Every year the Sage Fixed Assets team strives to bring you features, enhancements, and updates in our products to improve your ability to bring value and efficiency to your organization. Partly driven by customer requests and partly by tax changes, 2019 was a busy year for the team.

Note: Most of the features described below have links to documents with more information. Bookmark this article to use as a reference to find information on your favorite features.

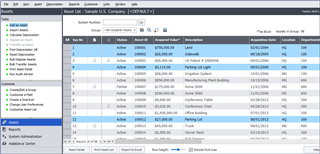

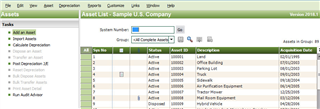

Refreshed User Interface

One of the first things you will notice after updating to Sage Fixed Assets 2019.1 this year is the fresh, modern user interface. You can compare the two versions below. See the comparison below.

Some useful information about the User Interface

- Adjust the asset’s row height and font size to your personal preference. The controls are shown at the bottom of the image below.

- Customize the asset list with book fields, see the Acquired Value* column below

The new Sage Fixed Assets user interface

The previous user interface

Bulk Edit

Customers have been requesting a feature to provide more flexibility for making changes to a large number of assets for some time. This significant addition of functionality to Sage Fixed Assets is a big win in 2019 for both the customers and the product. Bulk Edit is found in the top menu drop down for Depreciation and can be used for one, some, or all books.

Some useful information about Bulk Edit:

- Allows for the mass change of Depreciation Method and Estimated Lives for an asset group and can be effective as of the PIS Date, Begin Date, or Current Period.

- It simplifies conforming to the Section 163(j) rules. See Using Sage Fixed Assets’ new features for Tax Compliance

- It simplifies changes and error corrections across a group of assets.

- It simplifies taking advantage of the Section 250 (FDII/GILTI) deduction. See Using Your Assets to Generate a Section 250 Deduction

- Always perform a backup before running Bulk Edit. There is no “Undo” button.

Additional Bulk Edit resources include:

- KB ID: 95964 How to perform Bulk Edit of Critical Depreciation Fields

- Help Topics within Sage Fixed Assets

Section 199A Report

The Tax Cuts and Jobs Acts (TCJA) introduced the Qualified Business Income (QBI) deduction under Code Section 199A, and several customers requested an efficient way to calculate the Unadjusted Basis Immediately after Acquisition (UBIA) 2.5% calculation. The Section 199A Report fills this need.

Some useful information about the Section 199A Report:

- Detail mode of the report lets you see every asset included in the 2.5% calculation of qualifying property.

- The report is divided into three sections to provide a quick way to identify shorter-lived and longer-lived assets included in the calculation. And an optional third section that lists excluded assets.

- For detail tax-related and report setup information see KB ID: 92793 The Section 199A Report

Additional Section 199A resources:

- For an introduction to the QBI Deduction see Sage Fixed Assets - How to calculate the capital limitation for the new Section 199A deduction

- Help Topics within Sage Fixed Assets

New Depreciation Methods

Tax depreciation methods RM and RH have been added to simplify the depreciation calculation on assets after switching to a longer life under ADS due to changes under the TCJA (Tax Cuts and Job Act)

Some useful information about RM and RH:

- RM means: Remaining Value over Remaining Life, midmonth convention

- RH means: Remaining Value over Remaining Life, half-year or midquarter convention

- An example of when to use these RH or RM would be when conforming to the Section 163(j) rules.

Additional RM and RH resources:

- See KB ID: 93996 Sage Fixed Assets 2019.1: New Depreciation Methods release will support U.S. tax ‘change in use’ rules

- Help Topics within Sage Fixed Assets

Other Improvements and Tax Updates

The most significant tax law update for 2019 was implementing the new IRS Safe Harbor rules for Luxury Autos and Light Trucks and Vans. See New Safe Harbor Rules for 100% Bonus on Luxury Autos.

To see a list of other improvements and updates in 2019, read the following articles:

2020 Features

2020 is going to be another big year for Sage Fixed Assets and our customers, maybe even better than 2019. As always, you can count on seeing the normal updates and enhancements that will improve the accuracy and efficiency of your work.

Some scheduled features and improvements for 2020 include:

- Group Manager – Select and delete multiple asset groups at one time

- Copy Book – State and AMT books will be available as a “Destination Book”

- Books – State and AMT book names will be customizable in Edit Company

- Audit Advisor – Tweaks to the Section 179 detail

- New Books – Ability to add depreciation books

While we cannot yet promise the timing or inclusion of all the of the features above, the SFA team realizes that these kinds of functionality, features, and value are what our customers expect from us. Stay tuned!