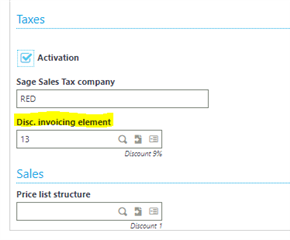

When using Sage Sales Tax, at the company level we have the option to select a single discount invoicing element

(Setup, Organizations structure, Companies, Others tab, Taxes grid).

When you assign a discount invoicing element at the company level it will distribute the invoicing element’s tax amount following the document’s line taxation rule.

Only one invoicing element can be assigned as a discount or surcharge at the company level.

Discount or surcharge amount’s tax is prorated based on the document lines taxability.

For SST documents, it will provide the ability to apply a discount or surcharge to all lines yet follow the line taxability rules prorating the discount amount for taxing on taxable lines only.

Note, tax is not calculated for the Disc. invoicing element.

To enable the Disc. Invoicing element, we need to;

- Have LTA activity code active

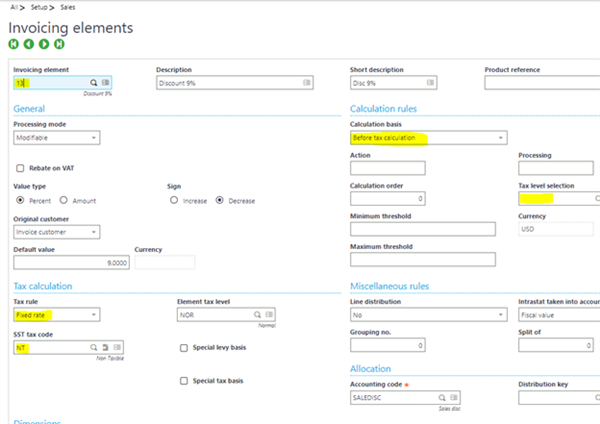

- Setup the invoicing element's for either discount or surcharge in Setup, Sales, Invoicing elements

- Tax rule = Fixed rate

- Tax level selection = blank

- Calculation base = Before tax calculation

- SST tax code = not blank

I have created 2 discount invoicing elements, 13 and 14. Both were setup with a default percentage value.

Highlighted fields are important when setting it up.

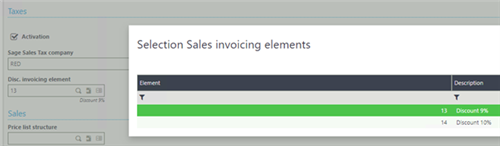

Once you have defined the invoicing elements you can position the elements based on the order that you want them to be displayed on the documents.

Once you have the setup completed then you can use the magnifying glass select it in company setup.

Additionally, we need to make sure the tax determinations are defined for the BP tax rule and product tax level + element tax level

(in Common data, Common tables, Taxes, Tax determination).

Now let's run an example to see how it works.

- Generate a Sales order with two lines both have different tax rates and one is tax exempt.

- Generate a Delivery from the order and validate it.

- Finally generate an Invoice.

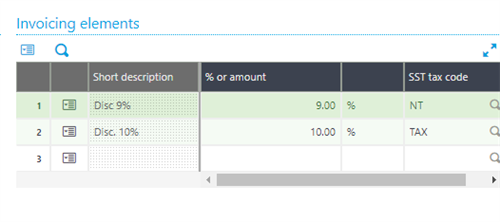

Below I have the sales invoicing element screen

- Disc 9% is assigned to the company as the default Disc. Invoicing element.

- Disc 10% invoicing element follows the standard Sage X3 functionality.

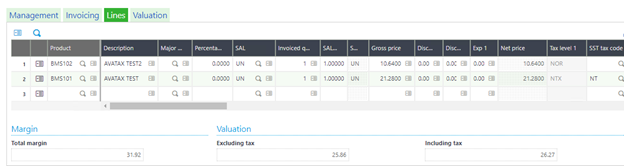

Sales invoice lines

- Line 1 = 10.64

- Line 2 = 21.28 (tax exempt line where SST tax code is specified)

Avalara will prorate the discount amount for all the lines to determine the taxable portion of the amount – tax.

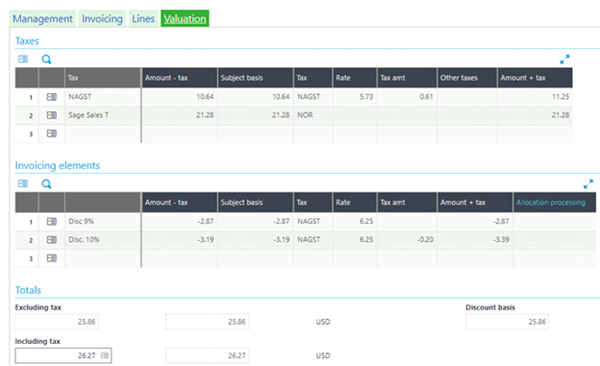

Below is the valuation screen

- Tax column NAGST line, Amount – tax = 10.64

- Prorated discount = 9.6824 (10.64 x 9% = 0.9576)

- Tax amt = 0.61 (9.6824 x 6.25)

- Tax column NOR, Amount – tax = 21.28

- Tax amt = 0 (No tax)

Taxes grid:

Discount invoicing element is calculated for all the lines.

Note, tax is not calculated for the Disc. invoicing element.

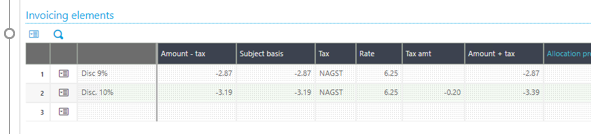

- Disc 9%, Amount – tax = -2.87 (31.92 x 9%)

- Disc 10 %, Amount – tax = 3.19 (31.92 x 10%)

- Tax is not calculated for Disc 9% (default disc. Invoicing element)

Invoicing elements grid:

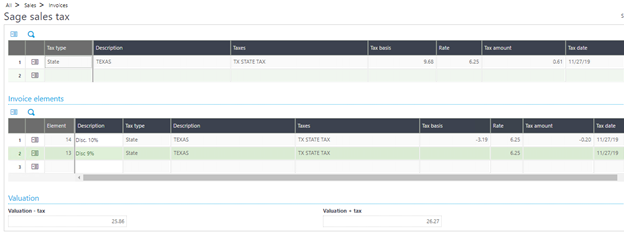

Use the action icon under Valuation tab to view the In Sage sales tax screen.

- The tax basis column displays the actual prorated discount amount $ 9.68

- The Tax rate displays the actual tax rate 6.25%

In Invoice elements grid,

- Tax basis column displays the actual prorated subject basis amount $ -3.19

- The tax rate displays the actual tax rate 6.25%