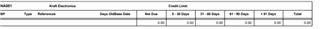

You are reviewing the month end AP aging and notice the balance for a certain supplier doesn’t seem right. There is a missing BP supplier invoice amount on the Supplier aging. You’ve run the aging in summary and it shows $0 balance for NA051.

Where did that invoice go? We will go in search of the missing invoice!

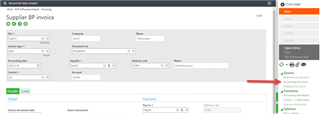

Invoices make their way to the agings when the invoice is posted to the general ledger. The first place to check is did the invoice post. If the Post button isn’t grayed-out, then it hasn’t been posted.

If you have posted the invoice, was an Accounting document created? Click on the Accounting document.

If no journal entry screen appears, check if the Accounting tasks are running. Remember until the transactions hit the GL, there is no entry to the aging.

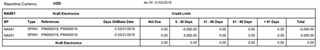

Once it is posted to the GL, let’s look at the aging with detail. Note that the invoice shows as a debit and credit for a $0 balance on the aging.

Notice that the journal is debiting and crediting the AP account.

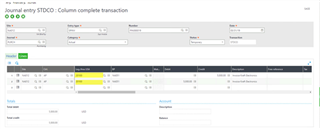

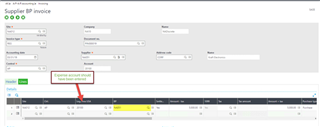

How does the BP Supplier invoice end up debiting and crediting the same account, leaving us with a $0 balance? Time to review the BP Supplier invoice lines. The BP was entered on the line with the control account instead of just the Expense account. The lines shouldn’t have the BP, just the desired expense account.

This is how a BP Supplier invoice should be coded with just the entry to the gl account field.

Another successful reconciliation! We found our invoice and can re-enter it with an expense account.