Have you ever gotten carried away and opened more fiscal periods than you intended? Does it leave you with a feeling of dread that people will accidently enter transactions into future months and you will be left with the resulting cleanup task. To stop data entry into past periods, you can just close the period. Closing doesn’t work for future fiscal periods because they have to be closed sequentially from oldest to newest. What can we do?

The periods start off with a Period status equal to “Not open.” This status indicates that no document or entry can be entered in this fiscal period. Once the fiscal year is opened, the Period status is eligible to be “Not open;” “Open, meaning any entry is authorized; or “Closed, meaning the period is closed and no entry is possible.

Periods may be updated from “Not open” to “Open” if the prior period is “Open.” The “Not open” Period status is perfect for preventing the entry of transactions into future periods.

Before we go any further, I must jump on my soapbox. We should not go into SQL or GMAINT and try to make changes. These options do not utilize business rules. “Business rules” refers to the verification process transactions go through when entered in the front end. For example: the business rules check to see if a BP number is valid when you enter an invoice, or the payment terms are valid. Busines rules help maintain referential integrity.

SQL and GMAINT don’t check to ensure the changes are valid. SQL and GMAINT updates don’t update transaction data to other linked tables/fields. If you update an amount field, related accumulated or linked fields are not automatically updated. I will jump off my soapbox now and move on to the process.

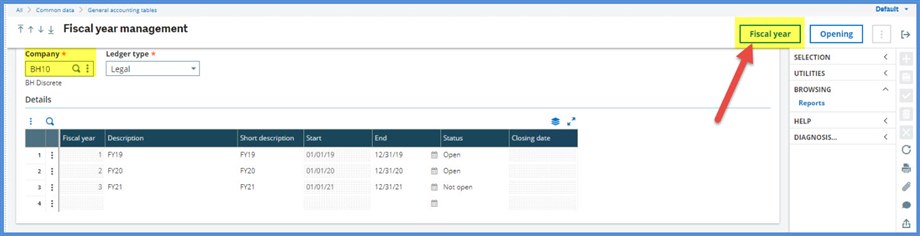

We will start by looking at the creation of fiscal years and fiscal periods. For company BH10 with one ledger, I have already created FY21. We will walk through creating new fiscal year FY22 under Common data, General accounting tables, Fiscal Year (GESFIY). After selecting the Company, click Fiscal year.

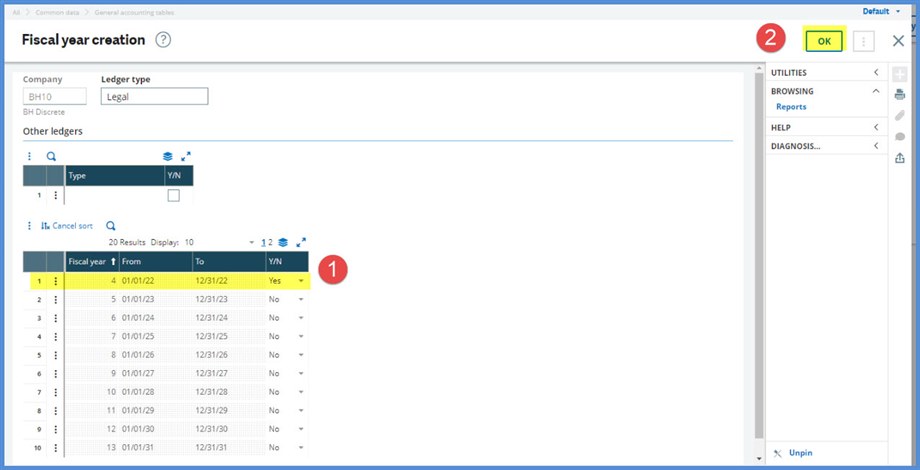

To create FY22, on the Fiscal year creation screen, we will (1) select “Yes” in the Y/N column in the grid line for Fiscal year 4 which is for the year 1/22/22 through 12/31/22. (2) Click OK.

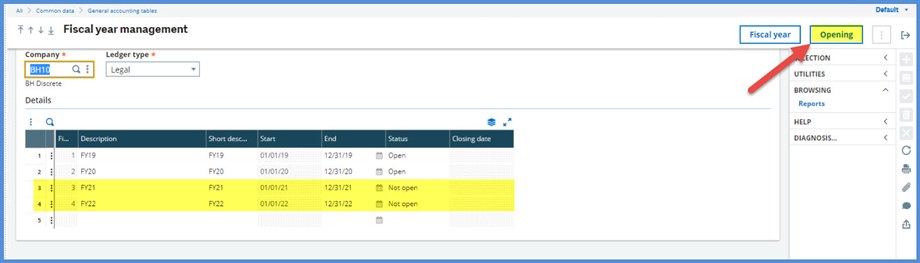

We will complete the Description and Short description fields. Note that F21 and F22 have Status values of “Not open.” We will click Opening to open FY21.

On the Fiscal year opening screen, we will (1) select “Yes” in Fiscal year 3 to open FY21. (2) Click OK.

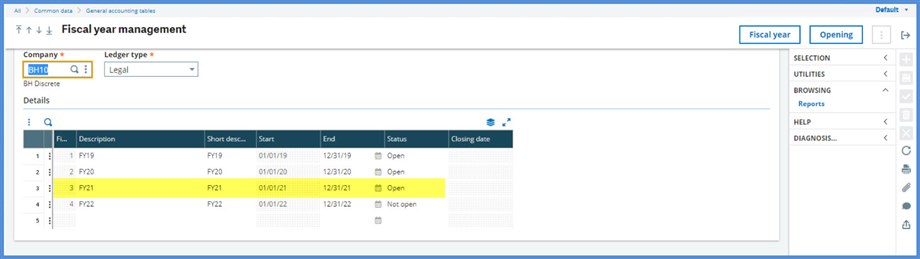

Back to the Fiscal year screen, we see that FY21 is now “Open.” FY22 is still “Not open”

Off to the Period function. When a fiscal year is first created, the associated fiscal periods are generated and can be seen under Common data, General accounting tables, Periods (GESPER). Note that both FY21 with the Fiscal year status equal to “Open” and FY22 with Fiscal year status set to “Not open,” have Period status values equal to “Not open.” Opening the fiscal year, does not automatically open the periods. Once the fiscal year is open, we can open the related periods either through Periods or through Multi-company period opening (TRTPERMC).

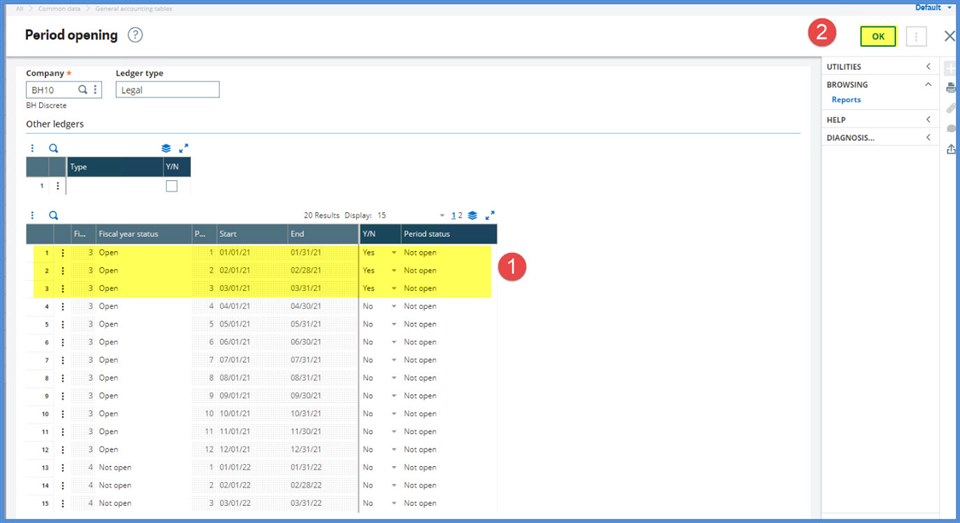

We will open January through March on FY21 using Periods. Click on Opening. Once in the Period opening screen, (1) select “Yes” on grid lines for Periods 1,2,3 and (2) click OK

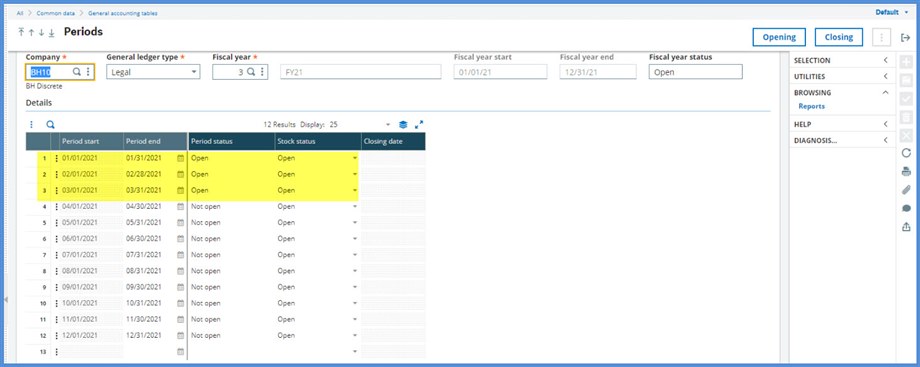

The Period status values for the first 3 periods of FY21 are now equal to “Open.”

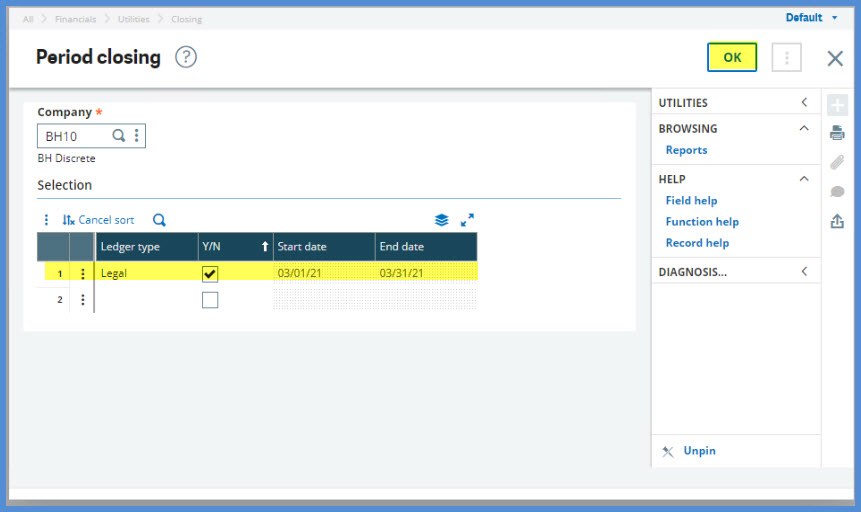

Oops, we only really wanted to open January and February! Not to worry, we do have an available method to change that month back to “Not open” if no transactions have been posted to the period. This method is Period closing (UTICLOPER). Period Closing is described in the Online help as follows: “This function is a utility used to reset to status ‘Not open’ some accounting periods on which no movement was recorded.”

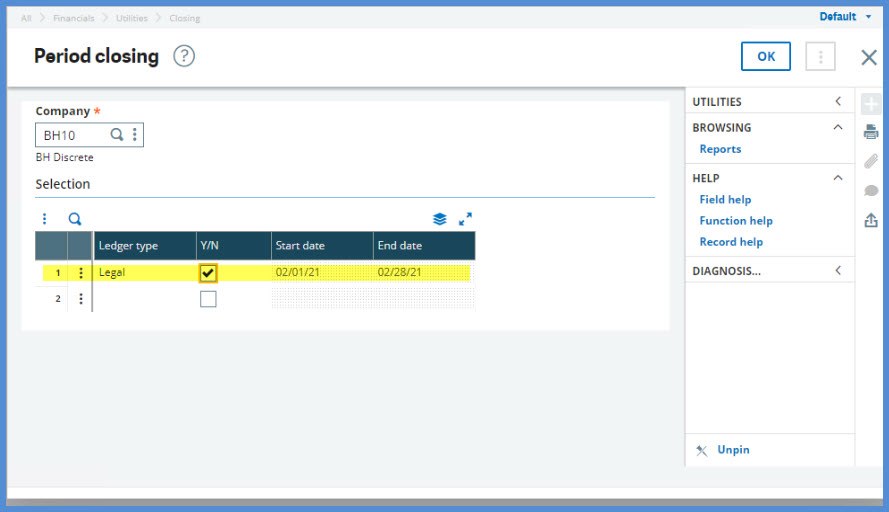

We will hurry down to Financials, Utilities, Closing, Period closing before any transactions are posted. Once there, we select the Company and automatically the Ledger type, Start date and End date fields will be populated. The Start date and End date field values are the dates for the newest period eligible to be changed. We selected the Y/N box. The period status can only be changed for one company and one period at a time. Click OK to run the process.

Here is the Log. It shows that Period 3 was changed.

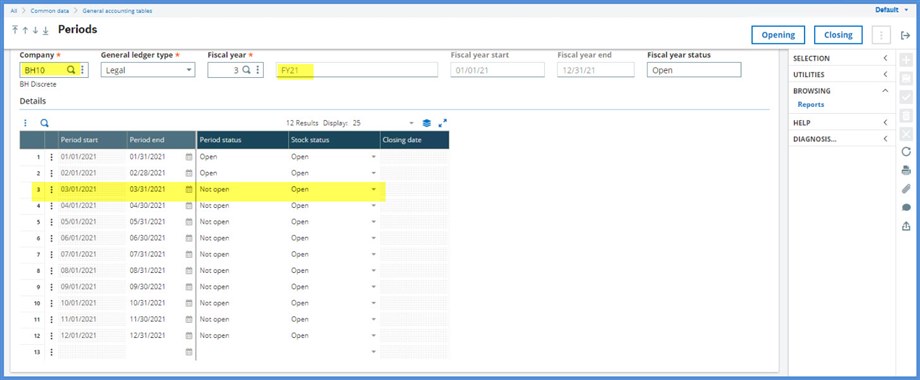

Back to Periods, we can see that for FY21, March has a Period status of “Not open.”

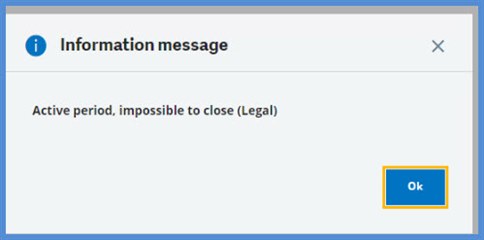

What happens if a transaction is posted to February? Would we be able to change it to “Not open?” I entered a journal to BH011 for 2/1/21. BH011 is a site under BH10. We will revisit Period closing. After we select the Company, the Ledger type displays and the Start date and End date fields are populated with February dates. We will select the Y/N box and click OK.

We receive a message: “Active period, impossible to close (Legal). We are not able to change this period to “Not open” because of the transaction.

What else can we do to block transaction entry? We have the option to set transaction start and end dates under Setup, General Parameters, Parameter values, Chapter TC, Group CLO. The parameters can be set to limit the dates for transactions creation. See the Online help for each parameter value to review more details.

There is the Stock status on the line per fiscal period under Periods. Here, we have 3 available choices as described in the Online help:

Direct

The period is open to all movements.

Balance adjustment

The period is open to price adjustment movements only. If not absorbed movements exist, they are posted on the first open fiscal period available. This status is used to modify an existing stock transaction (shipments, receipts, etc.) and to launch the price adjustment processing (issues and receipts).

Prohibited

The period is prohibited for any movement (for the end of month processing).The average cost and other value totals are not recalculated, variances are considered as being not absorbed and are posted on the first open fiscal period available.

I hope this information helps you in managing data creation.

Stay safe!