- Cost structure is used as part of the management of landed costs in the Purchasing module.

- The management of landed costs consider the purchase costs related to the moving of the goods from the supplier to the buyer and to allocate them to the product upon order receipt or invoice.

- There are two purchase cost methods, one is based on landed cost coefficient and /or a fixed cost per unit, called global costs (not detailed).

- The other is based on a cost structure, called detailed cost, fixed costs can be detailed and easily identified at the time of purchase.

- Only one method can be used, the choice of this method is performed at the level of the product. However, the routing costs can differ for the same product and identical suppliers when the sites are geographically remote.

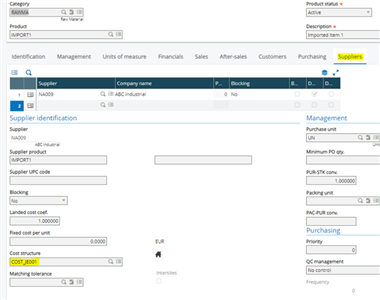

- You can define a cost structure at the Product category level, Product record level or Product-site level.

- When you define it at the product level, there are two places where you can define the landed costs, one is under purchasing tab, and the other is under suppliers tab.

- When you assign a cost structure to both purchasing and suppliers tab, suppliers tab selection supersedes the purchasing tab selection.

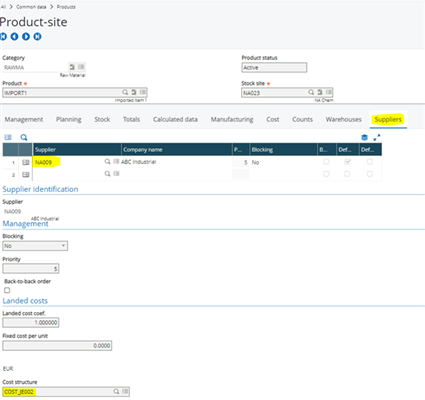

- Additionally, you can use a different cost structure at the site level. In that case the site level cost structure takes precedence.

- Cost structures are defined in Common data, Logistics tables, Cost structures.

- All the costs and information of the cost structure is stored in the product line.

- If you don’t want to use an existing cost structure it is necessary to deactivate it and it should not be associated to a product category, product, product-supplier and product-site.

- When deactivating, if the cost structure is assigned to a product, product-supplier, or product category you will receive a blocking message.

- You cannot delete a cost structure if it has been already used.

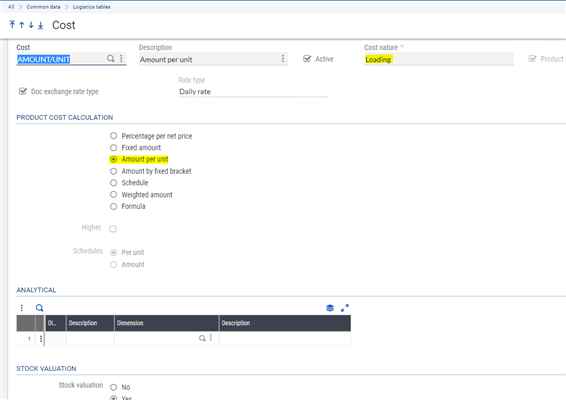

- Cost field within the cost structure, is used to define various costs that will be used in the cost structure.

- In Common data, Logistics tables, Costs you can define various costs and assign them to the cost structure.

- If a cost is used in a cost structure, a non-closed order, a non-invoiced receipt or a non-validated invoice, you cannot deactivate the cost record.

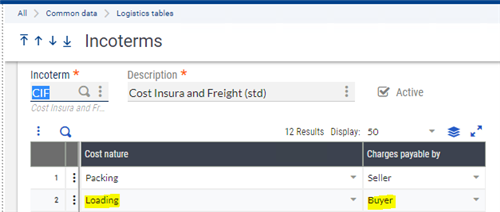

- Cost nature in cost setup is tied to the Incoterms on the supplier record.

- Incoterms can be setup under Common data, Logistics tables.

- Charges payable by column determines the percentage payable by the buyer.

- The distribution of each of the cost natures between the buyer and the seller is specified in the incoterm used or entered in the purchase document (order, invoice).

- If there is no incoterm the entire cost is paid by the buyer.

Let's create a cost structure with a single cost line and look at the calculation.

Setup:

1) Cost:

select the 'Amount per unit' calculation method

2) Cost structure:

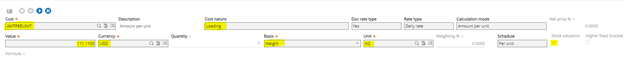

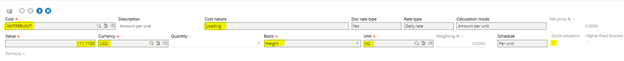

Popup view

When creating a cost structure fill in the mandatory fields and the rest will default from the Costs setup.

Calculation:

Value x (% payable by) x Quantity

- Value, the basis to which the cost is applied (the quantity, volume or weight) and the UOM used are specified in the cost structure.

- When calculating the cost amount the quantity of the product line is converted into the unit of the cost if they are different.

- % payable by, is the percentage payable by the buyer.

- The distribution of each of the cost natures between the buyer and the seller is specified in the incoterm used and entered in the purchase document (order, invoice) If there is no incoterm, the entire cost is to be paid by the buyer.

- For example;

- Detail of the cost in the cost structure:

- 111.11 per KG (value = 111.11, quantity 20, basis = weight, unit = KG)

- Detail of the order line:

- Quantity = 20, Weight unit= KG and the weight of the stock .50, % payable by the buyer 100%

- Conversion of the quantity into stock unit, in KG (unit of the cost): 20 x .50 KG = 10 KG

- Calculated cost = 111.11 x 100% x 10 = 1,111.1

- Detail of the cost in the cost structure:

3) Incoterm 'CIF' nature is 'Loading' and charges payable by is set to 'Buyer'.

4) Assign the incoterm to a supplier

5) Assign the cost structure to the product suppliers tab

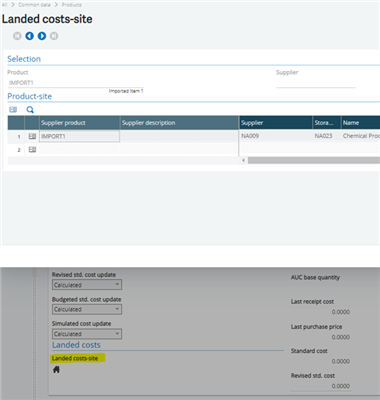

Once the cost structure is assigned you can use the Home icon to view the landed costs-site screen

- Product UOM STK weight = 0.5 KG

- Product standard cost = $1,000.00

6) Under product-site, suppliers tab we have the option to assign a different cost structure.

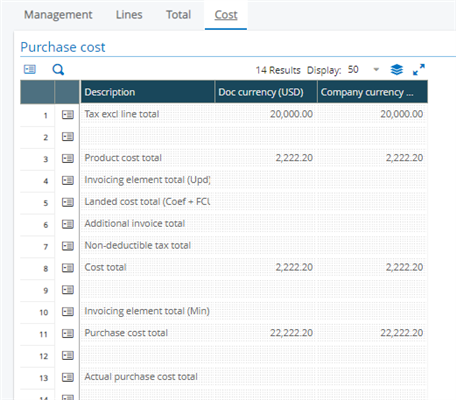

7) Generate a purchase order and select the supplier and the item.

- Under cost tab, the product cost total =2,222.20 (222.22 x (20 x 0.5)

- Notice, the cost structure used is from the site record.

When you generate a purchase receipt and run the stock accounting interface, the stock journal will have a line for the landed cost amount.

Similarly, you could have more than one cost on the cost structure to calculate the landed costs.

I hope this article will give a basic idea as to what is a cost structure and where it is used.

Top Comments