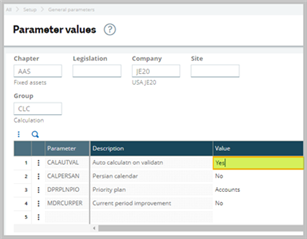

This parameter is located under AAS Fixed assets chapter, CLC calculation group. It is used during the management of the Financial assets and its set to ‘Yes’ and must not be changed.

It specifies that a calculation of the FY depreciations and a flow generation are systematically carried out during the creation of a financial asset and during the validation of any modification carried out on this asset.

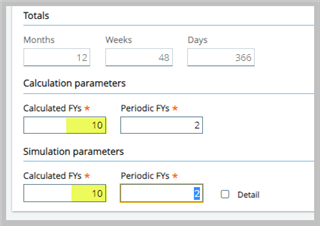

The calculation is performed for the number of FYs specified in the Context setup.

What does it mean calculation of the FY depreciations and a flow generation?

A. Calculation of the FY depreciation, it means when this parameter is set to Yes, upon creating a fixed asset in the fixed assets module, it automatically calculates the depreciation and you are not required to run the Depreciation calcs (FASCALC) function.

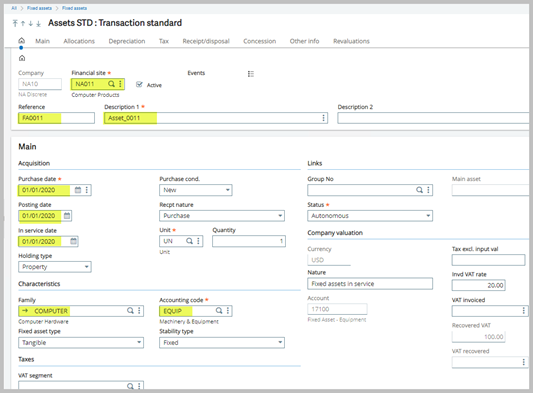

For example, create an asset manually in Fixed assets, Fixed assets, Assets.

- Select the financial site, enter a reference, description, purchase date, posting date, in service date, family (if setup already), accounting code.

- Then enter the depreciation method, duration and the balance sheet value.

- Click create.

- Once the asset is generated, system will automatically populate the depreciation table (DEPREC).

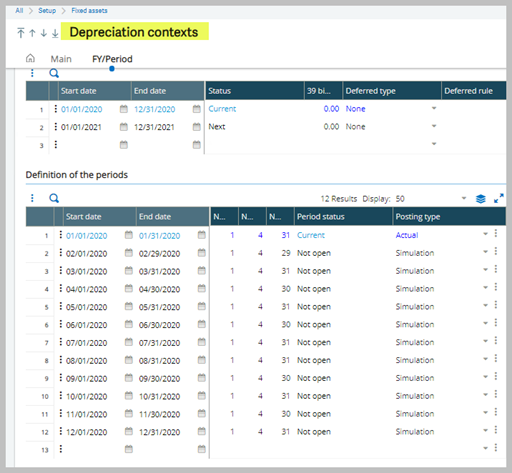

- The number of records in the DEPREC table will depend on the depreciation context, calculation parameters.

- In this scenario, there will be 32 records for the new asset.

- FY 2020 – 12 (12 periods)

- FY 2021 – 12

- FY 2022 – 1 (entire year)

- FY 2023 – 1

- FY 2024 – 1

- FY 2025 – 1

- FY 2026 – 1

- FY 2027 – 1

- FY 2028 – 1

- FY 2029 – 1

- When there are changes to the fixed asset record, this parameter will automatically update the records in the table.

- For example, change the In service date to 05/01/2020, it will update the STRDAPRDAT (depreciation start date) and the ENDDPRDAT (depreciation end date) accordingly.

B. Flow generation is a record creation in the flow table FXDLIFL.

- This table is used to generate majority of the fixed assets reports (FASLISDEP, FAS1PAGE).

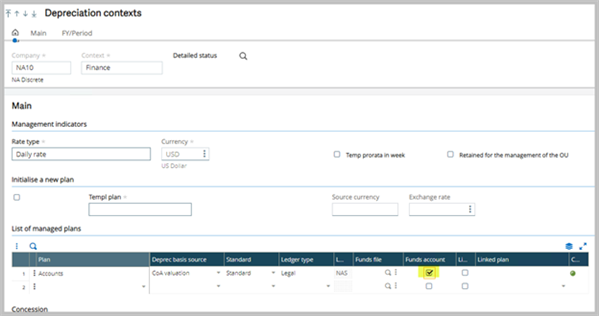

- Additionally, we need to check the ‘Funds account’ flag in the depreciation contexts (GESCNX).

- When the funds account flag and the CALAUTVAL parameter set to Yes, creation of an asset will automatically generate the records in FXDLIFL table.

Hope you have an understanding as to what happens when the CALAUTVAL is active.