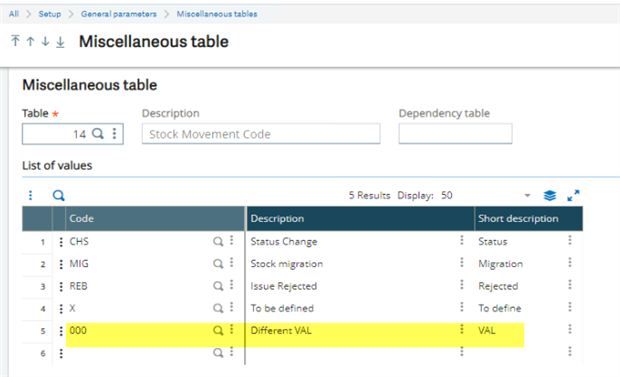

Movement codes are used to define different settings for the same movement type as long as the movement code is different. These codes can be created in the Data function under Miscellaneous tables in Setup, General parameters for table 14 “Stock Movement Code”. Movement codes can be associated with different transaction types such as Miscellaneous receipts and issues under Entry transactions in Setup, Stock.

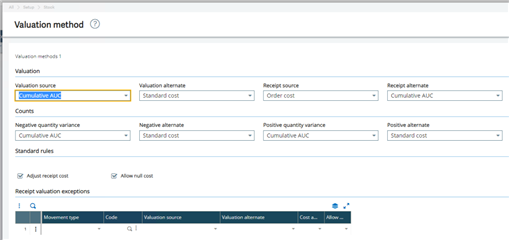

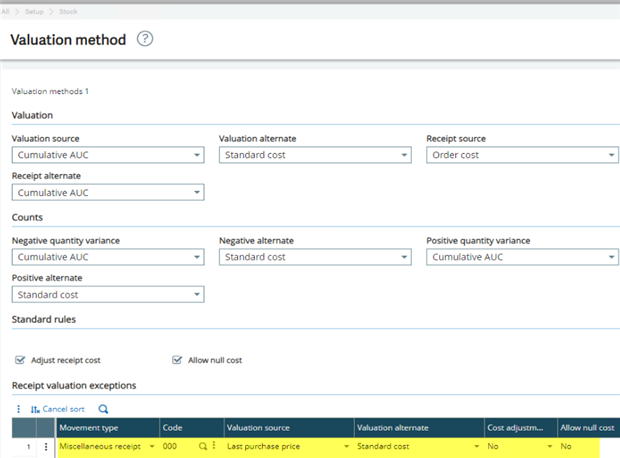

In the example below, there is a valuation method of Cumulative Average Unit Cost “AVC” assigned to a lot product where the Valuation source is a Cumulative AUC and the valuation alternate is a Standard cost. For standard rules, the Adjust receipt cost is checked as well as the Allow null cost.

Based on the settings above, when a stock transaction is processed, the prices will be assigned according to the valuation source made on the valuation method. However, sometimes, there is a need to assign a different valuation source for the product through using a specific stock transaction as in this example it is a lot product with AVC for the valuation method and it is assigned to it under the Cost tab in the Product-site. When this product is received using a misc. receipt, the valuation source needs to be “Last purchase price” instead of Cumulation AUC.

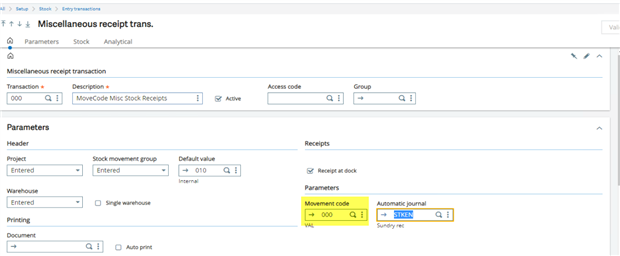

The first step is to create a movement code in the Miscellaneous tables 14

Next, from the Product-site, Cost tab, jump to the Valuation method then click the magnifying glass to arrive to the Valuation method window (Setup, Stock), then in the Receipt valuation exceptions section, you can select the Movement type which in this case is the Miscellaneous receipt, the Code is 000, for the Valuation source we are going to pick “Last purchase price”, and the Valuation alternate is “Standard cost”. Finally, for the Cost adjustment and Allow null cost, we are going to set both to No. Setting Allow null cost to "No" means if a product is new and has no cost on it and it has no valid standard cost record, the user will not be able to process a misc. receipt for this product with a zero cost, a message will pop out saying “Valuation price null not authorized!”

Then, we need to assign the newly created movement code to the Miscellaneous entry transaction (Setup, Stock, Entry transactions) under the Movement code.

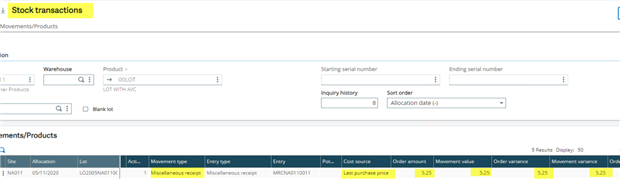

Once processing a misc. receipt using the Misc. receipt transaction that has the movement code assigned to it, the cost of the product will be the “Last purchase price” instead of the Cumulative Average Cost.

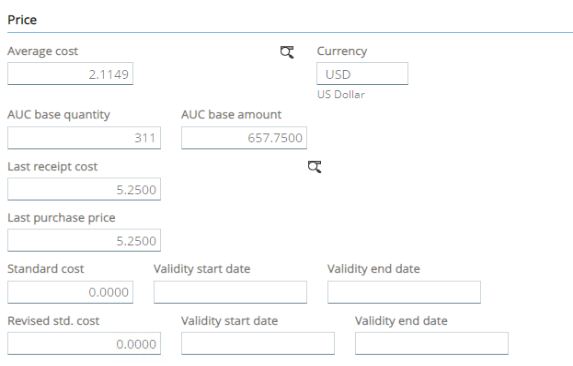

In this example, the Average cost is 2.1149 and the last purchase price was 5.25; when the misc. receipt is processed, the stock transaction movement shows the 5.25 as the last purchase price and not the average cost as the movement code we created and assigned to the misc. entry transaction allowed the system to pick the last purchase price instead of the average cost.