We are currently migrating from Sage 100 2016 to Sage 100 2019 (PR 2.x).

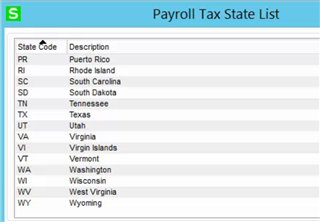

We have an International employee that in the 2016 version we would just put a dummy State code (we used IT) to not calculate or report taxes to any state.

At the end of the year we could adjust and specify the correct county code in the Payroll Reporting & Tax Filing module so it wasn't a big problem.

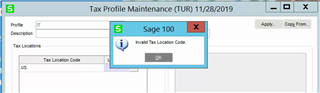

In 2019 we can no longer use IT for the State code as the system rejects it.

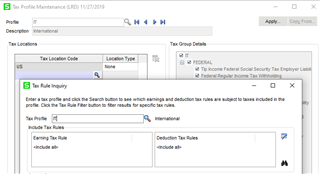

We tried to create a Tax Profile with no State code but the system doesn't allow that either.

So my question is how do we set up this International Employee in the 2019 PR 2.x system.

Maybe some others here have International employees and can share their experience

Appreciate your feedback.

Lonnie