Often, we underestimate the significance of the general parameter ACCPERCTL under AAS fixed assets chapter, CPT group.

Accounting period control parameter is used to check the consistency between financial data records and fixed assets data records of a fiscal year or period breakdown.

When the value is set to ‘Yes’ for a company, meaning the fiscal year or the period breakdown on the financial side is identical to the FY/Period breakdown on the Fixed assets side.

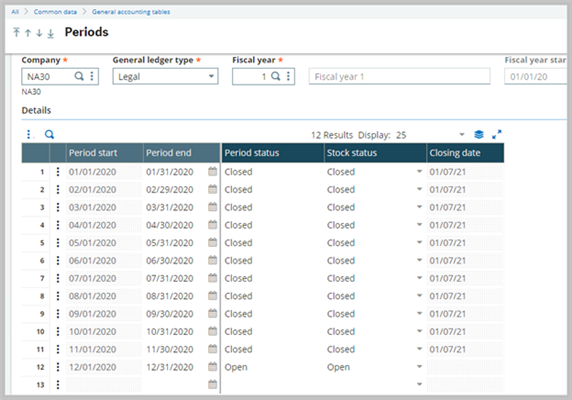

Fiscal periods under the Financial side:

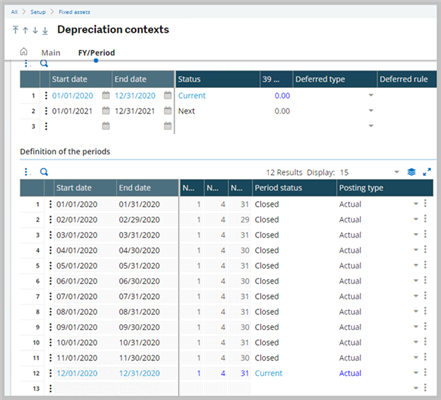

Fixed assets FY periods under Fixed assets side:

Now let us look at the limitations on the Financial side when the above parameter is set to ‘Yes’:

1. When the current period on the depreciation context is open and the posting type of that period is set to Actual, then you cannot close the period on the GL side.

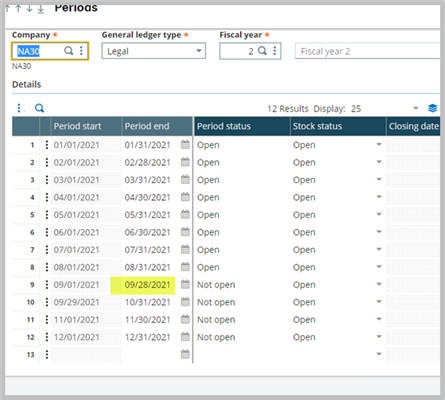

2. Any changes to the fiscal year or period breakdown related to a ledger type will desynchronize the depreciation contexts for that company using that ledger.

- For example, edit the period end date on the Financial side.

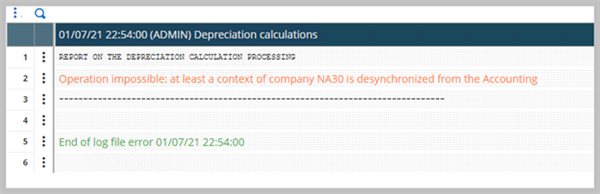

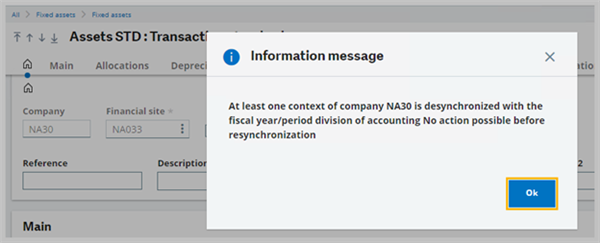

3. When at least one of the contexts of the company is desynchronized, you will not be able to perform a single or mass processes like reevaluation, depreciation, method change, closing etc., in Fixed assets side. Additionally, when closing in fixed assets is prohibited, it will prevent closing in Financials as well.

- You can see that I cannot run a depreciation calculation:

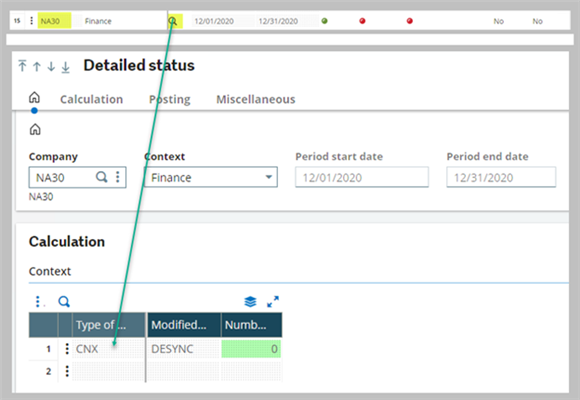

How to check whether the depreciation context is desynchronized or not?

- Check the depreciation context or status of context function.

- Use the magnifying glass to open the detail status screen.

- Type of modification “CNX” indicates that a context is desynchronized.

- This is due to the change happened above on the Financial side.

- The modified parameter value is “DESYNC”.

- Additionally, when you access the fixed assets function, you will receive a notification when a context is desynchronized.

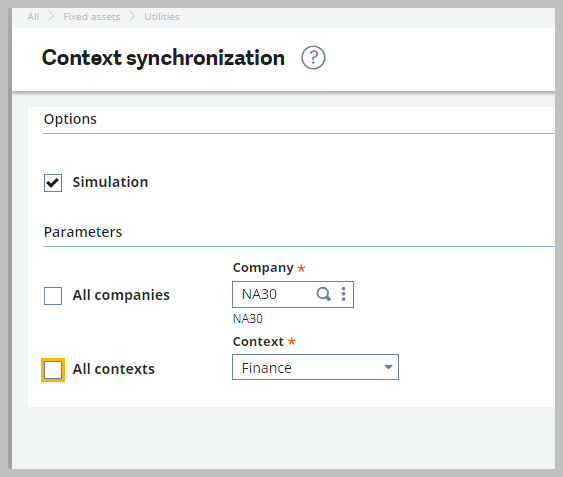

To resolve this issue, run the Context synchronization process in Fixed assets, Utilities, Context synchronization.

- When you run it in simulation mode, it will generate a log file indicating the updates. Then you can run it without simulation.

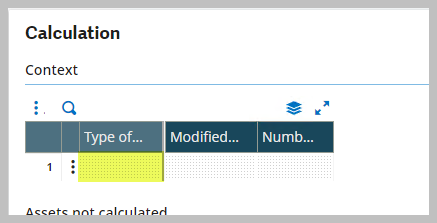

Context Desynchronization is fixed.

Next look at the limitations on the Fixed assets side:

1. The fiscal year or period breakdown is created automatically based on the fiscal year and period breakdown on the Financial side.

2. At lease one fiscal year and one period is open in financial side. The current period in Fixed assets is open.

3. At least one additional fiscal year is defined after the first fiscal year is opened in accounting. This is required to create the next fiscal year on the fixed assets side.

4. You cannot directly edit the fiscal year or period breakdown.

5. If a period in Financials is added, run the context synchronization process to extend the period in Fixed assets.

6. You cannot shorten a period.

7. You can only open a period if it is open in Financials.

8. You can only change the posting type of a period from Simulation to Actual when the period is open in Financials.

9. You can only close a fiscal year or period if the next period is open in Financials, even if you are closing a fiscal year and the context must be synchronized with financials.

10. When the context posting type is Simulation, you can close the period in Fixed assets even if it is closed in Financials.

11. When generating entries in Actual mode, accounting entries related to the closed period are generated for the first open period in Financials, provided the “First date” check box on the auto journal is checked.

Note, once the Accounting period control parameter is set to ‘Yes’ and suppose the context is Desynchronized, do not change it back to ‘No’. This will prevent the context from being getting fixed and you will get a message that the “The context is not desynchronized”.

Finally, when this parameter is set to ‘No’, you can create your own fiscal year period breakdowns on the Fixed assets side which is different to the Financial side.

I hope this article is useful when deciding which way to go with the accounting period control parameter.