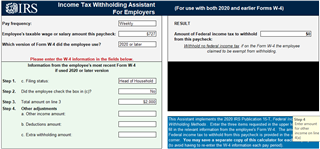

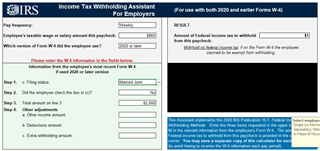

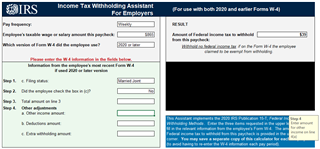

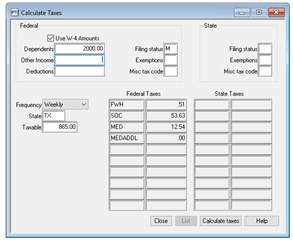

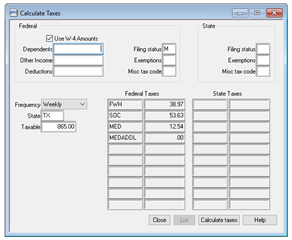

How confident is Sage that the last update fixed the tax withholding problems? One employee of ours chose Head of Household with $2,000.00 for dependents on the 2020 W4 has $727.80 taxable income and is paid weekly; the payroll module calculated her FWH as $0.41. Another employee, using the 2020 W-4 for married filing jointly and $2,000.00 for a dependent, had weekly taxable income of $865.65 and the FWH the payroll module came up with $0.59. They have decided to adjust their withholding to match what was being taken out at the end of 2019.

Sage Construction & Real Estate

Welcome to the Sage Construction and Real Estate products Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Sage 300 CRE General Discussion

2020 tax updates