UPDATE: There are Sage X3 1099 updates for 2019 if you are on Product Update 9, version 11 or version 12. See knowledgebase article 101916. If you are on v6, v7 or u8, there are no updates required for 2019

Time is really flying by. It was 2 months ago that I reminded everyone to start prepping for year-end in “How many shopping days ‘til Xmas? How many days left to prep for year end?” Have you started prepping for year end yet?

Now, it is time for my annual reminder to start prepping for 1099s. The good news is there is no patch required for 2019 1099s! There were no changes in the areas covered by Sage X3 for 2019. To generate 1099s for 2019, you will just have to have installed the patch for 2018 1099s.

How will you know that the 2018 1099 patch was installed?

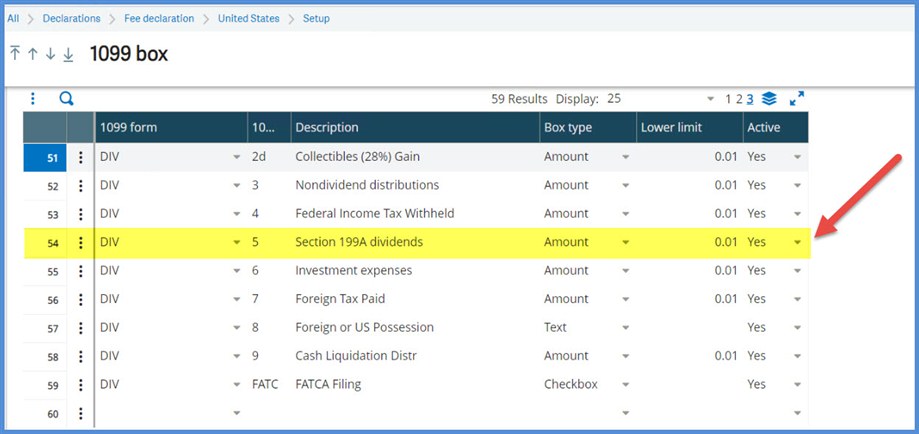

You can tell that 2018 update was installed if there is a 1099 DIV box 5 for Section 199A dividends in GESBX9. The function GESBX9 (1099box) is found under Declarations, Fee declaration, United States, Setup in v7, u8, u9, v11 and v12. In v6, GESBX9 is located under Common data, BP tables, 1099 box.

What if I didn’t install the 2018 1099 Patch?

If you didn’t install the 2018 1099 patch, it can be downloaded via knowledgebase article Download X3 1099 Updates for 2018 (94729.). To access the downloads, go to https://www.SageKb.com, log on, enter 94729 in the search field and click the magnifying class.

When you access the article, note there is a cumulative patch for each version which is compatible with the following:

Version 6.5 Patches 20 thru 40 (there are no patches for before v6p20)

Version 7 thru Patch 18

Update 8 thru Patch 10

Update 9 thru Patch 9

Version 11 thru Patch 10

The 2018 1099 / 1096 changes were delivered in the following version/patch and therefore these versions and their patch levels above this do not require any updates:

Update 9 Patch 10

Version 11 Patch 11

Version 12 Patch 14

What prep is required for printing?

First, Sage X3 only supports the printing of forms 1099-MISC and 1096. 1099-INT and 1099-DIV data can be collected in Sage X3, but only 1099-MISC forms can be printed.

Sage X3 only supports the printing of Laser Jet forms.

If you need forms, call Sage Checks and Forms at 800-617-3224 or go to https://sagechecks.com and ask for the generic preprinted 1099-MISC/ 2 per page forms.

Depending on your printer and driver, you may need to adjust your 1099 crystal reports to align properly on your forms. Be sure to do a test print your 1099-MISC forms and 1096 form on the printer you will be using to print your final forms. Do it early so that your internal Crystal person or business partner / Sage Professional Services consultant will have time to assist you with any adjustments that are required.

What prep is required for e-filing/electronic filing?

Sage X3 does not support e-filing/electronic filing. However, the 1099 data can be easily exported and formatted to map into 3rd party software.

What resources are available as I prepare my 1099s?

For questions on what to include or exclude and verifying out deadlines, refer to the IRS website (irs.gov) or your tax advisor.

You can refer to knowledgebase article 18346 for 1099 FAQs

Miscellaneous

Should you need to file a corrected 1099 MISC form, the correction box must be manually checked on the forms. Then, check with your 3rd party software’s instructions on filing the corrected form.

If you are still on v5 and v1.4, check out knowledgebase article 18349. While you can’t print 1099s from these versions, the article explains how to gather it. From there, you can use it with a 3rd party to print and file electronically.

Next

We will look at reviewing the 1099 data in Sage X3