You were positive you entered the lines for the new customer address in a certain order, but now they’ve changed. You wonder if you forget to it that way? Did someone change it? Let take a look.

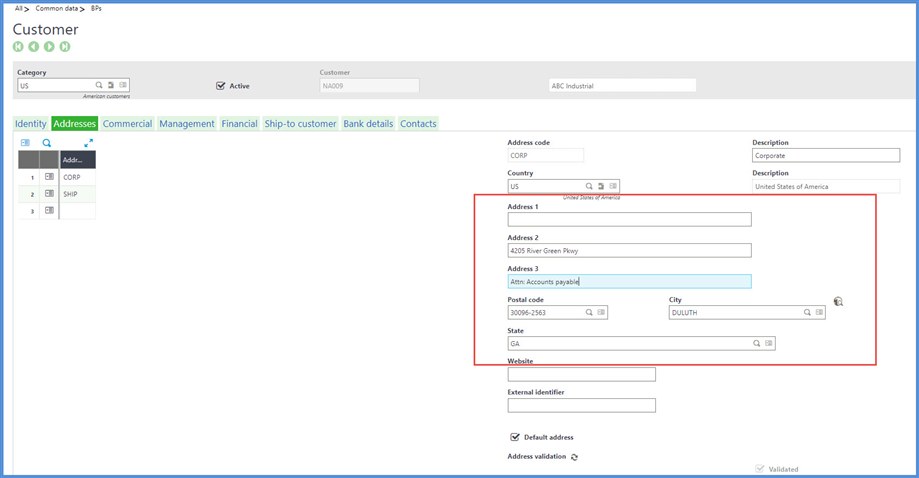

Your billing department asked for the street address to be on Address 2 and the "Attention" on Address 3 so invoices would fit in the new window envelops they are trying out. We will try again. Head over to Common data, BPs, Customer (GRSBPC) and reenter the address in the billing department’s preferred format. Then click Save.

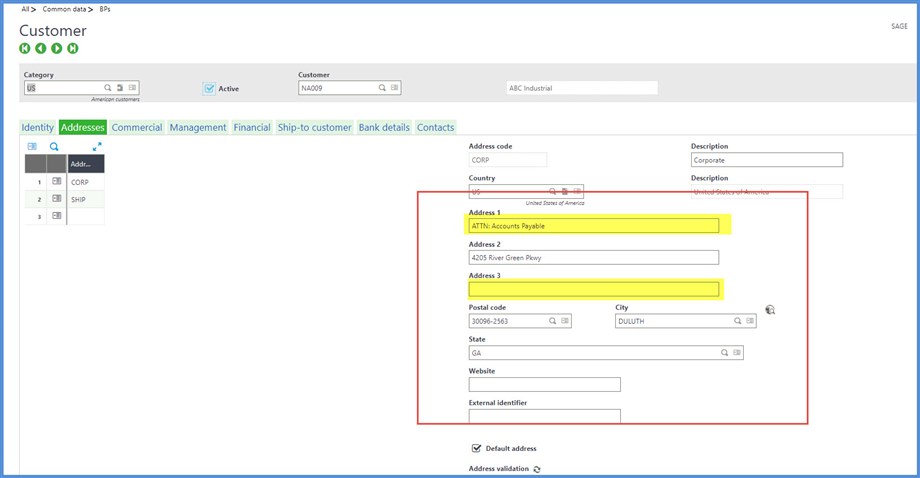

After clicking Save, the Attn line has jumped to Address 1. You feel better knowing you weren’t forgetting to change the address format, but what is happening?

If you are using Sage Sales Tax (SST), the address format must conform to the United States Postal Services preferred formats. The Online help center’s Implement Sale Sales Tax Guide explains it as follows: “When addresses are validated, the address information can be slightly modified in some cases. This includes changing the lines of non-address information such as the ATTN (attention to) field or similar identifiers”

Is there anyway that the address format can be changed? No, these formats are required and come back from the SST vendor (Avalara) in this format after validation. The sales tax calculation depends on the accuracy of the address. You will need to contact your business partner for a customization to the customer invoice form.

If you are having issues with validating an address, you can look up addresses and zip codes at USPS.com to ensure you have valid information in your system.

Hope this helps you as you validate addresses. Stay safe!