So, you’ve started to review your supplier payments and noticed that you never changed the Supplier default 1099 form and 1099 boxes to those for 1099-NEC. Or perhaps, only some of your Supplier transactions are showing up as form 1099-NEC payments. Or you are now asking, “What is a 1099-NEC form anyway?” Don’t panic! We can get this sorted.

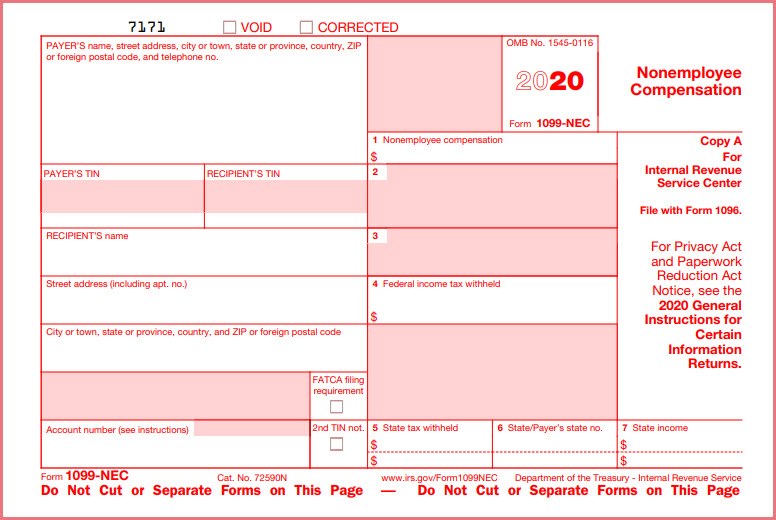

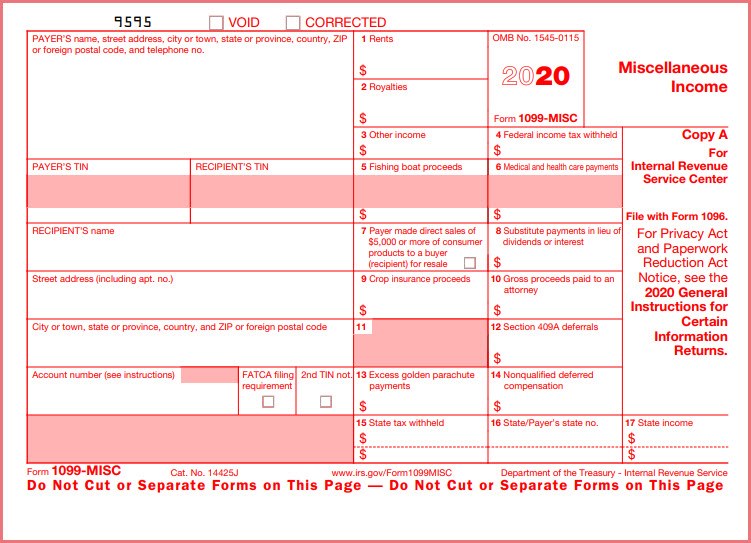

Let’s start with a review of what 1099-NEC forms are. This form is for tracking non-employee compensation. It basically shifts the tracking of the Nonemployee Compensation (Box 7) and Direct Sales of $5000 or more (Box 9). Nonemployee Compensation is now in Box 1 on 1099-NEC. 1099-NEC has a Box 2 checkbox to indicate “Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale.” 1099-MISC has Box 7 checkbox which reads “Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale.”

The requirement to track the nonemployee compensation on a separate form began on January 1, 2020. For further clarification on the changes and due dates, contact your tax advisor or check the IRS website (www.IRS.gov). Here is a look at the 2020 1099-NEC and 1099-MISC forms. Note: These forms are for information purposes only and should not be used to print actual 1099-NEC or 1099-MISC forms.

With the X3 2019 updates for 1099, if you were on U9, v11 or V12, you could begin tracking data into 1099-NEC categories. With the release of 2020 1099 updates, 1099-NEC forms can be generated and printed for v11 and v12 only. See Sage City forum article Sage X3 and 1099 year-end reporting for Sage X3 LifeCycle Policy information as it pertains to the 2020 1099 updates.

Processing 1099s between 2019 and 2020, has not changed significantly. See the blog: UPDATED: Sage X3: Tips for 2019 1099s and beyond for information on setting up Supplier 1099 default forms and boxes, entering transactions and reviewing data.

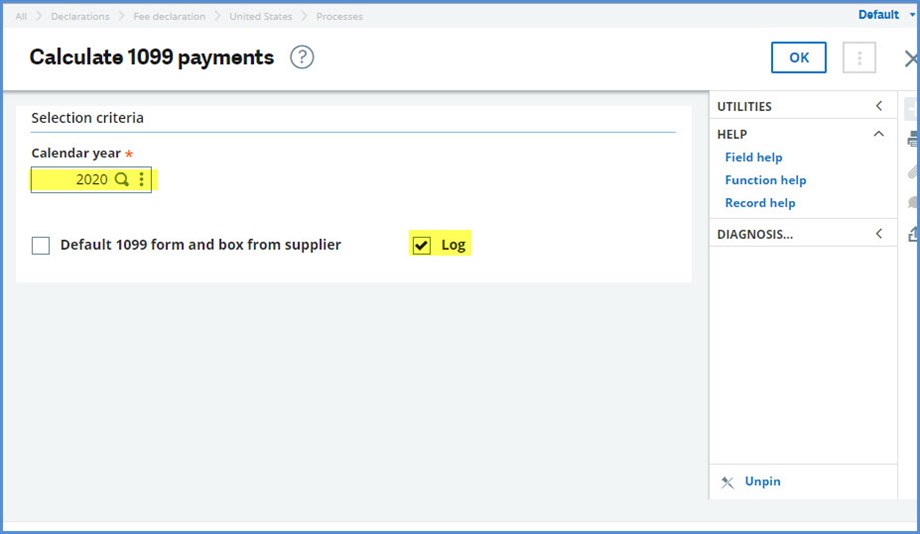

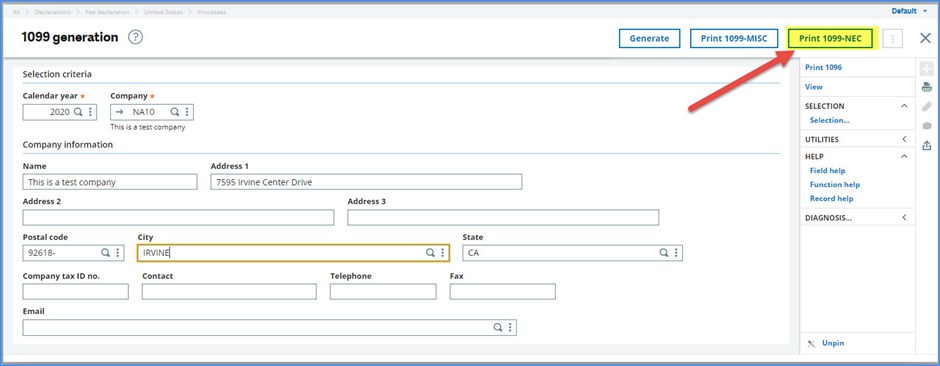

After you apply the 2020 1099 update, you will have the ability to generate and print out form 1099-NEC. Again, the 2020 1099 update is only available for v11 and v12. Remember first you need to create 1099 data records by executing Calculate 1099 payments (BPS1099CLC) for the appropriate Calendar Year under Fee declaration, United States, Processing.

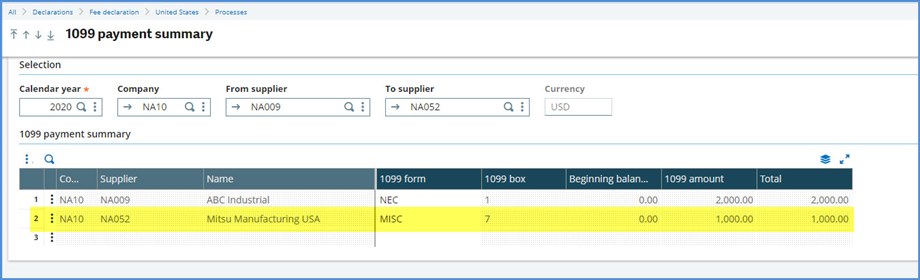

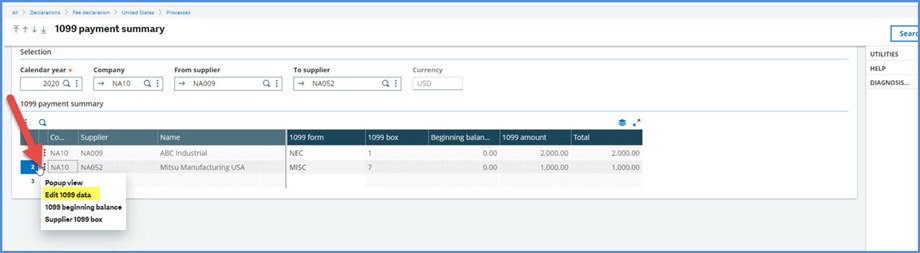

After you have run Calculate 1099 payments, you can see your 1099 totals under Declarations, Fee declarations, United States, Processes, 1099 payment summary (BPS1099SUM). Notice in my example, I still have $1,000 for form 1099-MISC / 1099 Box 7. How will we fix this?

When you print out your 1099-NEC forms, those incorrect 1099-MISC amounts will automatically be mapped to the appropriate 1099-NEC boxes on the printed forms. The 1099-MISC will not be generated for this vendor. No additional work is required!

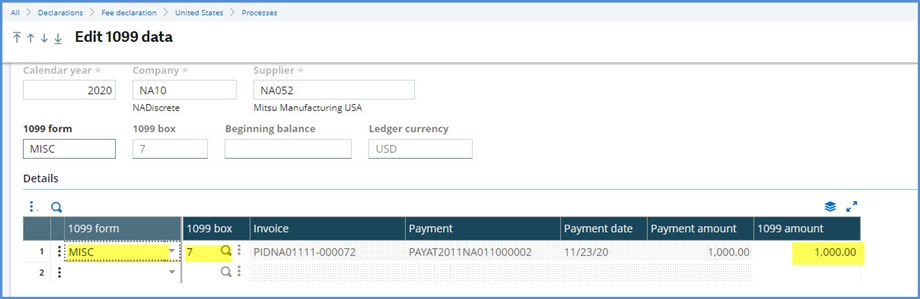

You still do have the option of manually changing the 1099 forms and boxes under 1099 payment summary. In the 1099 payment summary grid, click the Action icon on the Supplier’s grid line. Select Edit 1099 data from the drop-down menu.

In this screen, you have the ability to manually change 1099 form, 1099 box and 1099 amount values. Be sure to document your changes because there is no transaction log for these.

Do not attempt to correct this issue by changing the Box type or Form type in 1099 box (GESBX9) under Fee Declaration, United States, Setup. You risk corrupting your data.

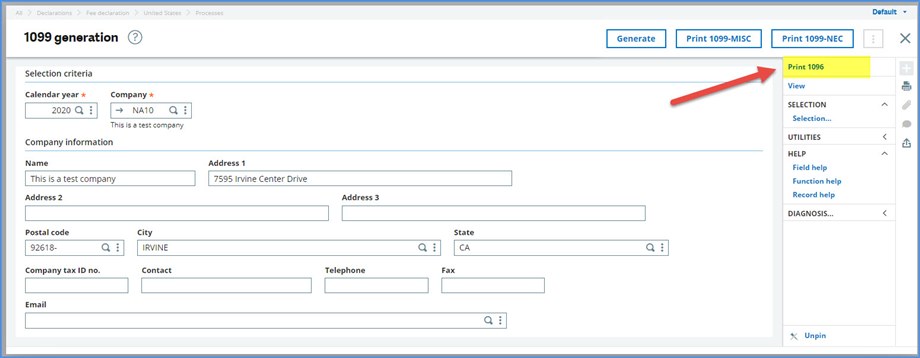

You may have noticed that the 1099 Generation function only has Print 1096 displayed in the right block for the Annual Summary and Transmittal of U.S. Information Returns. It doesn't list out options for NEC or MISC.

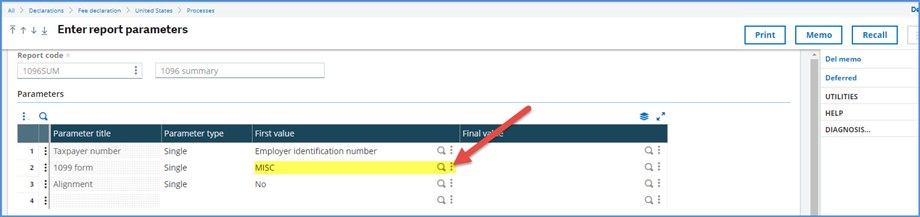

Click Print 1096 top open the Enter report parameters screen. The 1099 form value defaults to MISC.

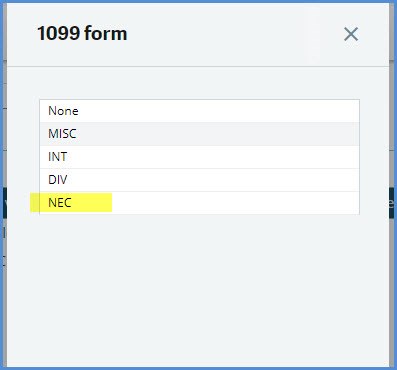

Click on the Magnifying glass in the 1099 form line’s First value to bring up the selection options. Select NEC.

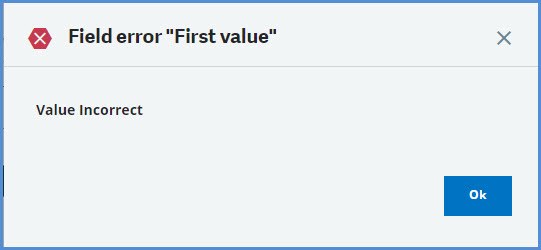

Only NEC and MISC are valid choices. If you select INT or DIV, you will receive an error message: “Field error ‘First value’ Value incorrect.” X3 allows us to track 1099-INT and 1099-DIV data, however, it does not provide for the printing of 1099-INT or 1099-DIV forms. Nor does it provide for the printing of the related 1096 forms for interest or dividends.

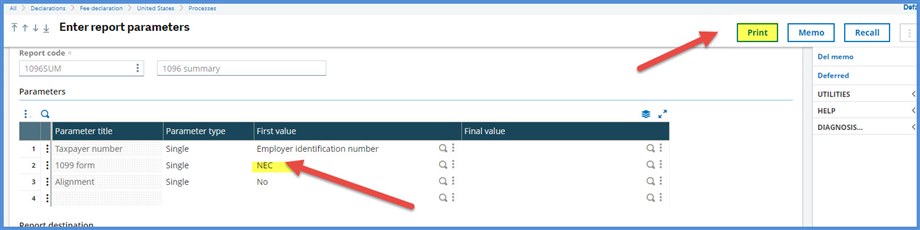

Once you select NEC, you are ready to print the 1096 summary form for the 1099-NEC forms..

Additional Information

- Be sure to check out the 1099 FAQs knowledgebase article 18346 for answers to common questions. .

- The 2020 updates for 1099 were included in v11.0.18 and v12.024. To be notified when the 2020 1099 update patches are available for other v11 and v12 patch levels, subscribe to the Sage X3 Announcements, News, and Alerts section of the Sage X3 Forums. Instructions on subscribing can be found in the Forums article Sage City, your new source for product release updates.

I hope this eliminated a little of your 1099-NEC stress. Take care and stay safe!