- It’s 1099 time again! Here are a few tips to help you along as you review.

- Before you start reviewing your 1099 data, be sure you have you applied your 1099 patches for 2018.

- A cumulative patch was created for each version and it includes previously delivered fixes. The cumulative patches are compatible with:

- Version 6.5 Patches 20 thru 40

- Version 7 thru Patch 18

- Update 8 thru Patch 10

- Update 9 thru Patch 9

- Version 11 thru Patch 10

- The 2018 1099 / 1096 changes will be delivered in the following version/patch:

- Version 6.5 Patch 41

- Version 7 Patch 19

- Update 8 Patch 11

- Update 9 Patch 10

- Version 11 Patch 11

- Links to the 1099 download can be accessed from Sage Knowledgebase article 53011. Log into https://support.na.sage.com and enter 53011 in the Search field.

- A cumulative patch was created for each version and it includes previously delivered fixes. The cumulative patches are compatible with:

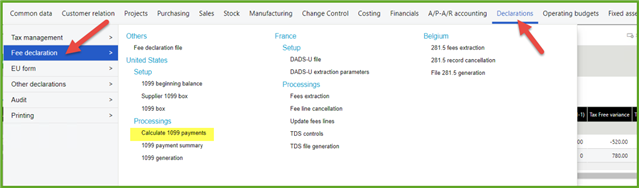

- If there isn't any 1099 data available to review, check if the Calculate 1099 payments (BPS1099CLC) has been run for the calendar year.

- V11

- If it appears that there are missing payments or too many:

- Remember that the 1099s for 2018 only include payments made during calendar 2018.

- Examples:

- Invoices entered in 2018 are only included in 1099 totals if they were paid on a check dated within calendar 2018.

- Invoices with a 2017 or even 2019 accounting date are included in the 2018 1099 totals if they were paid by a check dated from 1/1/18 through 12/31/18.An invoice dated 6/1/18 paid by a check dates 1/2/19, will not be included in the 2018 totals because the check isn't dated within the 2018 calendar year.

- Your fiscal year configuration is not considered. The transactions included in the 1099s are entirely based on the calendar year.

- It is possible that you may need to adjust the 1099s.

- You may have payments that were entered in another system or perhaps paid out of the petty cash.

- Invoices may have been processed to the wrong 1099 box.

- A supplier may not have been set up as a 1099 vendor.

- A specific invoice might not have been marked as 1099.

- What are the options if you need to make an adjustment?

- You can import data using the Import template,1099 beginning balance (B98). This is especially helpful if you are bringing in multiple balances from another system.

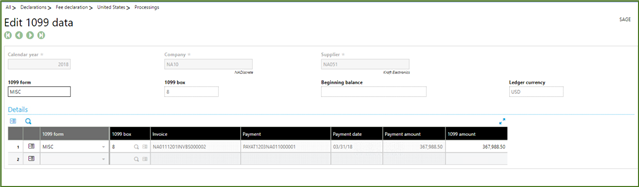

- Instead of importing, you can manually enter 1099 balances, using the 1099 Beginning Balance (GESB98) function to set the 1099 beginning balances by year, company, supplier, form, and box.

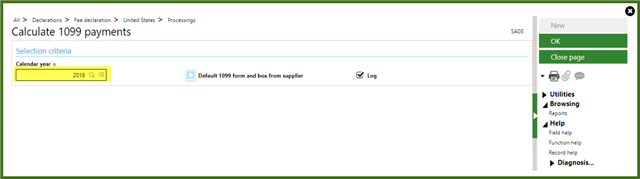

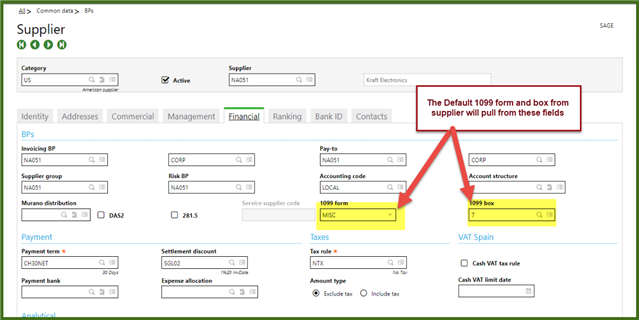

- Under Calculate 1099 payments, there is an option, Default 1099 form and box from supplier. If selected, the form and box from the supplier will default on the payment record, when the invoice 1099 form is none and the supplier has selected a default 1099 form type on the supplier record. This is useful when a supplier is initially not setup for 1099 tracking and invoices and payments have been processed against the supplier.

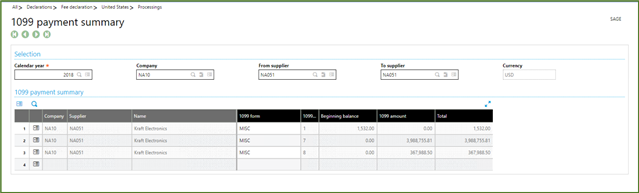

- Under 1099 payment summary (BPS1099SUM), you can adjust the 1099 amounts or the 1099 box. Clicking the Actions icon will display the details behind the box totals.

- 1099 Notes:

- Only 1099-MISC and the 1096 can be printed out from Sage X3. Data can be tracked for1099-DIV and 1099-INT, but the forms cannot be printed.

- To determine what payments should or shouldn’t be included in 1099s, refer to the IRS website, https://www.irs.gov/, or your tax advisor.

- You can order 1099-MISC forms from Sage at http://www.sagechecks.com or call 800-617-3224

- See Sage Knowledgebase article 18346 for frequently asked questions on 1099s.

- You can print out the detail behind the 1099s with 1099 activity report (1099ACT).