New 1099 form for 2020

Starting with the January, 1, 2020 calendar year, the IRS is reinstating the 1099-NEC form. The IRS last used the 1099-NEC form in 1982.

What is tracked on the 1099-NEC form?

This form is for tracking non-employee compensation. This basically moves the tracking of the Nonemployee Compensation (Box 7) and Direct Sales of $5000 or more (Box 9) from the 1099-MISC form to the 1099-NEC form. Nonemployee Compensation will be Box 1 on 1099-NEC and Direct Sales of $5000 or more checkbox wll be Box 2.

The change was necessitated by the PATH Act that accelerated due dates for the filing of Form 1099s that included nonemployee compensation (NEC) and eliminated the automatic 30-day extension for forms that included NEC. This resulted in different due dates for 1099-MISC forms with Nonemployee Compensation (Box 7) and those without. The aim in reinstating the 1099-NEC form is to minimize the burden of separating out the 1099-MISC forms and the confusion surrounding the due dates. For further clarification on the changes, contact your tax advisor or check the IRS website (www.IRS.gov).

How do I get ready or this change that begins on January 1, 2020?

For Product Update 9, version 11 or version 12, install the Sage X3 1099 updates for 2019. The updates can be downloaded via knowledgebase article Download X3 1099 Updates for 2019 (101916).

For version 6, version 7 and update 8, ensure the Sage X3 1099 updates for 2018 are installed to generate the 2019 1099s. Then, contact your business partner or Sage Professional Services to determine alternatives for reporting the 1099-NEC for 2020.

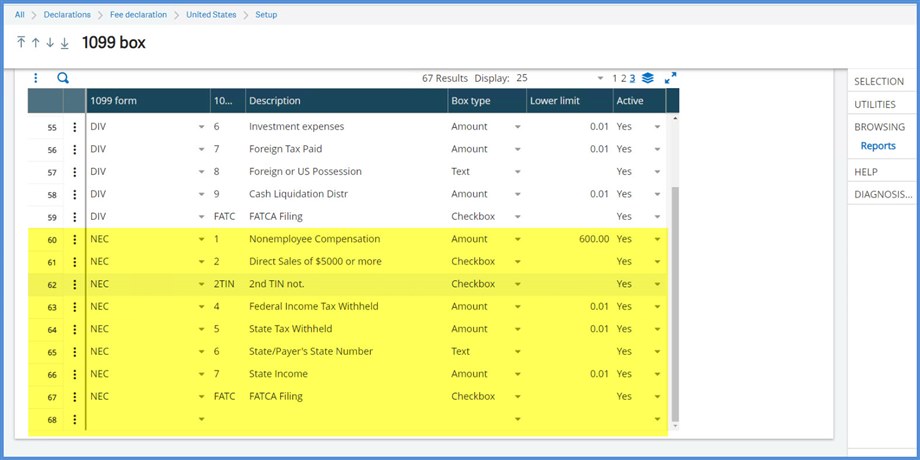

Once you have installed the 1099 2019 update, review Declarations, Fee declaration, United States, Setup, 1099 Box. There will be 8 new NEC boxes.

Further preparation for changes with 1099s 2020

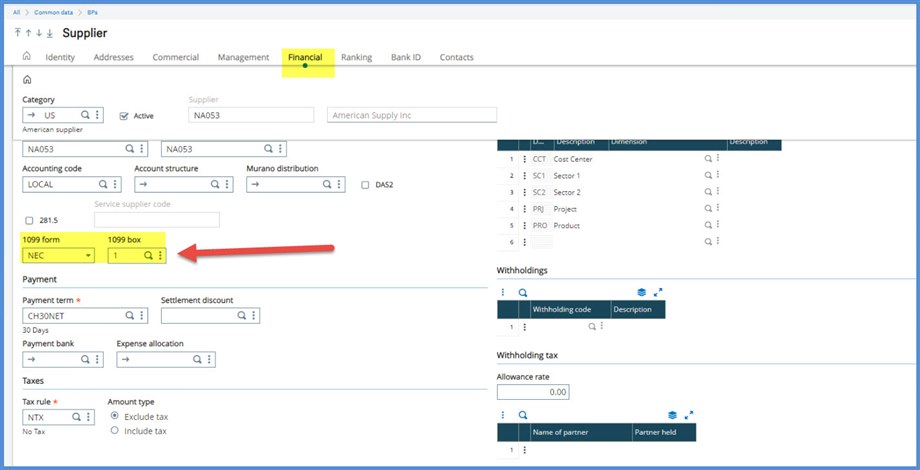

Before entering invoices for 2020, consider changing the 1099 form and 1099 box default values on the Financial tab under Common data, BPs, Supplier for Suppliers that will be tracked under the 1099-NEC.

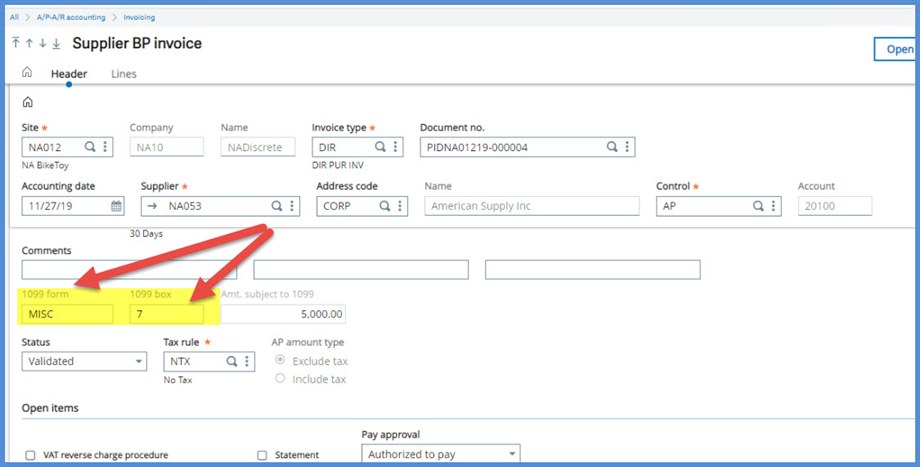

Remember that you will have to adjust 2020 1099 totals any invoice that were not paid before January 1, 2020 and had a 1099-MISC box 7.

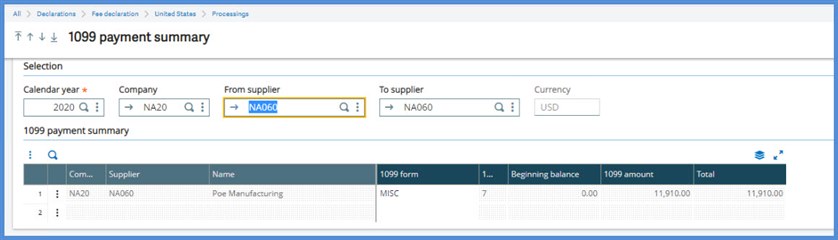

You can make adjustments next year using 1099 payment summary, under Fee declaration, United States, Processings.

Will I need to install another update for 1099 2020 if this is installed?

Tune in toward the end of 2020 to find out. We have to wait for the IRS to finalize the 1099s for 2020.

Top Comments