When you close a fiscal year (hard close) using the Fiscal year end (FIYEND) process there may be instances where the ending balances with dimensions of the previous fiscal year may not match the opening balances with dimensions of the new fiscal year.

You may be thinking why when you run the “Year end simulation” (SIMULFINEX) process for the new year the carryforward balances with dimensions match the ending balances with dimensions of the previous fiscal year, but upon running the Fiscal year end process the carryforward balances with dimensions were off.

This is a product limitation until v11 that has been fixed in v12. Backporting this fix is not possible due to complexity of the fix.

What is the best way to fix this issue? We need to force the AMTLED values using an import template.

Steps:

1. Refresh your PILOT/TEST folder with your recent PRODUCTION folder. This is to test the fixes in your TEST folder prior to moving it to your LIVE folder

2. Run the NA-TRLBAL report with dimensions for the closed fiscal year and for the new year. For example, let’s take 2018 is the closed fiscal year and 2019 is the new year.

3. Identify the accounts and the dimensions that are out of balance.

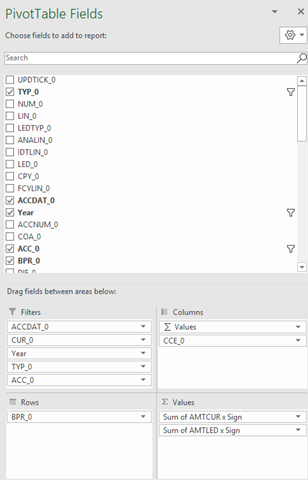

4. Extract the GACCENTRY and GACCENTRYA tables using SQL server management studio and save it to Excel. Once you have the information analyze the differences between 2018 and 2019 and make a note of them. To identify the year, use the ACCDAT_0 column and then use the PivotTable to filter the data by the ACCDAT_0, CUR_0, Year, TYP_0, ACC_0. Take a note of the AMTCUR (transaction currency) and AMTLED (ledger currency). For a foreign currency transaction AMTLED is what we need to compare to.

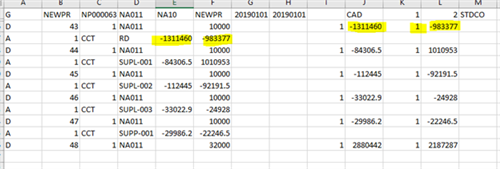

5. Once the analysis is complete you will have an idea on how may accounts are affected and which NEWPR entries that need to be fixed. Meaning when the fiscal year is closed there maybe a few new period entries generated and we need to know which ones must be corrected. For example, we have NEWPR entries in CAD, JPY and USD local currency and some of the accounts (carryforward) with dimensions were incorrect.

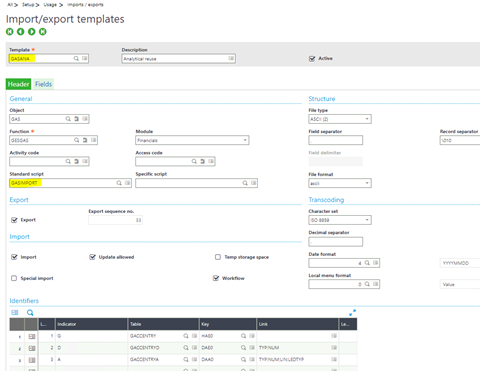

6. After identifying the accounts using the import template import the correct values. In order to do that we need to use the import/export templates (GESAOE) GASANA and copy it to create a new one.

7. Export the NEWPR entries to generate an import file. Once the file is exported update the import file. We need to force the AMTLED1 field by setting it to “1”.

Highlighted fields are the AMTCUR_0, AMTLED_0 and AMTLED1.

8. Once the import files are ready, we need to reverse the carryforward journals by using the reversal button in the journal entry screen (GESFAS).

9. After the import run the NA-TRLBAL report to make sure the beginning balances with dimensions are correct.

10. Additionally, you might want to adjust the retained earning account balances to match the correct balances after the import process.

Note: GACCENTRY table FLGREP (carryforward) flag. The imported carryforward journal entries may not have a correct value for this field and the NEWPR entry will show up under the manual matching screen. To avoid that set the value to 2 and it should remove those carryforward entries from the manual matching screen.