We are in the process of closing Fixed Asset periods.

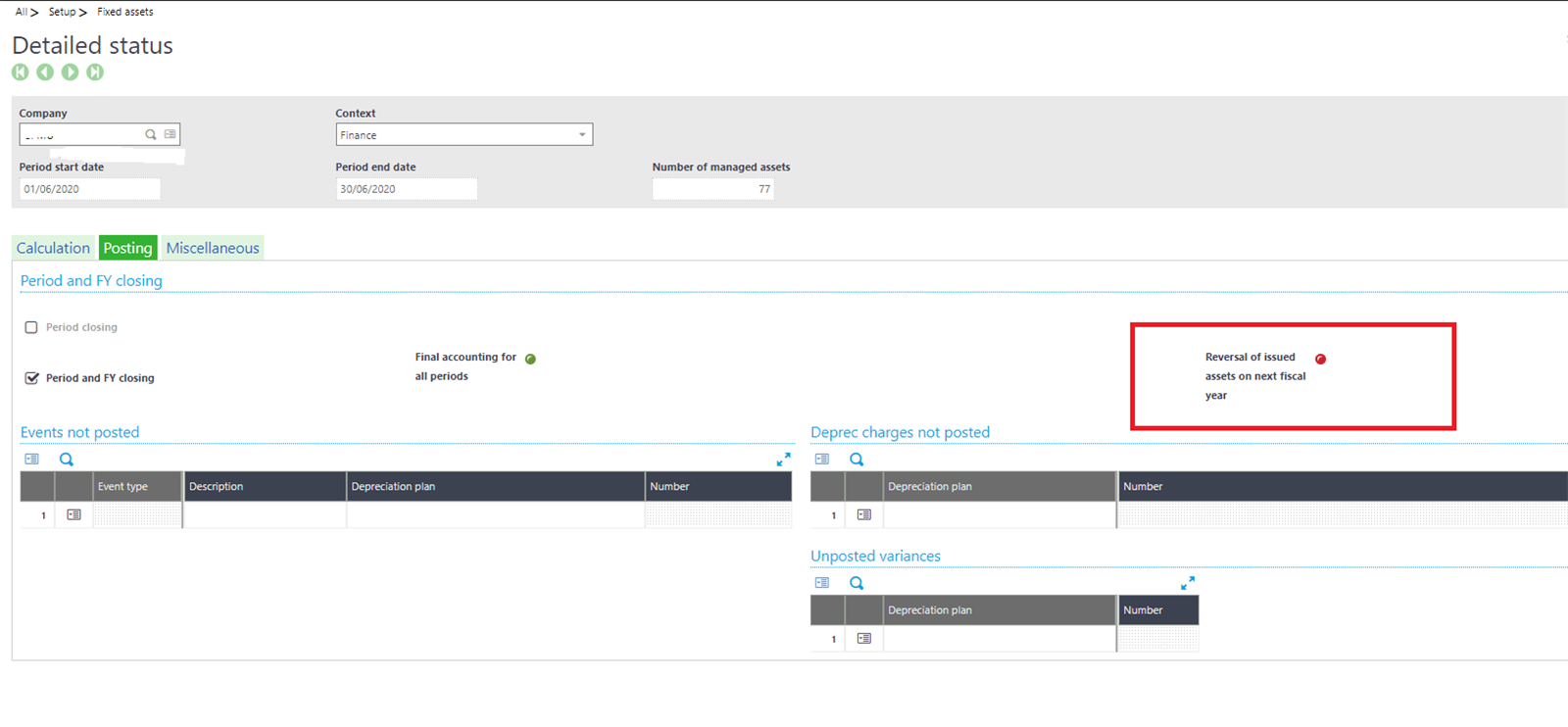

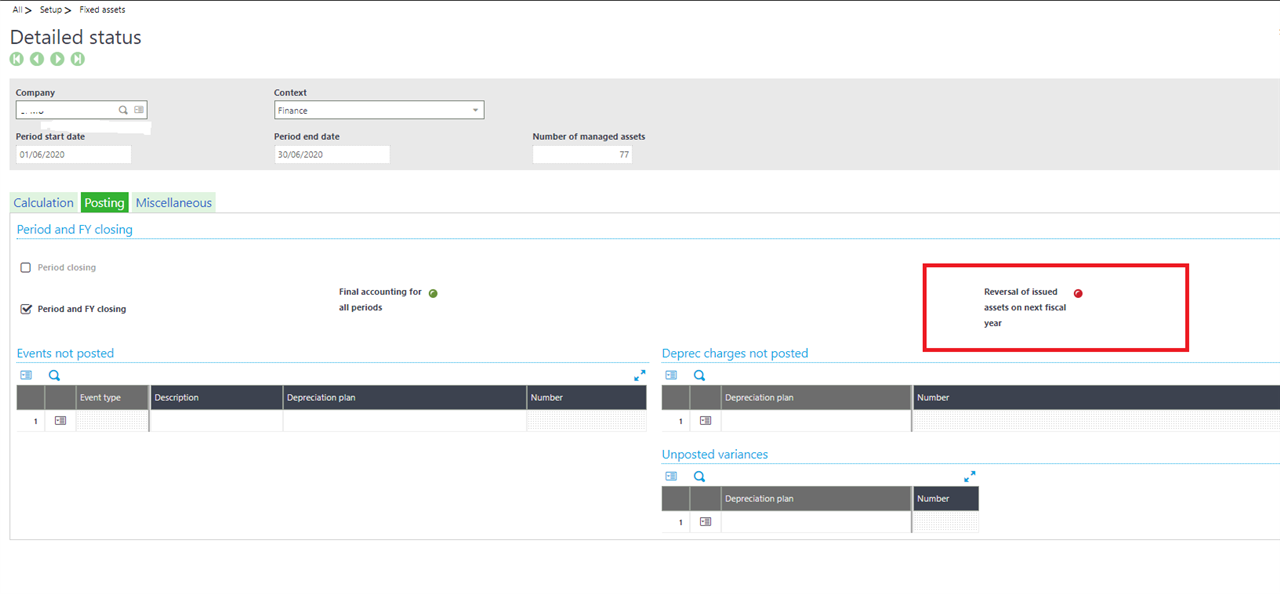

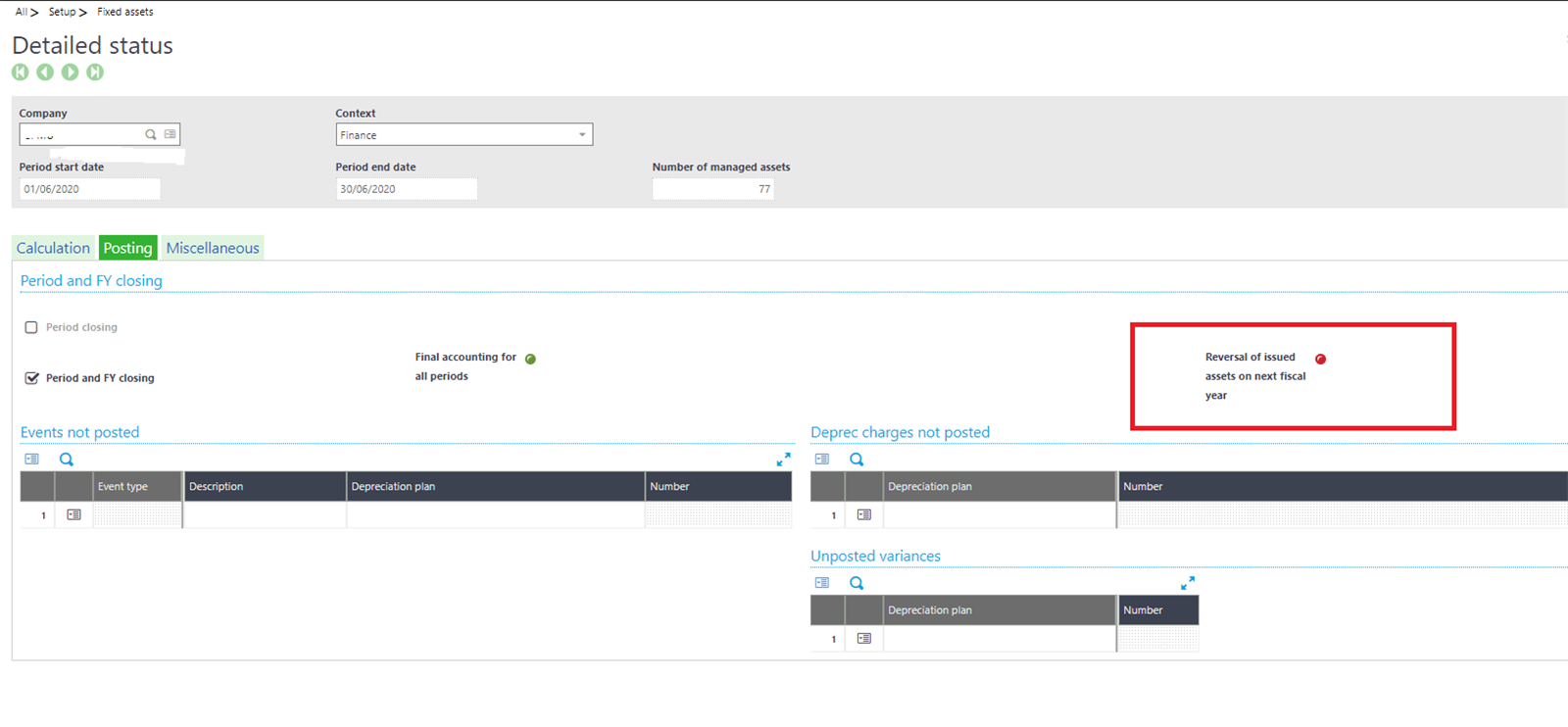

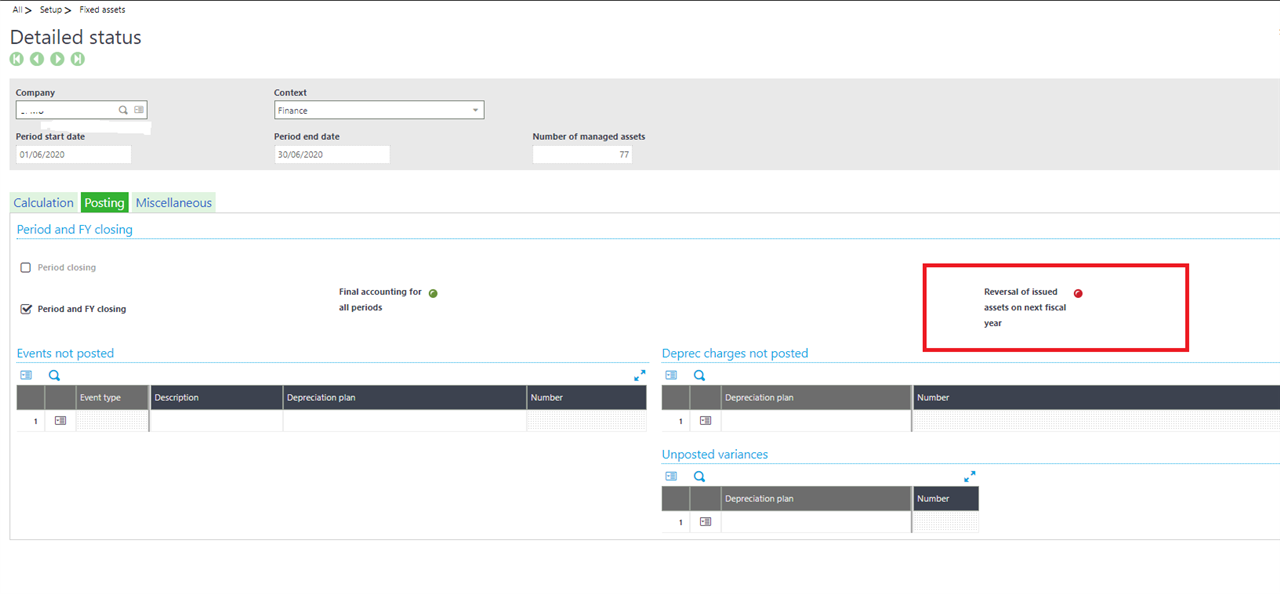

When we go to close period 12 we getting the message "Reversal of issued assets on next fiscal year" on the detailed status

How do we resolve so that we can close the period

We are in the process of closing Fixed Asset periods.

When we go to close period 12 we getting the message "Reversal of issued assets on next fiscal year" on the detailed status

How do we resolve so that we can close the period

Hello,

Per online help

Eligibility to the fiscal year closing:

- The company contains no 'Inactive' asset.

- All the assets have been calculated.

- All the periods are in Actual posting.

- All charges, variance between associated plant (if their posting is managed) and events (as a Event type/depreciation plancouple of the context to close) used in the active accounting entries, have been posted on all the periods of the fiscal year.

- Update 8.0.0 and higher: All assets classified for sale in the fiscal year have been disposed.

- For the assets disposed in the current fiscal year, there is no amount to be posted on the periods of the next fiscal year if their posting is 'Actual' (the depreciations and variances between plans posted on the next fiscal year before recording the disposal must be reversed).

- The company is not used as a source or target company for an in-progress operation of intra-group sale (the Sale confirmation processing has not been performed).

When concessions are managed according to the 'Renewal' method:

- all Renewing assets in service on the CoA plan have been part of a renewal operation,

- all renewal operation which renewal date is in the current FY have been validated.

If the value of the parameter ACCPERCTL.htm - Accounting period control is set to 'Yes', the following conditions must be met:

- the following period (future current period) is open in accounting,

- the context is synchronous with the accounting,

- no error or inconsistency has been detected in the context data.

Hello,

Per online help

Eligibility to the fiscal year closing:

- The company contains no 'Inactive' asset.

- All the assets have been calculated.

- All the periods are in Actual posting.

- All charges, variance between associated plant (if their posting is managed) and events (as a Event type/depreciation plancouple of the context to close) used in the active accounting entries, have been posted on all the periods of the fiscal year.

- Update 8.0.0 and higher: All assets classified for sale in the fiscal year have been disposed.

- For the assets disposed in the current fiscal year, there is no amount to be posted on the periods of the next fiscal year if their posting is 'Actual' (the depreciations and variances between plans posted on the next fiscal year before recording the disposal must be reversed).

- The company is not used as a source or target company for an in-progress operation of intra-group sale (the Sale confirmation processing has not been performed).

When concessions are managed according to the 'Renewal' method:

- all Renewing assets in service on the CoA plan have been part of a renewal operation,

- all renewal operation which renewal date is in the current FY have been validated.

If the value of the parameter ACCPERCTL.htm - Accounting period control is set to 'Yes', the following conditions must be met:

- the following period (future current period) is open in accounting,

- the context is synchronous with the accounting,

- no error or inconsistency has been detected in the context data.

Thanks, Rafael, We have managed to identify that the user had done Financial Year-end before Fixed Asset year-end.

The user has also generated a depreciation journal for the first period of the new year and when trying to close this is what is stopping the year-end.

Is there a way to undo depreciation journal in Fixed assets (Reverse depreciation run)

*Community Hub is the new name for Sage City