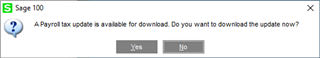

We just upgraded our Sage 100 2017 to Sage 100 2019 with Payroll 2.20. I'm used to the old TTU method where we were told not to install the next year Q1 TTU before processing the previous year's W-2s. However, based on a comment from KathleenF on this post it makes me think that in Payroll 2.x the Tax Updates can be installed whenever and W-2s can be run whenever too. Can I just get a confirmation that it's okay to click YES to this message now before we've processed our 2019 W-2s?