Did you ever notice the function Calculated journals under Financials, Current processings? The thought of exploring the function pops up every close, but the thought gets lost in the hustle of finishing period end until same time next month? Let me get you started on your exploration.

What does this function do?

First, we’ll go to where the process starts at Setup, Financials, Accounting forms, Calculated journals and see what the Online help center has to say:

Use this function to calculate a journal amount based on the total of movements, on the balance of a general account or on an account class. An accounting entry is then generated based on a template.

Examples:

Provision of doubtful customers,

After-sales,

Revaluation of the expenses or revenues.

You can specify a discount date if necessary.

After setting up the calculated journal, use the Calculated journals launch function (Financials > Current processings > Calculated journals) in order to generate journals in accounting.

Creating a basic scenario

I have a Notes Receivable account 12201. At the end of each month, I want to ensure that I have 10% of the balance in my Allowance for Doubtful accounts 12600. My entry should debit Bad Debt Expense 81001 and credit Allowance for Doubtful accounts 12600. I will reverse the amount at the end of the next month and repeat the entry.

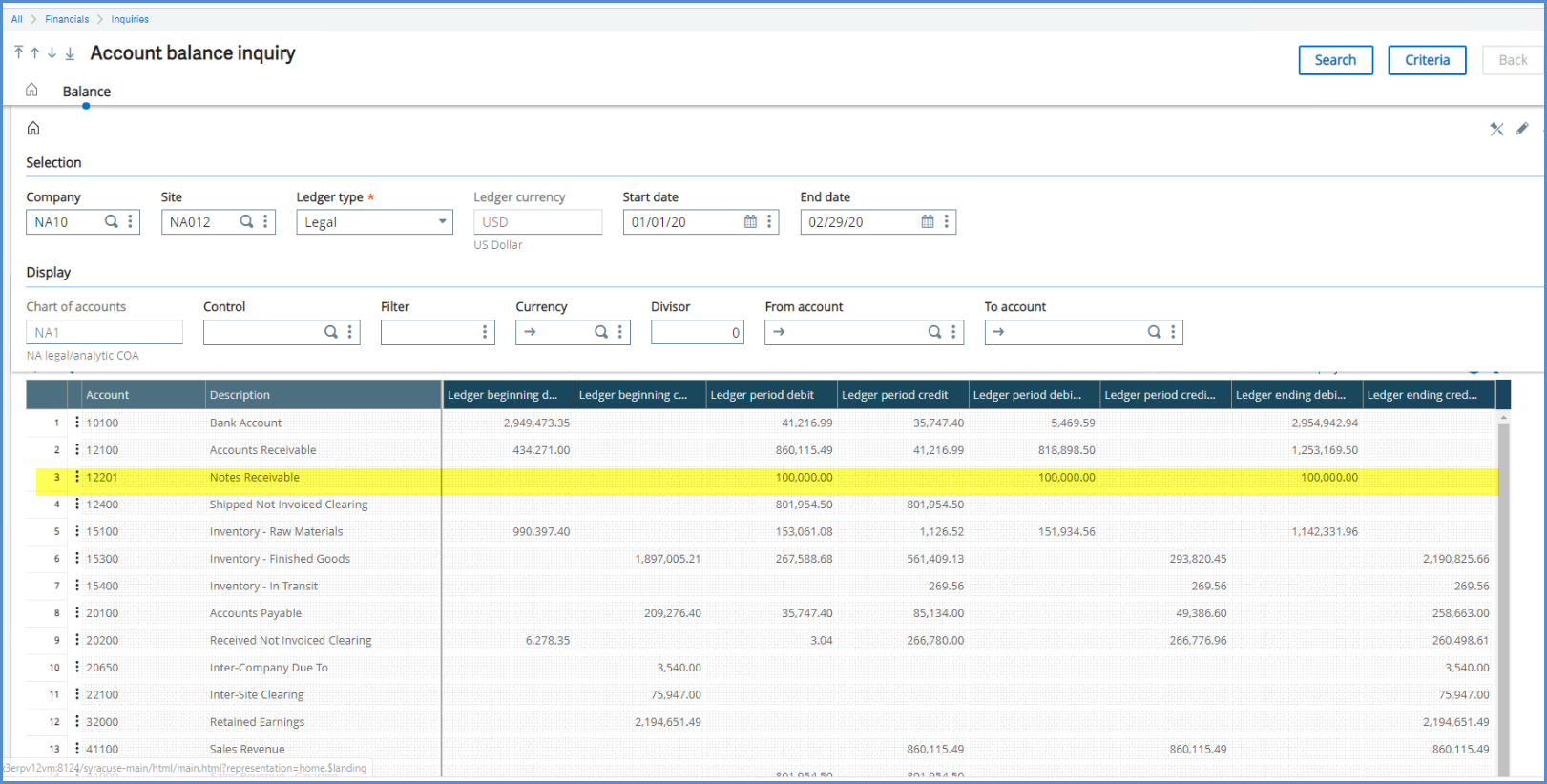

As of 2/29/20, I have $100,000 in Notes Receivable account 12201 as we can see in my Account balance inquiry under Financials, Inquiries. I have no balance in Allowance for Doubtful accounts 12600

We will make an entry for ($100,000 * .10) = $10,000 for bad debt for February.

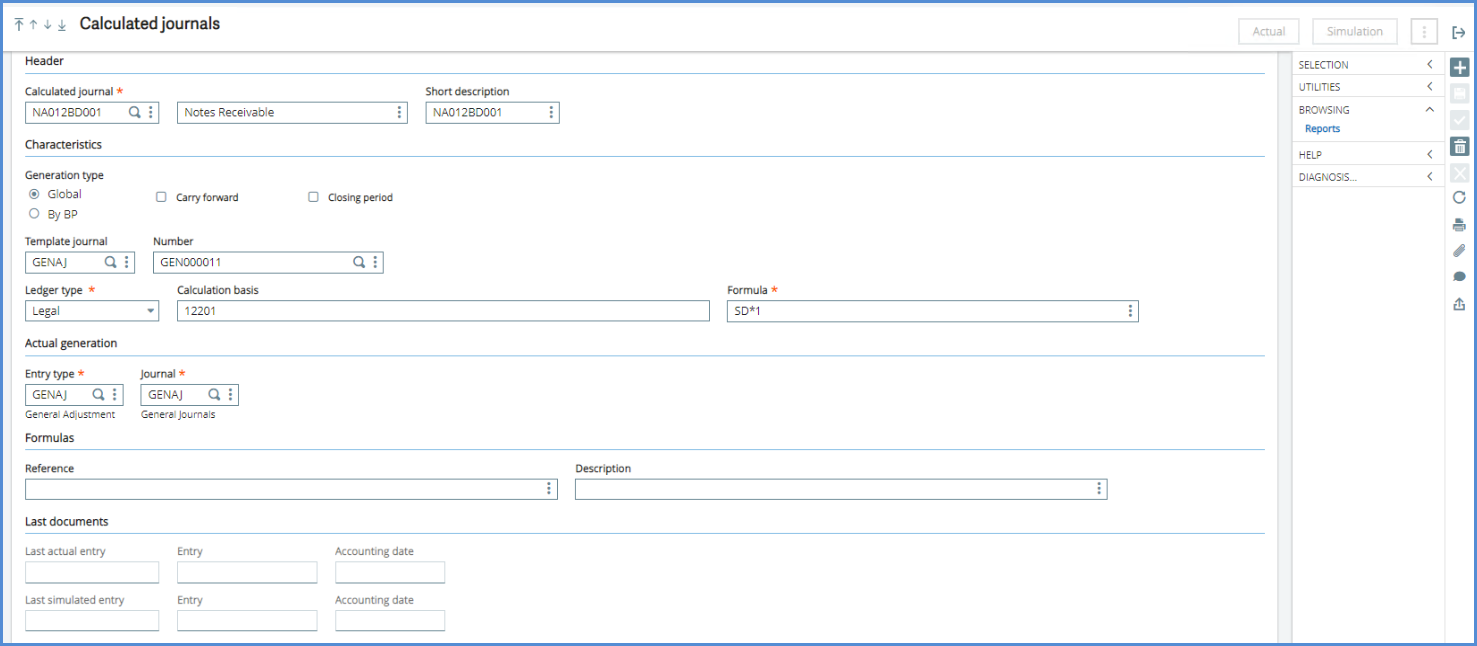

Setup, Financials, Accounting Forms, Calculated journals (GESCLC)

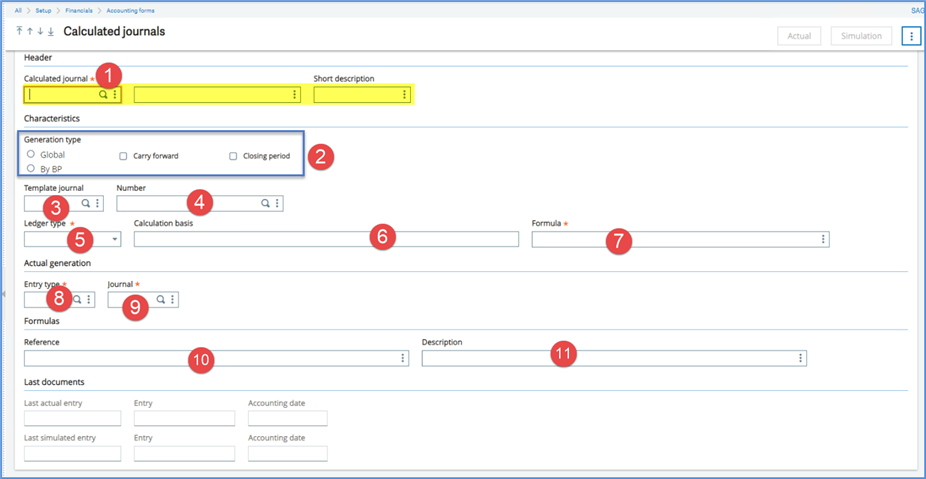

What do we have to do for the setup in GESCLC? Here are 11 items that we will review.

1. Calculated journal: I’m going to name it NA012BD001 for the site, bad debt and the first created. There is also room for a description and short description if you so desire.

2. Generation type: Global, By BP, Carry forward, Closing period. We will select Global which considers the debit or credit total or the debit or credit balance at the account or control account level. By BP considers the debit or credit total or the debit or credit balance at the account or control account level + the BP level

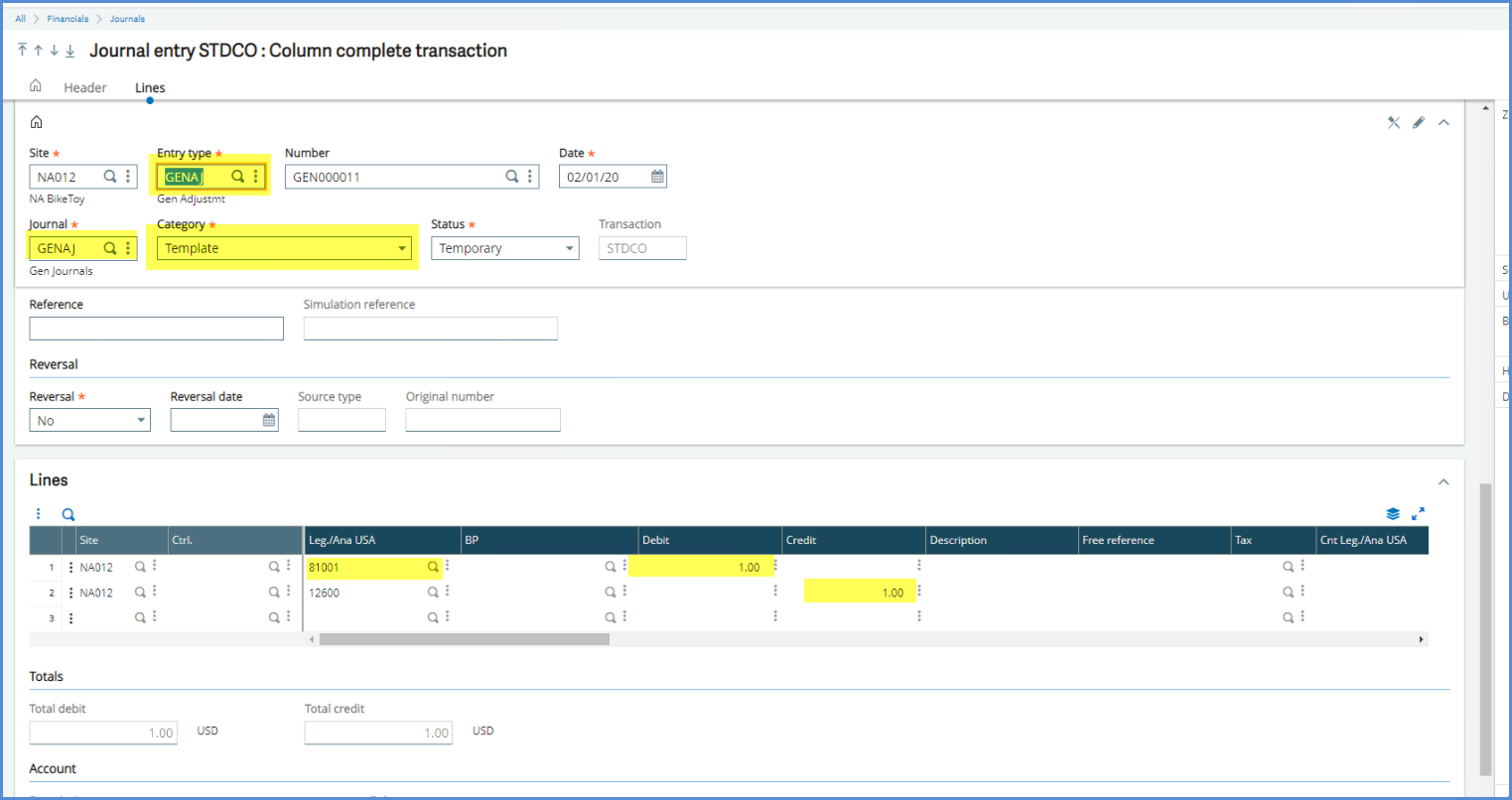

3. Template Journal: This is the Document type for the template. I am using GENAJ. Now, let’s create the journal template under Financials, Journals, Journal entry. The Category is Template and I’m using Entry type GENAJ and Journal GENAJ. You can use other Journals and Journal types when you great yours. I want the journal to debit a/c 81001 and credit a/c 12600. Note that I’ve set the Debit and Credit amounts to 1. This determines the ratio of the amounts. For every dollar in a/c 81001 there will be one dollar in a/c 12600.

4. Number: The template number is GEN000011.

4. Number: The template number is GEN000011.

5. Ledger type: Legal.

6. Calculation basis: We’ll base the accrual on the balance in 12201. You can use an account or an account class. If you used 707, it would be based on all accounts starting with 707. 70-72 would be all the accounts between 70 and 72.

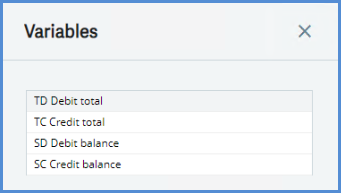

7. Formula: The formula must contain one of the variables in drop down menu: TD = Debit Total, TC =Credit Total, SD = Debit balance, SC = Credit balance.

8. Entry Type: We will use GENAJ for the active Document type and GENSM for the simulation.

9. Journal: We will select Journal code GENAJ for active and GENSM for simulation.

10. Reference: You can define a reference or a title or both. If they are blank, they will default from the template journal.

11. Description: It will default from the template, if left blank.

In Set II, we will look at running the Calculated journal and varying the templates and formulas.

Hope your close is going well.