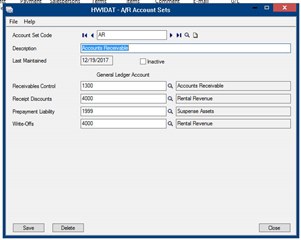

I believe I may have set the G/L accounts -- in A/R Account Sets -- incorrectly. Here's my set-up:

We have just performed a large import of almost four years of invoices, credit notes, and payments. In some cases the payments could not be auto-matched to an invoice, so we imported these payments to the customers' profiles as pre-payments. We then viewed all customers with outstanding balances and applied the pre-payments, unallocated credit notes, etc. We were feeling very smug and self-satisfied, until I happened to run a trial balance. I was surprised at the huge balance in our suspense account, G/L 1999.

It appears that many transactions have gone into suspense and I suspect that the culprit may be the set-up of the G/L accounts.

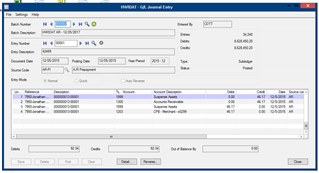

The problem is that most of the transactions from A/R that are in our G/L account cancel one another out -- net change to suspense is zero. Here's a sample:

In these cases the entries to G/L 1999 seem to mirror the correct transactions -- to the A/R control account (G/L 1300) and the bank account (G/L 1203). Unless I am mistaken, the transactions to G/L 1999 can be disregarded in these cases -- they are annoying, and unexplained, but they cancel each other out.

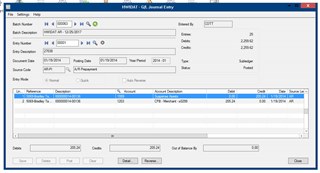

More troublesome, however, are the entries where it seems that the A/R module produced only an entry to G/L 1999 and the bank account G/L 1203:

These entries have produced lopsided transactions in G/L 1999.

My guess is that we need to create entries to offset the G/L 1999 entry -- the entry in this case should be to DR G/L 1999 $205.24 and CR G/L 1300 $205.24. G/L 1300 is our A/R control account.

But I don't like to go anywhere near the A/R and A/P control accounts unless I'm certain I know what I am doing.

In this case our customer looks fine -- but I just noticed that, because the customer has a zero balance, we've not applied the prepayment to the invoices. I did so just now, and surprise, surprise, this automatically produced the reversing entry to G/L 1999.

So is the answer that we simply need to apply all of the prepayments to invoices and that will clear all outstanding G/L 1999 items?

Is there an easier way to handle this -- should, for example, we use a different G/L account for prepayments?

Thanks for your help on this! Any advice will be most appreciated.

Aloha, and Happy New Year, from Hawaii.