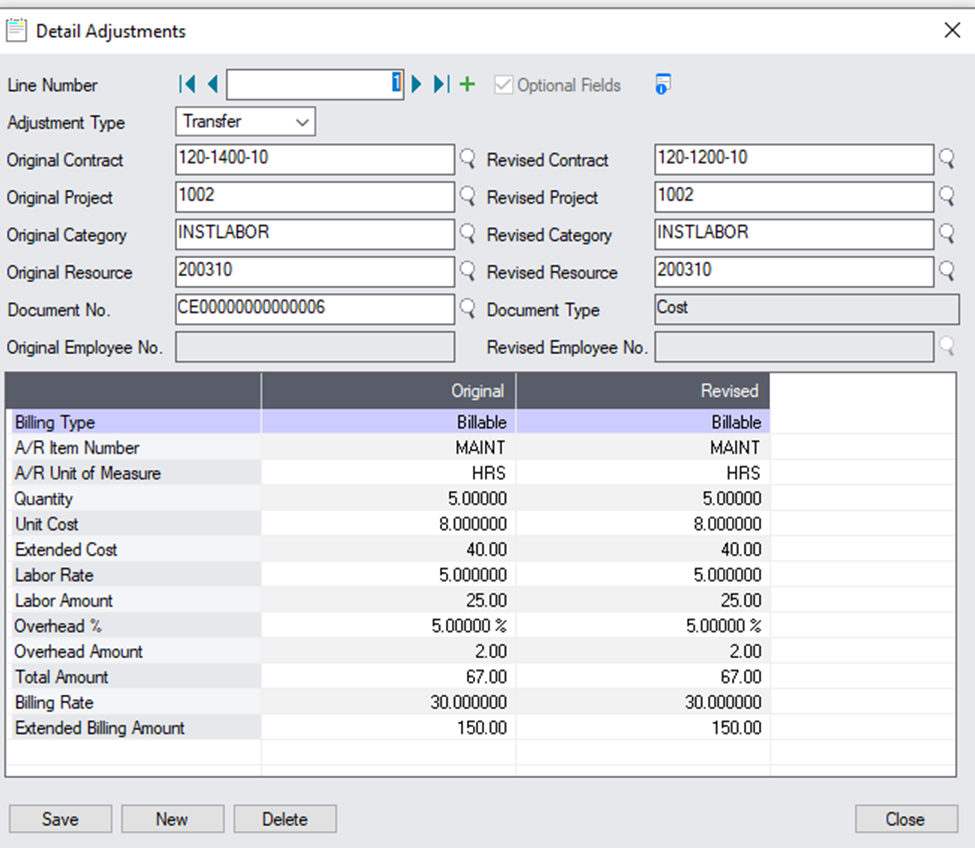

Now if we want to reverse the PJC cost transaction, use PJC Adjustments in PJC Transactions folder. There are 2 types of adjustments you can do. One is Adjustment and the other one is Transfer. The PJC Adjustments screen to adjust or transfer timecard, equipment usage, material usage, material return, cost, or charge transactions that you have posted in Project and Job Costing. You can:

- Adjust the A/R item number, unit of measure, unit cost, quantity, extended cost, and billing rate.

- Transfer a transaction to the correct contract, project, or category, if the original transaction was posted incorrectly.

To adjust transactions originating in another Sage 300 program, use that program. We can show you how to reverse these two transactions in the program.

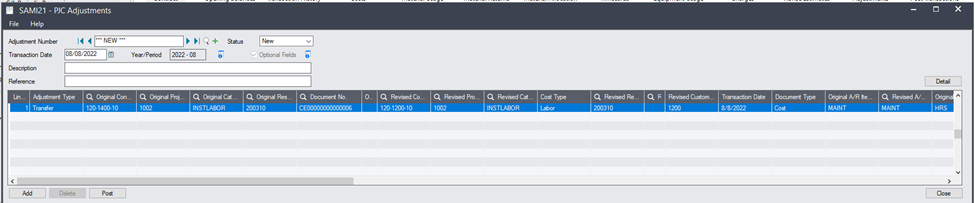

5. Use PJC Adjustments to transfer from 120-1400-10 / 1002/ INSTLABOR/200310/CE00000000000006 to 120-1200-10/ 1002/ INSTLABOR/200310 if the original amount from the PJC cost transaction was posted to the wrong job and needs to transfer the amount to the correct job.

After the PJC transfer from120-1400-10, the Actuals amount was taken out and transferred to the correct job.

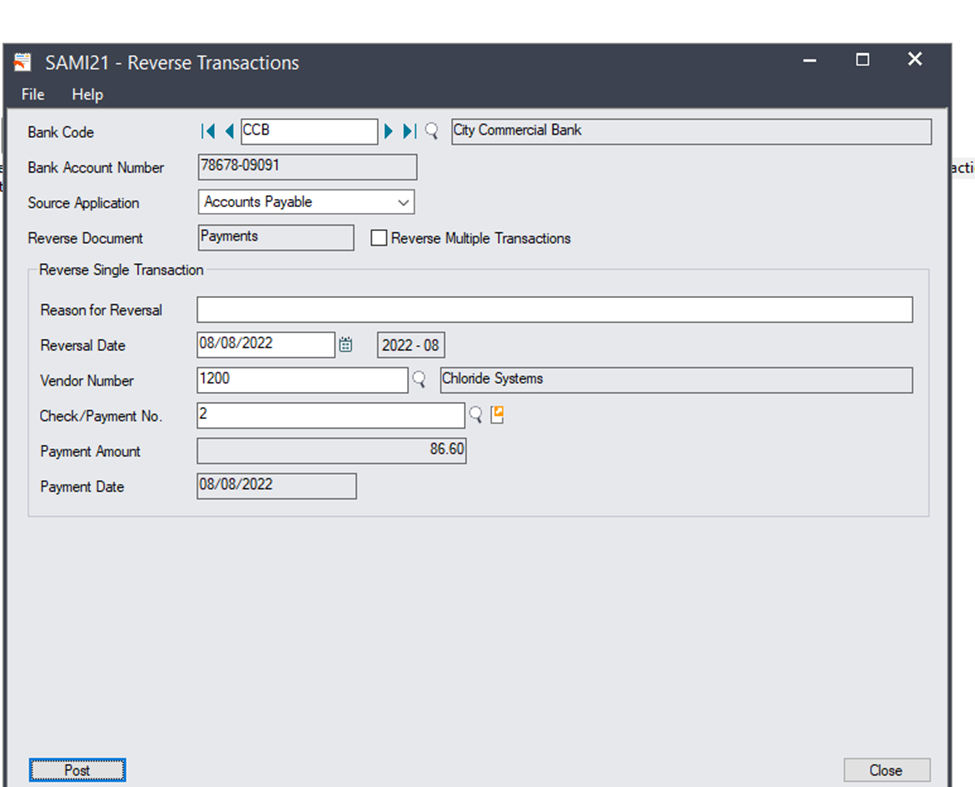

In order to reverse the A/P job related payment we did earlier, we use Reverse Transactions in Bank Services.

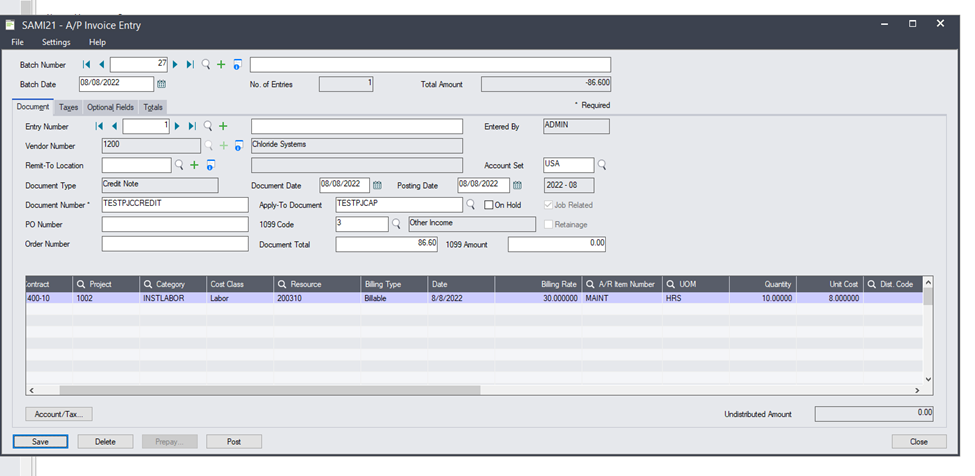

Then, after the reversal, the job related A/P invoice will become outstanding, we can use an job related A/P credit note to cancel out the job related A/P invoice.

Now, all 2 transactions were reversed correctly and the Actuals amounts are updated.

Hope these information help.