It’s coming up to that time of year. All the pumpkin spice drinks and foods are already available at your local coffee shops, restaurants and grocery stores. Before you know it, Christmas lights will be replacing barbeques and pool floaties in the seasonal section of stores.

I hate to sound like one of those ads that constantly warn you about the ever-shrinking number of shopping days left until Christmas, but… year end is rapidly approaching, and the days left to prep are decreasing! Now that I have you in a panic, let’s take a look at a few tasks you can do ahead of time that will help you have a smoother year-end close. This isn’t all inclusive; just some frequently overlooked areas.

Sage X3: Year-end Resources on Sage City

Be sure to bookmark this site Sage X3: Year-end Center: https://www.SageCity.com/YearEnd. There are links to year-end videos and Sage University training. The videos cover correcting some common year-end errors. Sage University offers courses on closing year-end. A bookmark to the Sage Knowledgebase will come in handy too https://:www.SageKb.com. It's helpful to have these easily available as you start your year-end prep.

Do you have a test folder with fresh data?

It is always good to have a freshly updated test folder to practice on. Do a test run of the year-end close. Better to “play around” there than in your production folder. They are perfect for trying out those “I wonder what would happen if I…” scenarios. Test environments are great for training newbies too.

Have you cleared out your suspense account?

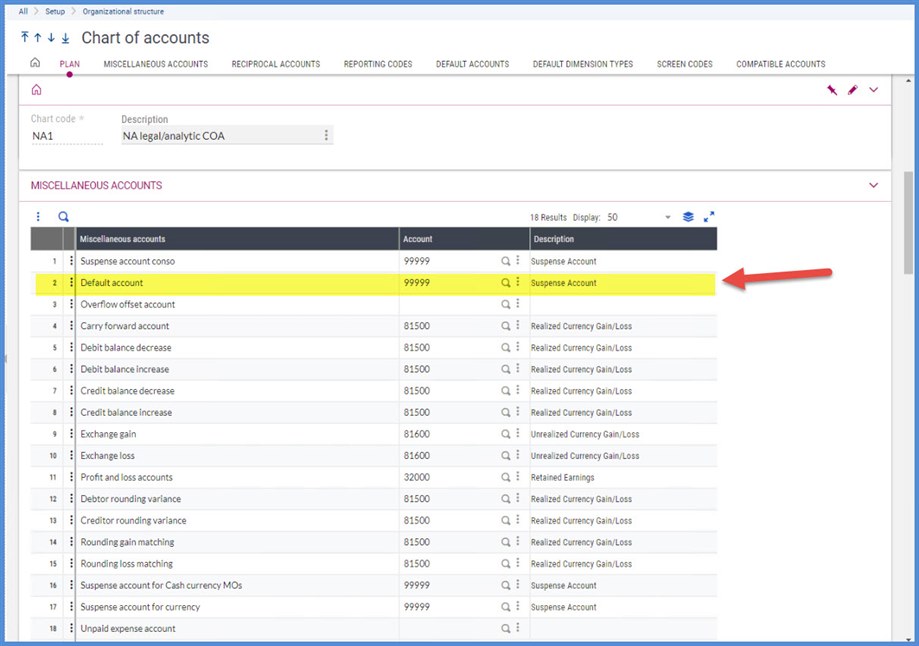

“I have a suspense account?” you ask. Head over to the Miscellaneous Accounts tab under Setup, Organizational structure, Chart of Accounts. For a definition of each line look at the Field help for the Account field (COAACCDES) to find what accounts are being used for suspense.

The GL account assigned on Default account line 2 is where you are likely to find the most activity. It is defined in the Online help as “The account mentioned is used in the automatic journal generation process when the account built from an accounting code is inconsistent or when the account has not been defined.”

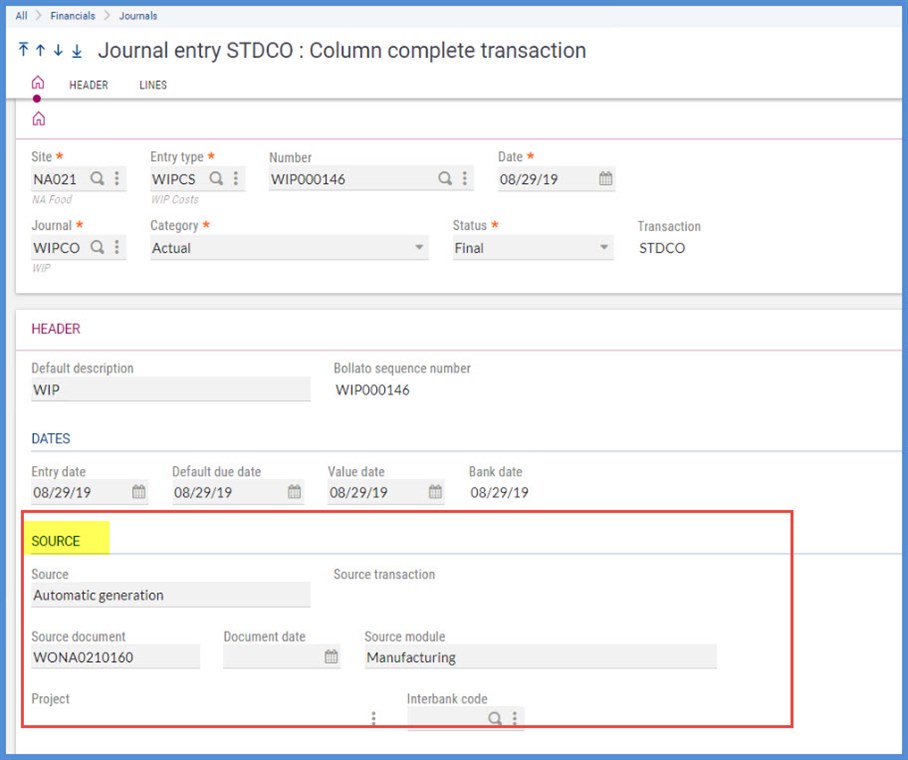

When you are trying to find where these suspense journals originated, don’t forget v12’s new section on the Journal Entry screen (GESGAS): Source. The section supplies information on how it was created, source module and source document.

Have you checked out Query Management?

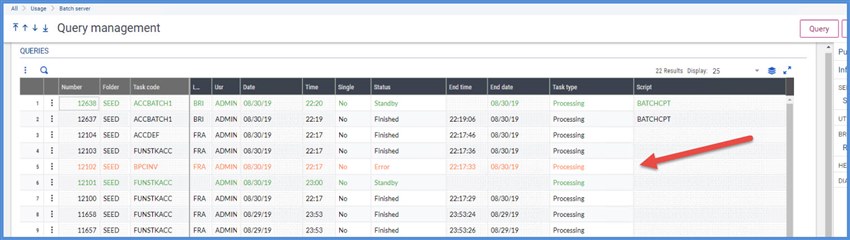

Query Management (AREQUETE) is found under Usage, Batch Server. This is where you can check up on all your recurring tasks. You don’t want to leave unresolved errors out there or discover that nothing has been processed because of bad parameters. For additional tips, see the blog: Are your recurring tasks recurring?

Have you been regularly closing periods?

You don’t want to be struggling at the last minute to review and close out 12 months of transactions. Start the process sooner rather than later. If you do find that transactions haven’t hit the general ledger, check out the blog Where are my journal entries? This will give you some tips on where to look.

All periods in a year must be closed sequentially before you can close the year. Run the Cloper report (Pre-closing verification report) before you start attempting to close. Remember the Cloper report can only be run for open periods or years. The report will show you what transactions require care before you will be able to successfully close the period. See the blog Sage X3: Clearing common Cloper anomalies for tips on handling the errors. Also,the Cloper report ends with a a warning section indicating whether an account that you expect should have a debit balance has a credit balance or visa versa. You can get a jump on reviewing these accounts before year end. You don't want an accrual account with a debit balance when the auditors come in.

Once you’ve cleared up all your problem transactions, you are ready to head to Common data, G/L accounting tables, Periods to close out the periods. Of course, as you review data, you may need to reopen a period for corrections or adjustments. See knowledgebase article 41758: How to reopen a fiscal period or year.

Study last year’s close

Look over your notes from last year. Were there any “gotchyas” that held up the year-end close that you can address now? Did you take too much time creating workpapers for accounts? In the blog Fun Financial Facts, there is a section on using manual matching to create Excel spreadsheets for account analysis. This could speed up your account analysis process.

What reporting or analysis did the auditors request? Do you have all the Crystal and Query Tool reports that you promised yourself you’d have created by this year’s audit? Don’t wait to contact your business partner or Sage Professional Services consultant if you need assistance with these.

In closing

I hope these tips motivate you to start preparing for your year end. Me? I’m off to get a pumpkin latte and start Christmas shopping. There aren’t many days left!