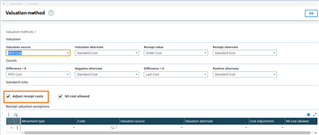

The behaviour of the system if the “Adjust Receipt Cost” flag is selected or NOT selected on the product valuation method:

Setup:

Purchase Order: 20UN x £13

Purchase Invoice: 20UN x £15

Posting for the Receipt: £260 stock cost at the time of receipt

Purchase Invoice posting: £300 (+ £60 VAT)

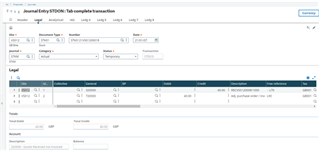

Scenario one:

If the stock has NOT been consumed before the invoice AND if there is a variance in purchase order price (20 UN x £13) and the invoice price(20 UN x £15). After this invoice has been posted and running the stock accounting interface. We will get below additional postings:

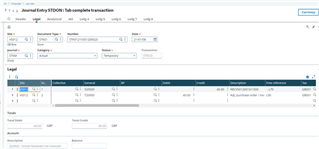

Posting with the Flag Ticked:

Second posting for the same receipt, It will revalue the stock based on the invoice price instead of the receipt price, £2 variance for Stock 20 UN, stock value UP by £40.

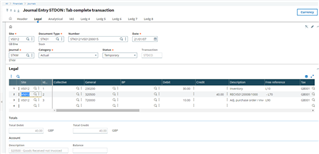

Posting Without the Flag:

This time, It will not touch the stock account and will only Credit the GRNI account while debiting one of the P&L accounts for the variance.

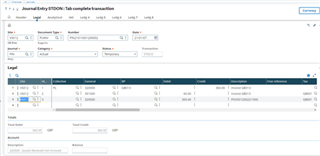

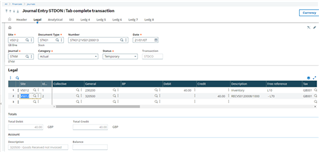

Scenario two:

If the stock HAS been consumed (5 UN being consumed, remaining 15 UN in the stock) BEFORE the invoice AND if there is a variance in PO price and Invoice Price:

Posting with the Flag Ticked:

System will INCREASE the value of the remaining stock i.e 15 UN x £2, £30 debit in inventory and will adjust the remaing balance of £10 to a P&L account.

Posting without the Flag Ticked:

No stock account will be touched, all the variance will be posted to the P&L account.