Hi Guys,

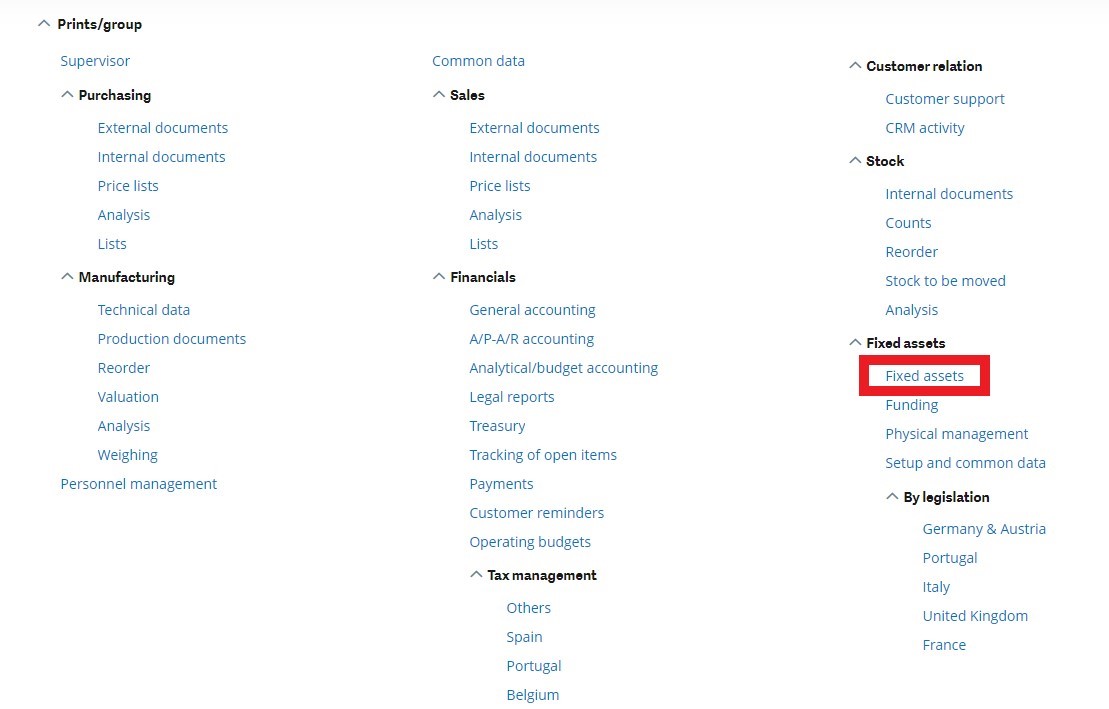

So following on from our recent blog post on Reports in the General Accounting prints/group, we will be continuing in the series with the Fixed assets reports. This can be located as below:

Take a look at the table below, showing you all the Fixed asset reports available within Sage X3.

|

Report Code |

Description |

Information displayed |

|

CIGDEPSITU (Intra-Group sale control) |

Report is used to make sure that the intra-group sale processing is carried out correctly.

|

IGS reference, Company type, Financial site range, accounting code range, General account ranges, IFRS" account range, Depreciation plan, Asset range, Classification criterion 2, Classification criterion 3, Detailed status by asset |

|

DEPRECTWIN (Reconciliation of 2 schedules) |

This report reproduces the situation of two given depreciation plans in order to underline the gaps between both plans.

|

Company Limit, Financial site range, accounting code range, General account ranges, IFRS account range, holding type, Family range, Asset range, FY or period, Date range, Depreciation plan 1, Depreciation plan 2, Detailed status by asset, Print selections |

|

DEPREEVAL (Plan revaluation) |

This report reproduces the revaluations carried out during the fiscal year or during the current period of a given depreciation plan.

|

Company Limit, Financial site range, accounting code range, General account ranges, IFRS account range, Asset range, Deprecation plan, FY or period, Date range, Entry selection, Selection of the issued assets, Detailed status by asset, Print selections |

|

DEPSIMU (Depreciation plan simulation) |

This screen is used to display the result of the unit calculation of the fiscal year depreciation or period depreciation for an asset, from the current fiscal year or current period up to the end of its life.

|

Company Limit, Financial site range, accounting code range, General account ranges, IFRS account range, holding type, Asset range, Deprecation plan, FY or period, Number of years, in progress, Detailed status of asset, Print selections |

|

DEPSIMUDERO (Book vs tax simulation) |

This report associated with the Fixed assets Datamart (FIXASSET) displays the situation of the book vs. tax depreciation of one or several companies for a given fiscal year. |

Company ranges, financial site ranges, Fiscal year ranges |

|

DEPSITU (Depreciation schedule situation) |

This report displays the situation, or status, of a depreciation plan by the end of the fiscal year or the end of a given period for each asset selected. This situation is in the depreciation plan currency.

|

Company limit, financial site range, accounting code range, General account ranges, IFRS account range, holding type, Asset range, Depreciation plan, FY or period, Date range, Assets in process, Cost, Others, Active assets, Entry selection, Selection of issued assets, Local menu, Classification criterion 2, 3, Multi-language, Detailed status by asset, Print selections |

|

DEPSITUCUR (Depreciation schedule situation) |

This report displays the situation, or status, of a depreciation plan by the end of the fiscal year or the end of a given period for each asset selected. This situation is in the depreciation plan currency.

|

Company limit, financial site range, accounting code range, General account ranges, IFRS account range, holding type, Asset range, Depreciation plan, FY or period, Date range, Assets in process, Cost, Others, Active assets, Entry selection, Selection of the issues assets, Local menu, Classification criterion 1,2,3 Multi-language, Detailed status by asset, Print selections |

|

DEPSITUDERO (Book vs tax situation) |

This report associated with the Fixed assets Datamart (FIXASSET) displays the situation of the book vs. tax depreciation of one or several companies for a given fiscal year. In the BO Infoview, this report has the following code: FAS-DEPSITUDERO_EXE

|

Company ranges, financial site ranges, Fiscal year ranges |

|

DEPSITUREINT (Reintegration of depreciation) |

This report displays the situation of the depreciation reintegration of the financial year or of the current period for each of the selected assets.

|

Company limit, financial site range, accounting code range, General account ranges, IFRS account range, holding type, Asset range, FY or period, Date range, Active assets, Entry selection, Selection of issued assets, Local menu, Classification criterion 2,3, Detailed status by asset, Print selections |

|

DFDDPE (Deferred depreciations) |

This report details the status of the depreciation deferred at the end of a given fiscal year and for each selected asset. |

Company limit, financial site range, accounting code range, General account ranges, IFRS account range, holding type, Asset range, Date range, Assets in process, Active assets, Entry selection, Selection of the issues assets, Local menu, Classification criterion 2,3, Detailed status by asset, Print selections |

|

FASLISTGRP (Grouping of expenses) |

This function is used to create expense grouping setups, each one identified by a code.

|

Reporting currency, Ledger, Company limit, financial site range, holding type, accounting code range, Family range, Supplier range, Purchase date, Allocation date range, Update date range, Date created, Asset range, Active assets, Detailed status by |

|

FASMAIN (Principal and component assets) |

This report reproduces the list of the fixed assets with the Main status, responding to the selection criteria, by displaying for each of them, when the print is asked in detailed form, the list of the fixed assets with Component and Additional component status that are attached to it. |

Company limit, financial site range, accounting code range, General account ranges, IFRS account range, holding type, Asset range, Depreciation plan, FY or period, Date range, Active assets, Detailed status by asset, Print selections |

|

FLUAMTFCY (Depreciation flow/site) |

This report, just like the FLUAMTCPT - Depreciation/account flow report, shows the evolution of assets depreciation, recorded during a fiscal year or period, on a given depreciation plan.

|

Company limit, financial site range, accounting code range, Depreciation plan, FY or period, Date range, Asset range, Sort by financial site, Detailed status by asset, Print selections |

|

FLUIMMOFCY (Fixed asset flow/site) |

This report, just like the FLUIMMOCPT - Fixed assets/account flow report, shows the evolution of the gross values of fixed assets by account, observed during a fiscal year or period, on a given depreciation plan.

|

Company limit, financial site range, Account range, Depreciation plan, FY or period, Date range, Asset range, Sort by financial site, Detailed status by asset, Print selections |

|

FS1PAGE (Grouping of expenses) |

This function is used to create expense grouping setups, each one identified by a code.

|

Reporting currency, Ledger, Company limit, financial site range, holding type, accounting code range, Family range, Supplier range, Purchase date, Allocation date range, Update date range, Date created, Asset range, Active assets, Detailed status by asset |

|

LISLOF (Expense journal) |

This report restores the list of expenses that meet the selection criteria specified when submitting the report.

|

Company limit, financial site range, General account ranges, IFRS account range, Allocation date range, Activity code range, Family range, Supplier range, Analytical dimension type, Dimension range, UGT range, invest projects range, invest budgets range, Market range, Journal range, Report detailed by expense, Local menu |

|

VATREGHIS (VAT adjustment history) |

This multi-site and multi-company report display, for a given depreciation plan, the history of VAT adjustments carried out on a selection of assets.

|

Company limit, financial site range, Depreciation plan, Date range, |

|

VATTRFDOC (Transferred VAT certification) |

This report can be useful in case of sales, or intra-group sale, non-submitted to VAT. This document is designed for the asset owner and mentions the invoiced VAT amount the seller is entitled to transfer to this owner. |

Company limit, financial site range, Invoice range, Sort by financial site, Print selections |

For more detail, please click on the Report Codes, this will redirect you to the online help page for the report, or a directory on the online help where you can select the report.

That’s all for this post but keep an eye out for our next edition in this series.