Chances are you haven’t paid much attention to the Period value in Document types under Setup, Financials. When you create a new document Entry type, you probably just copy an existing one and change the Description and maybe the Sequence number and/or the Default journal. But don’t neglect the Period value! If you do, you may start hearing panicked cries of “Why is that entry showing up in the wrong period on some reports?” or “Why don’t my reports tie anymore?”

What is the significance of a Period in Sage X3? In some tables, transactions are recorded with both a period/fiscal year designation plus an accounting date. Example: the journal entry header table (GACCENTRY) and the Sales invoice header table (SINVOICE) tables have both.

We have three options for Period in Document Types: Normal, Carry Forward, and Closing. Normal is the Period type for your day-to-day transactions. Carry Forward and Closing are used in the closing process. What happens if you select Carry Forward or Closing for your everyday entries by mistake.

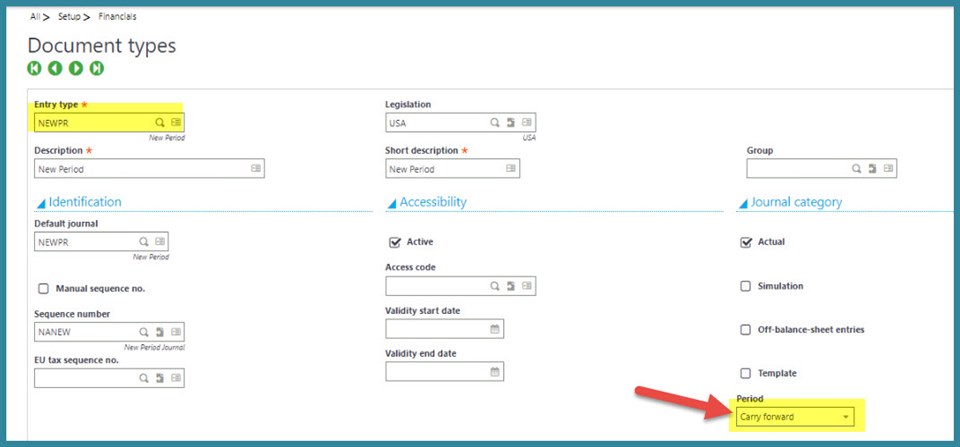

Let’s look at Carry Forward first.

Typically, Carry Forward is used on the NEWPR document type and shows up on your journal establishing beginning balances. Transactions using the Document type end up in Period 0.

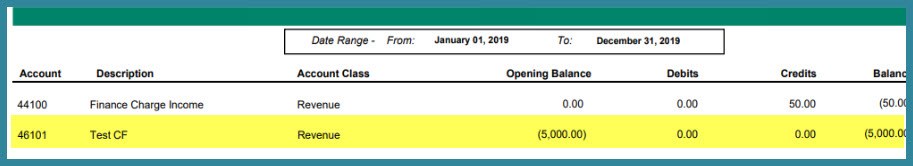

If I accidently use the Carry forward document type on a Customer BP invoice for $5,000 to GL account 46101, with the date of 5/1/19. The transaction is assigned to period 0. The transaction shows up as a beginning balance in 2019 on the NA-TRLBAL report. We wouldn’t expect a beginning balance in a Revenue account.

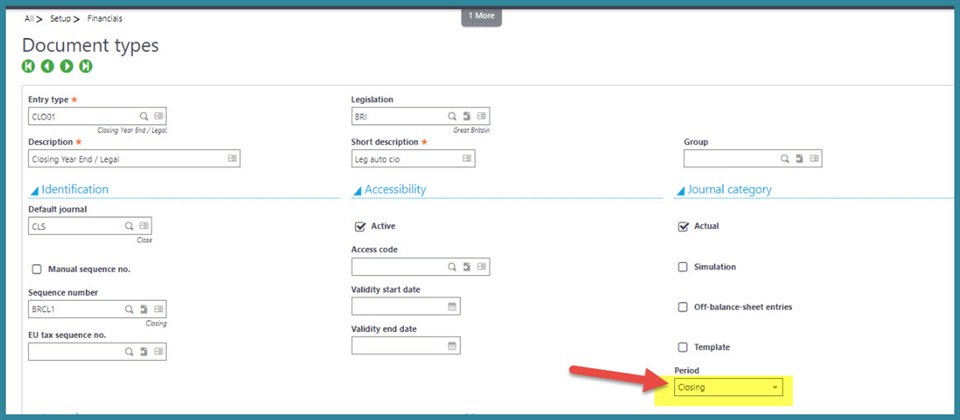

What if I use the Closing Period type?

If I accidently use the Closing document type on a Customer BP invoice for $7,000 to GL account 46102, with the date of 5/1/19. This transaction will head to the next open period. The transaction shows up in Period 6 on the NA-TRLBAL report instead of the expected May which is period 5. It does maintain its ACCDAT of 5/1/19.

How does this affect your reports?

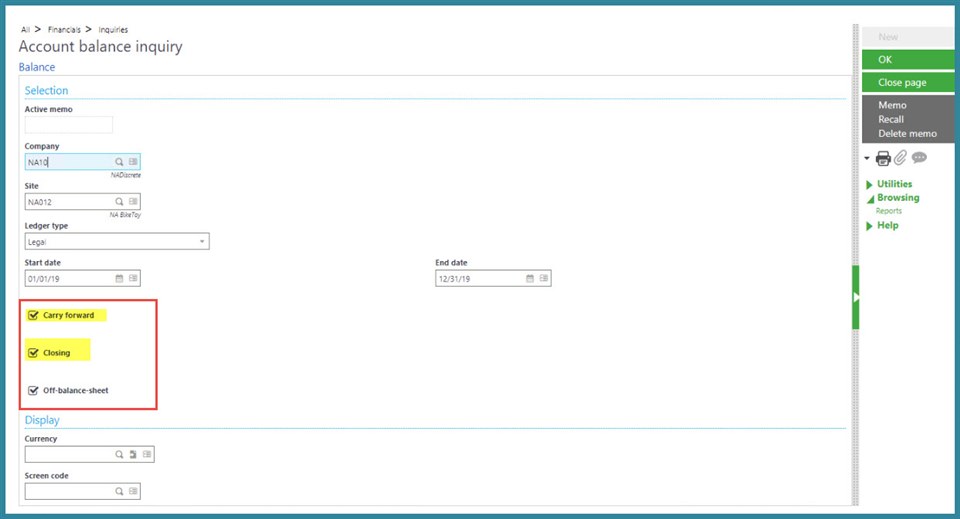

If you are using a report that is based on accounting dates and your range is from 5/1/19 through 5/31/19, the above transactions will be included. If you are running a report which uses periods and fiscal years, a report run for period 5, fiscal year 2 (2019), won’t include the above.

Don’t forget that Inquires and some reports may have Criteria with options to include or exclude Carry Forward and Closing entries. The Criteria can be saved in Memos. (See blog: Sage Ent. Mgmt. Overlooked features: Memos and Criteria). This could cause some confusion.

Remember when copying Document Types or setting them up from scratch to not overlook the Period. Make sure you are using the appropriate Period value.