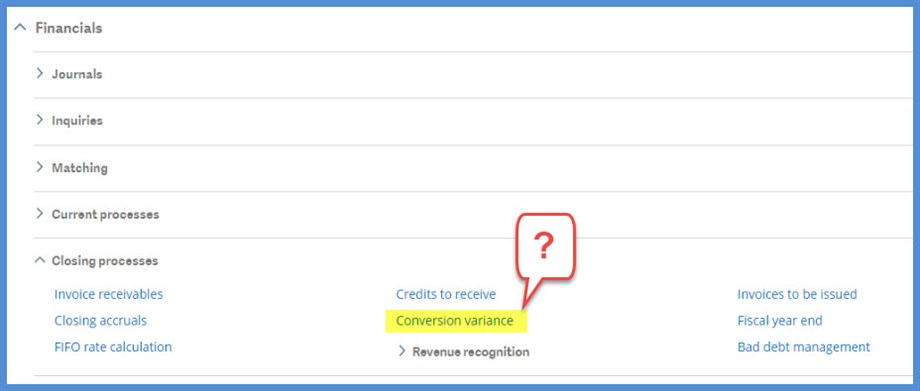

You were going through your close and happened upon the Conversion variance function under Financials, Closing processes. Did you wonder what that function was? Well, wonder no more because we are going to explore the mechanics of running the Conversion variance function (CNVECAR)!

Let’s start with the question, “What is the Conversion Variance and why would I ever use it?” It is a function that allows us, in a multicurrency environment, to revalue accounts or transactions as of a specific date at a specific currency rate. The Online help center tells us to “Use this function to automatically generate the exchange variance and conversion variance entries on the accounts generated in currencies… Variances are usually reported at the end of the period and reversed at the beginning of the next period.”

We have two methods that can be used for calculating exchange rate variances with the Conversion variance: By journal entry assessment method or By account balance assessment method. What is the difference between the two methods? We’ll head back to the Online help to define these two methods:

“For the By journal entry assessment method, the account revaluation results are kept in currency. The calculation is performed for each unmatched entry or for each partial matching group, by determining the difference between the balance of the entry in local currency and the balance in ledger currency valued at the new exchange rate.

“For the By account balance assessment method, the account revaluation results are kept in currency. The variance is assessed by determining the difference between the account balance in local currency at the end of the period and the balance in ledger currency valued at the new exchange rate.”

Which method should you use? I leave that decision to be made between you and your accountants.

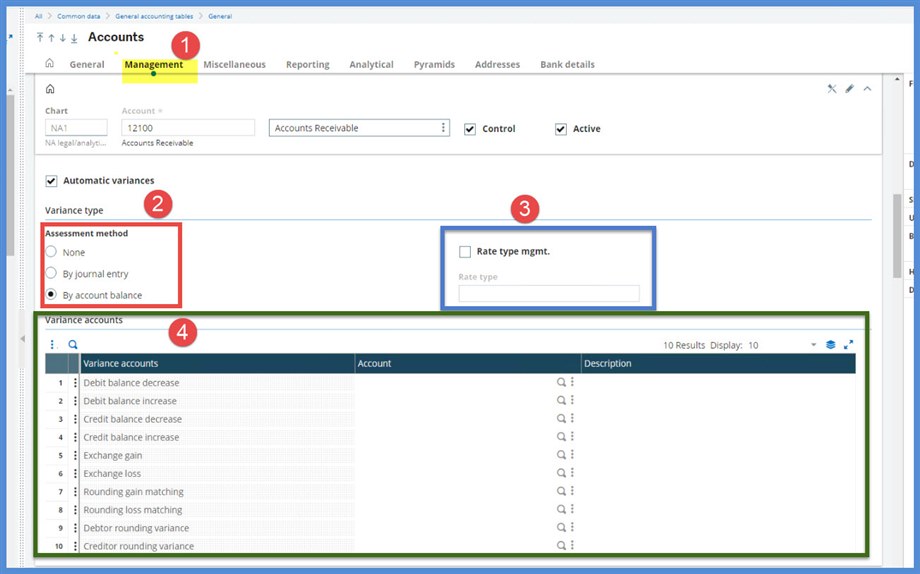

Once the method decision is made, it is time to assign the method to each account that you intend to revalue. This is accomplished under Common data, General accounting tables, General, Accounts. On the Management tab (1), in the Variance type box, you can select an Assessment method (2) of None, By journal entry or By account balance.

On the Management tab, you can also select Rate type mgmt. (3) If this is selected, the Rate type box opens and allows you to assign a dedicated Rate type to the current account. This Rate type is used for the account revaluation instead of the rate type selected in Conversion variance. We will leave it blank and let the process use the Conversion variance Rate type.

You have the option of selecting Variance accounts (4) for the selected account. These will override the Account values established under Setup, Organizational structure, Chart of accounts (GESCOA) in the Miscellaneous accounts grid.

We are going to do a simple example. I have 2 invoices in the fiscal year 2020 on Company NA30:

- Customer NA006 $1500 CAD where the rate is 1 CAD = .92 USD

- Customer NA009 $1000 CAD where the rate is 1 CAD = .90 USD

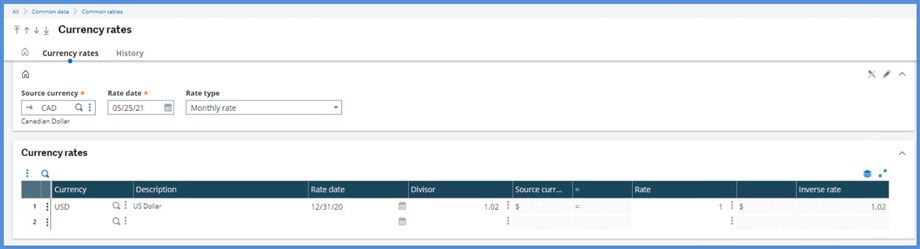

Currency rates are found under Common data, Common tables. We are going to use the Monthly Rate type for our example. Note: if you decide to use the Average Rate type, it is not automatically calculated. You must manually calculate and enter the rate.

The monthly rate is 1 CAD = 1.02 USD

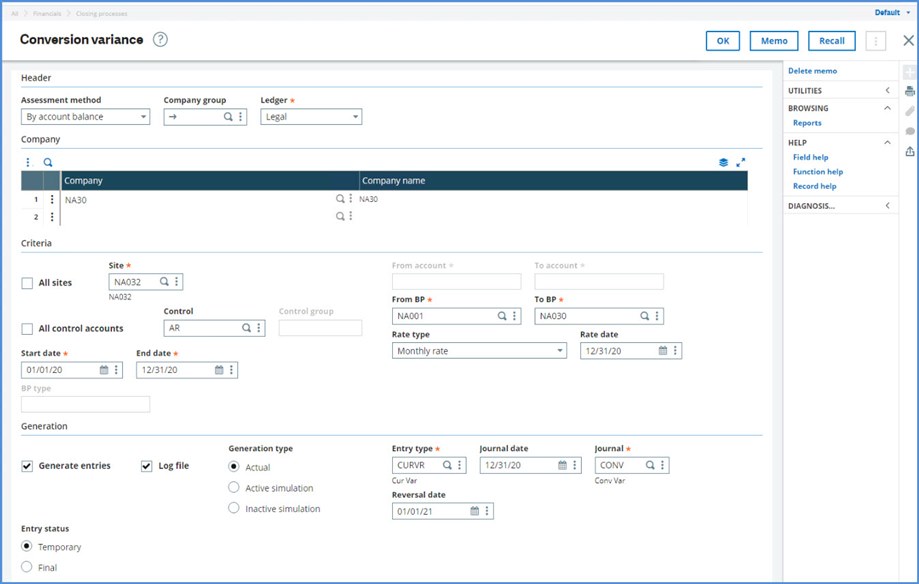

Let’s start entering our Conversion variance selections.

- Assessment method = By account balance.

- Company = NA30.

- Ledger = Legal.

- Site = NA032.

- Control = AR.

- Start date: 1/1/20

- Because we are using By account balance, the period start is always the start of the fiscal year. This process includes balances of accounts managed in currency. If we had selected By journal entry, the start date would have to begin with the date of the earliest unmatched journal. This would most likely be before the start of the fiscal year.

- End date = 12/31/20.

- Rate Type = Monthly.

- Rate date: 12/31/20. We are revaluing as of year end.

- From BP and To BP = I’ve selected all my company’s BP customers.

- Select Generate entries.

- Select Log file: I recommend selecting the log whenever available so that you have a record of your transactions.

- Generation Type = Actual. You have the option to run in simulation first. I’ve already run my simulation.

- Entry status = Temporary. This is an individual preference.

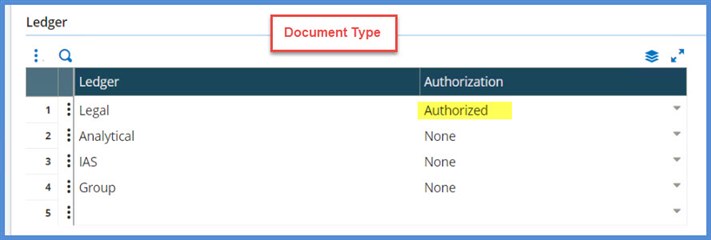

- Entry type = CURVR .Ensure that Document type is only authorized for one ledger under Setup Financial, Document types. Each ledger should have its own Document type.

- Journal = CONV.

- Journal date = 12/21/20. The last day of the valuation period

- Reversal date = 01/01/21. The first day of the next period.

Before you go any further, remember that you can save you settings as a Memo. Save the simulation. When you are ready to do the Actual, click on Recall and just change the Generation type and the Entry type (if you have a separate one for simulations and one for actual) and Journal. Or, save your selections for next month and only change the dates. It saves a lot of keying!

Time to click OK.

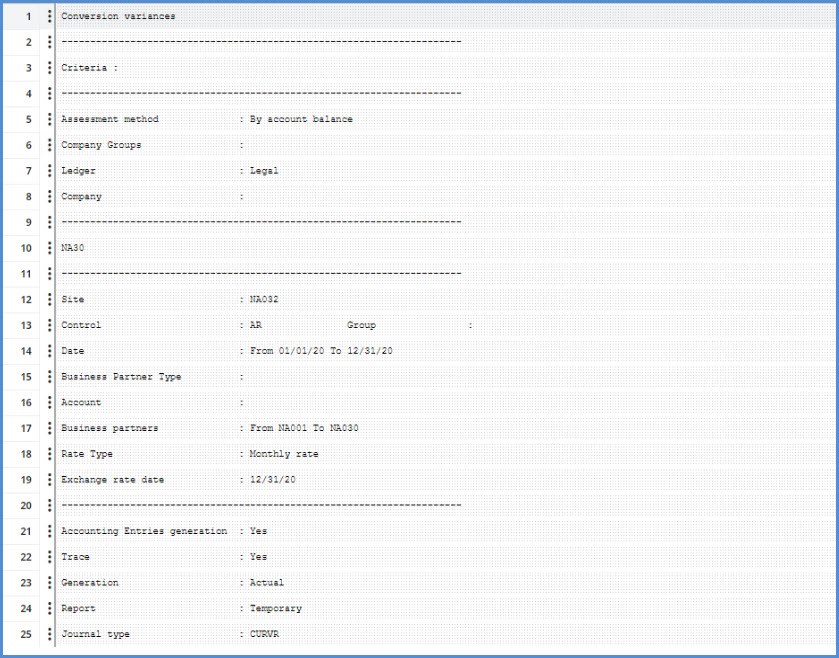

The first page of the Log confirms our settings.

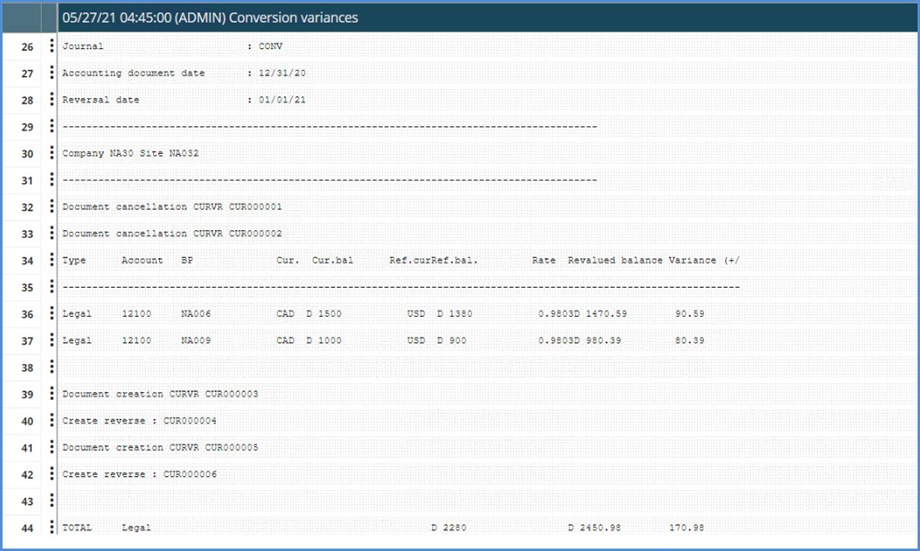

The second page of the Log gives us the transaction calculations and the journal entry numbers. What are the Document cancellation entries? Those were the simulated entries created prior to the actual. They are automatically cancelled when the Actual is run.

If you should accidently close a log, you can retrieve it under Reports, Reports, Log reading.

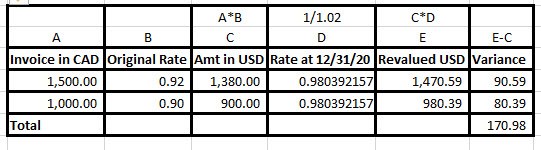

Here are how the amounts were calculated:

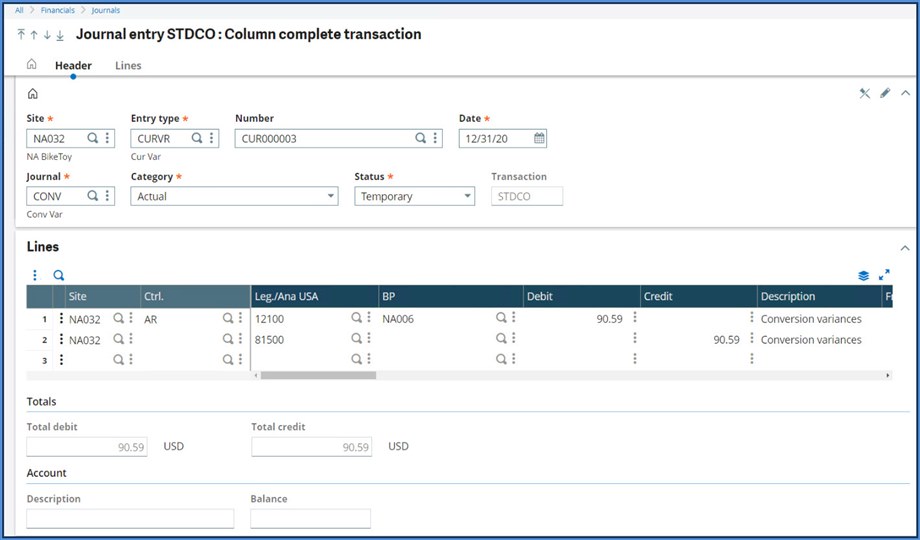

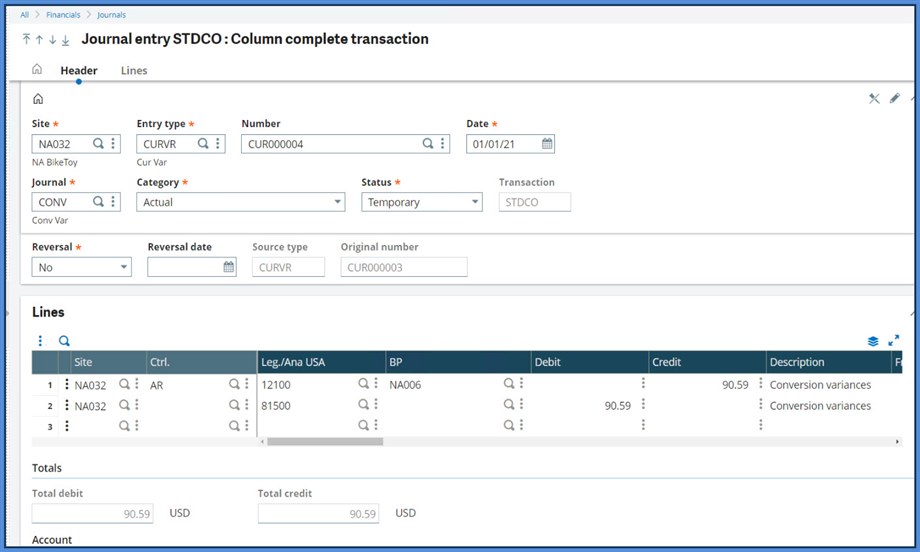

Here are our December journal entries:

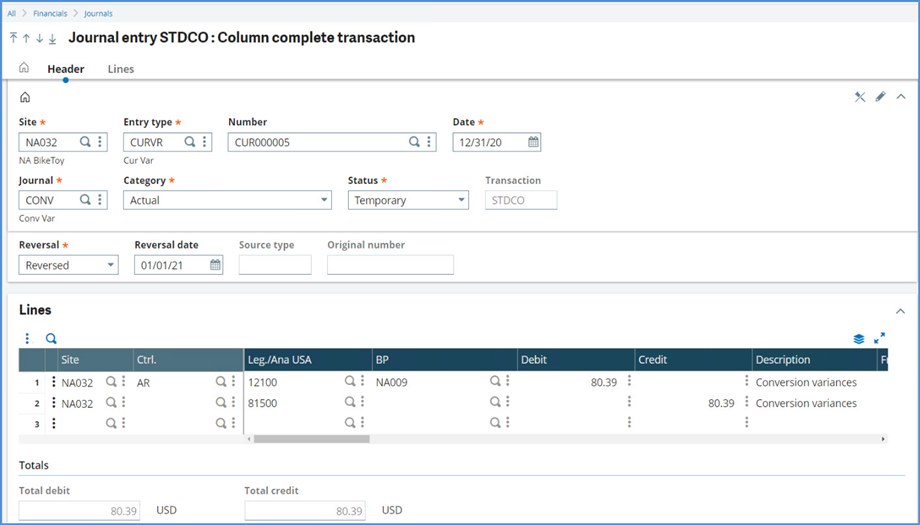

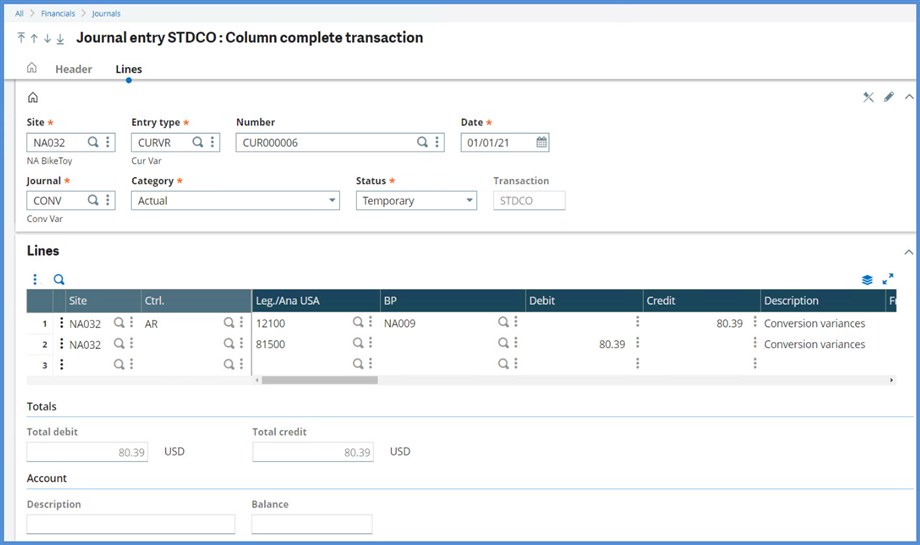

Here are the January reversals:

Where did the Account 81500 come from? It was pulled from the Miscellaneous tab’s Line 6 (Debit balance increase) in the Chart of accounts. The Chart of accounts is found under Setup, Organizational structure.

I hope this satisfied your curiosity about the Conversion variance function.

Until next time my Sage X3 friends. Stay safe!