The scenario is that a building is being constructed and the invoices are being assigned to the components (Roof, Shell, HVAC, etc.) posted to a CIP account and then transferred in mass when the building goes into service.

We assume when the asset is in CIP, no depreciation against the principal and component assets. Once the building goes into service there will be depreciation against the principal and component assets.

Prerequisites:

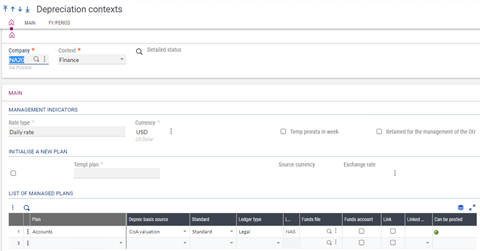

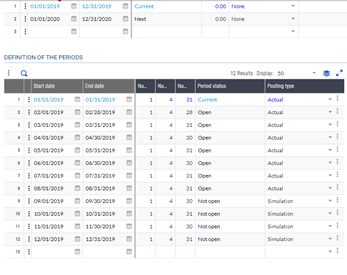

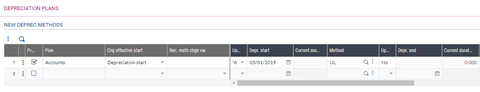

- GESCNX: Setup the depreciation context for the company and the fiscal years.

- Current period is 01/01/19 – 01/31/19

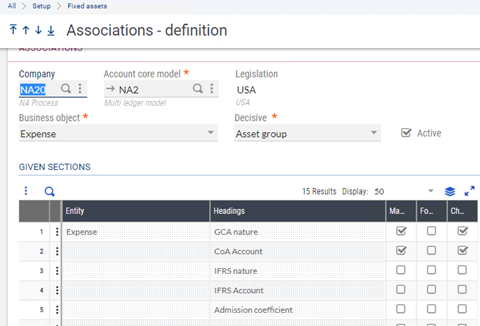

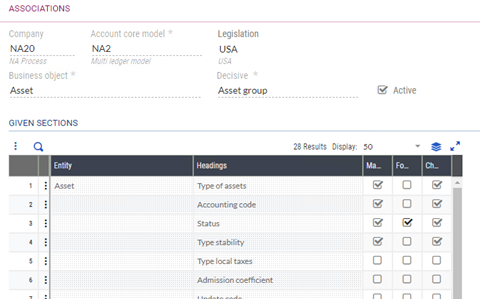

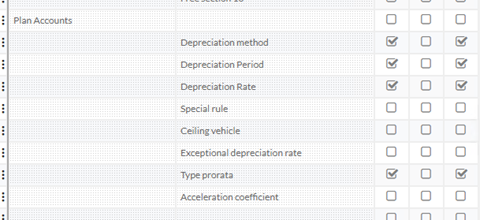

- GESRDE: Setup the associations - definitions for Expenses/ Asset groups and Assets/ Asset group

Expense/ Asset group

Asset/ asset group

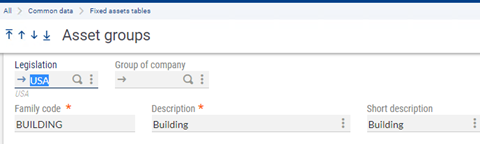

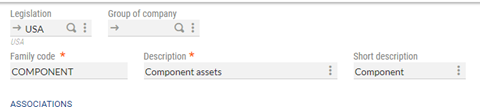

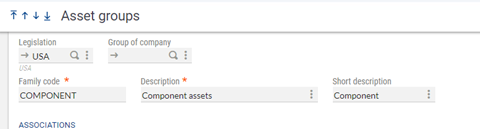

- GESFAM: Setup the asset group

Building CIP

Component CIP

In service group

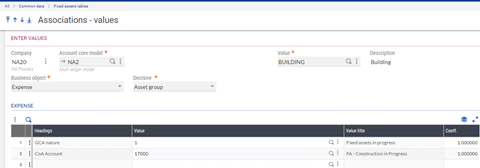

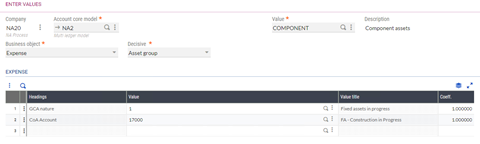

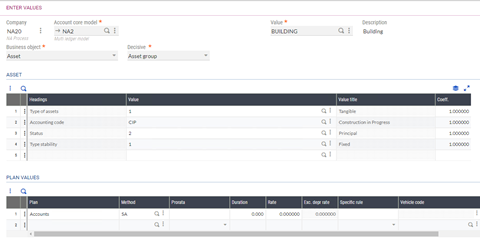

- GESRVA: Enter the Associations – values for Building and Component groups (this setup is done to default the values when creating an asset).

Expense/ asset group - Building (CIP)

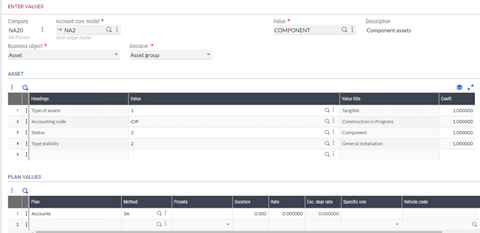

Expense/ asset group - Component (CIP)

Asset/ asset group - Building (CIP)

Asset/ asset group - Component (CIP)

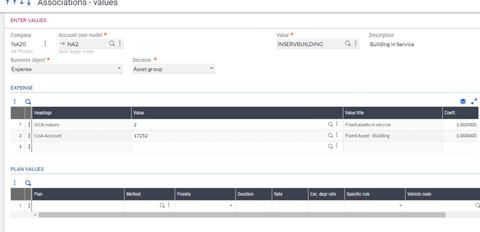

Expense/ asset group - In service building

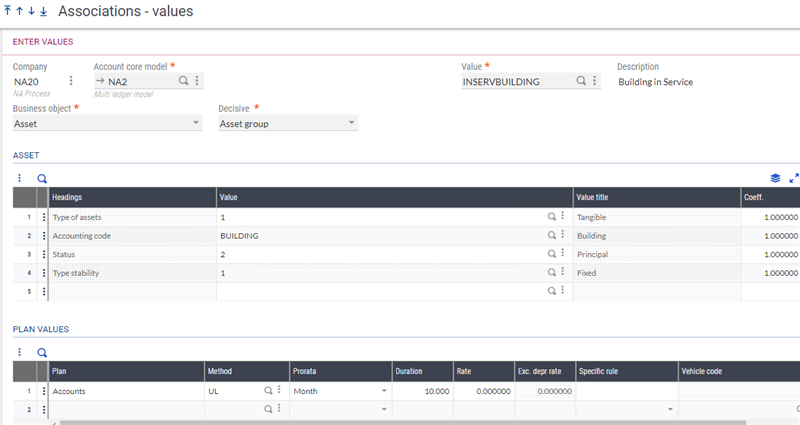

Asset / Asset group - In service building

Steps:

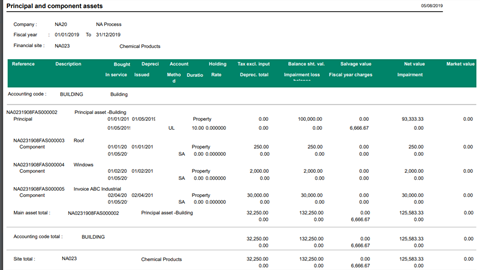

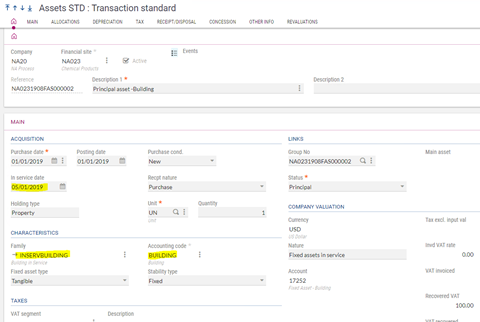

1) GESFAS: Enter a principal asset

- Building - NA0231908FAS000002

2) GESPIH: Generate a few purchase invoices to capitalize and generate the component assets.

- Roof 01/01/19 PIN000045 250.00

- Windows 02/01/19 PIN000046 2000.00

- HVAC 04/02/19 PIN000047 30000.00

3) GESFAS: Capitalize the above expenses to generate component assets.

- Link the main asset

- Roof - NA0231908FAS000003

- HVAC - NA0231908FAS000004

- Windows - NA0231908FAS000005

Now let’s assume the building is complete and it’s time to put the building to in-service.

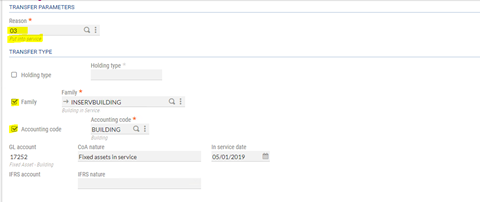

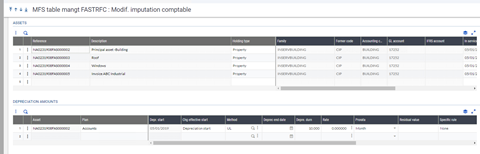

4) FASTRFCM: Run the Accounting allocation change to update the accounts from ‘CIP’ to ‘Fixed assets in service’ accounts.

- This process can be run in simulation to make sure the changes are correct.

- Then run it in actual to update the assets.

- Select the company

- Reason for the transfer

- Transfer type, depending on your setup you can select a family to default the accounts.

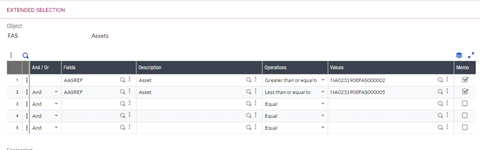

- Finally, select the assets.

- Click the ‘check’ button to check the changes prior to confirming them.

5) GESFAS: the accounting code has been updated to an in-service account.

6) AIMP: Run the report FASMAIN Principal and component assets to look at the principal and component assets on a period or a fiscal year.