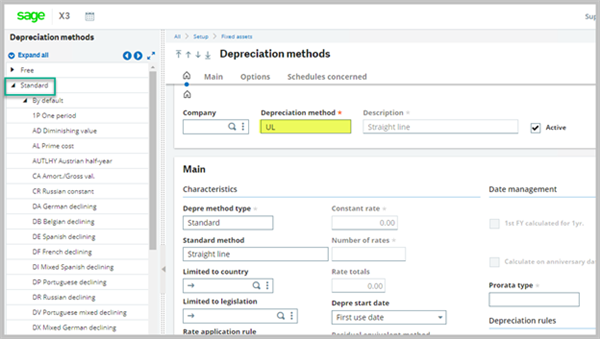

In Sage X3 fixed assets module, standard depreciation methods are located under Setup, Fixed assets, Depreciation methods. Standard depreciation methods can be used to calculate the fixed asset depreciation based on your country, legislation and or accounting practice. Occasionally we will have some scenarios where the standard depreciation method might not work and thanks for the availability of the free depreciation method where we can create a user defined depreciation method.

The standard depreciation method cannot be modified or duplicated but the free depreciation method can be a user defined method.

Additionally, free depreciation method can be limited to a single company, and the following choices of rate types to allow mixed rates, choice of start dates (purchase, first use or posting), choice of start and end rules for dates/periods, choice of prorata types (day, month etc.), allows the choice of value for depreciation.

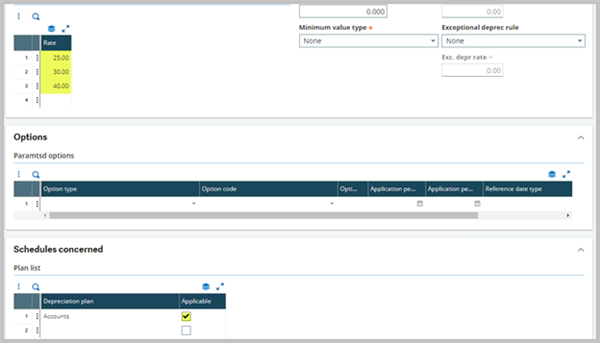

Options tab is not available for free mode and it can limit plans on the schedules concerned tab.

Example of a standard depreciation method – Straight line UL

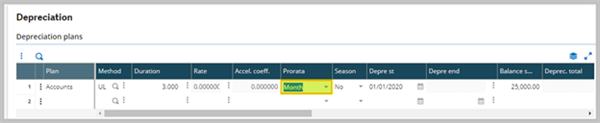

When creating an asset, some of the following information can be entered or defaulted and the others are automatically calculated.

Depreciation origin: is dependent on the type of prorata temporis specified by the user in the depreciation plan. There are four prorata types, Month, Mid-month, Mid-quarter, and Half-year.

When the prorata type is Month, depreciation starts on the 1st day of the month of the depreciation start date. Regardless of the day of the depreciation start date.

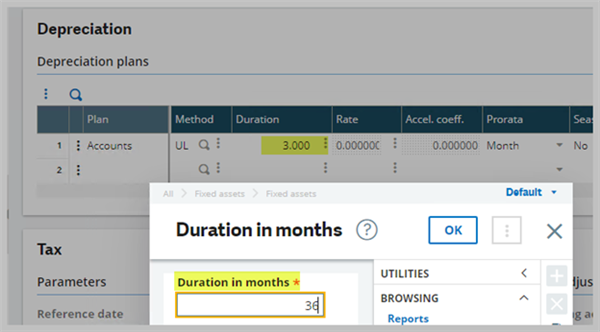

Duration: is expressed in years and we can enter the number of months as well.

Depreciation rate: cannot be entered by the user. It is automatically calculated as follows 1 / duration.

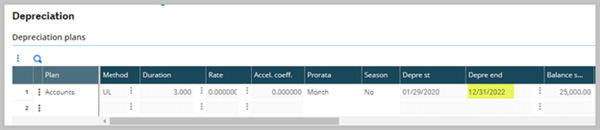

Depreciation end date: it depends on the prorata temporis type. If the prorata temporis is month, depreciation end date = 1st day of the month of the depreciation start date +Depreciation duration.

Depreciation charge:

= Depreciable value * Depreciation rate * prorata temporis

- (Depreciable value = (Gross value – Residual value))

Distribution of the fiscal year charge on the periods:

If the fiscal year is divided into several periods, the fiscal year charge is distributed over these periods. The distribution rule differs according to the prorata temporis applies.

If the prorata temporis = ½ year or Month, the holding period starts on the 1st day of the month of the depreciation start date.

Period charge = Fiscal year charge

* (sum of p1 to pc (number of holding months in the period))

/ (sum p1 to pf (number of holding months in the period)) – Depreciation total of previous periods.

[p1 to pc = from the 1st holding period in the fiscal year to the current period included]

[p1 to pf = from the first holding period in the fiscal year to the last holding period in the fiscal year]

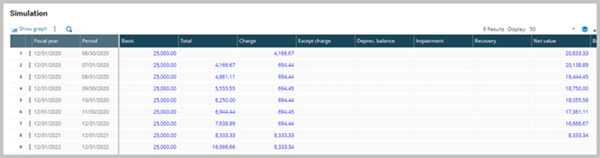

Example:

Balance sheet value 25000

Residual value 0

Depreciation start date 01/29/2020

Depreciation duration 3 years, rate 1/3 = 33.3333 %

Prorata temporis type month, depreciation end date 12/31/2022

Fiscal year charge = 25000 x 1/3 x 12/12 = 8333.33

Period charge (JUNE) = 8333.33 x (6 / 12) – 0 = 4166.67 (current period 06/30/20)

Period charge (JULY) = 8333.33 x (7 / 12) – 4166.67 = 694.44

Depreciation plan simulation:

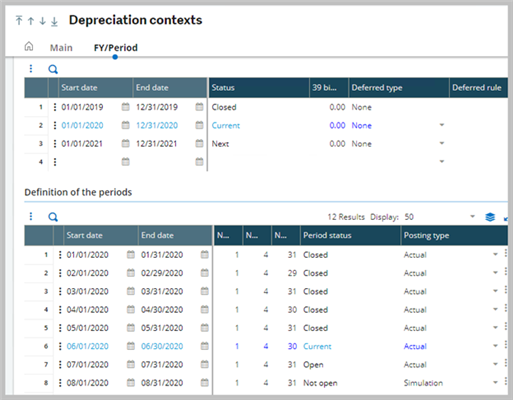

Depreciation context:

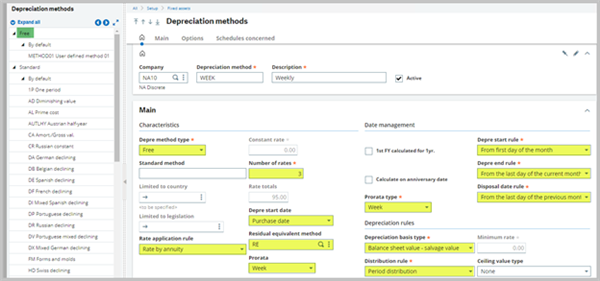

Next let us create a free depreciation method and assign it to an asset:

Setup, Fixed assets, Depreciation methods click New and enter the company, depreciation method description and set it to active.

We can limit the use of this depreciation method for a single company.

Note, we cannot assign a standard code to a free depreciation code.

The maximum number of free depreciation methods are 400.

Main tab is used to define the calculation methods, notably the rates, the date management rules and the depreciation rules.

Create a new free depreciation method with a prorata type set to week. Highlighted fields below are required ones and you can use the online help to look them up.

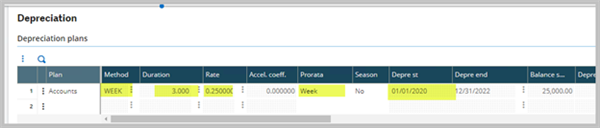

Now assign the free depreciation method to an asset and check the calculations.

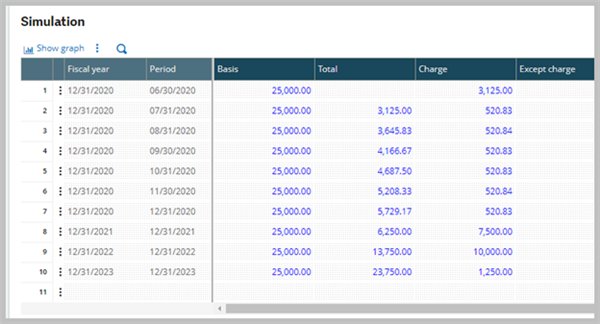

Balance sheet value 25000

Residual value 0

Depreciation start date 01/01/2020

Depreciation duration 3 years, rate 25%

Prorata temporis type Week, depreciation end date 12/31/2022

Fiscal year charge = 25000 x .25 x 1 = 6250.00

Period charge (JUNE) = 6250 x 0.5 – 0 = 3125.00

Period charge (JULY) = 6250 x 0.5833 – 3125.00 = 520.83

There you go... now you know the difference between the standard vs. free depreciation methods.