Finally, after many years of discussions and negotiations, since the British public voted to leave the EU, we are now entering the final month of the transition period. On January 1st 2021, a new era begins and with that comes new rules and regulations.

The changes in the use of recapitulative statements, as a result, are expected to be significant, depending on the types of goods and services your business provides and whether it operates in Great Britain, Northern Ireland or the EU. But what are recapitulative statements? These statements are a reporting requirement, consisting of the EC Sales List (ESL) and Intrastat. The ESL is used to report on the aggregate value of goods and services. In contrast, the Intrastat is used to report only on the movement of goods between EU member states.

Recapitulative statement requirements in the EU

If a VAT registered business in the UK is supplying goods and services to another VAT registered business in the EU, they are required to provide HMRC with an ESL or a simplified ESL, contingent on meeting the threshold requirements. You can send the completed ESL, which summarises the value of sales to each EU member state and is sometimes referred to as the VAT101 form, electronically or on paper. This may be submitted monthly, quarterly or annually depending on the value of your supplies and whether you’re completing the full or simplified ESL.

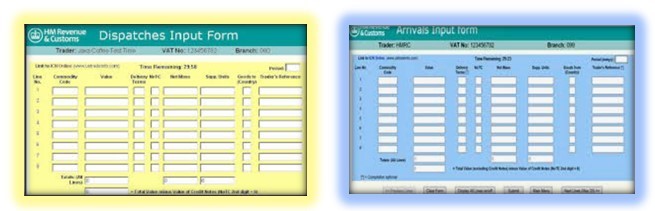

The Intrastat declaration may also be required for submission. But what is Intrastat, and how does it apply to the UK? It is the system used to collect statistics on the movement of goods between Businesses mandated to report under Intrastat should complete a monthly arrivals declaration confirming the value of goods moved into the UK from other EU member states and a monthly dispatches declaration to confirm the value of goods moved out of the UK to other EU member states. It’s also important to note that Intrastat reporting will require the use of ‘commodity codes’. Commodity codes are a standardised numeric description that classifies your goods and is also used for import and export customs declarations. There is also a requirement to provide the 2-letter country codes for the movement of goods between each EU member state.

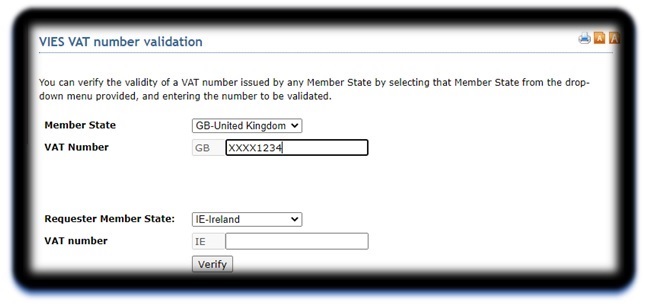

Before submitting the ESL, the EU customers VAT registration number must be provided. This will need to be verified using the VAT Information Exchange System (VIES). This system combines and allows the free flow of data from the individual electronic databases. These are maintained and monitored by the tax administration authority, from each member state. The Central Liaison Office (CLO) is the institute, instilled in each member state, responsible for governing intra-community trading. They have direct access, through VIES, to each individual VAT registration database.

The CLO are in control of the national access granted for traders to VIES. Due to data protection and security regulations, the information provided to traders is in the form of confirmation, validating a VAT number and its association to a given name or address. Once established, the query is valid, the trader will receive a certificate of proof of checking. VIES has enabled businesses across the EU to obtain instant and accurate information about their customers' VAT details in real-time, increasing efficiency and accessibility, equally throughout the EU. Other benefits of VIES include identifying irregularities and potential intra-community fraud.

Once you’ve completed your recapitulative statements and have verified the validity of all of your customers, you’re ready to submit to HMRC.

Changes from 1st January 2021

Up until now, all recapitulative statements were required for British businesses, either selling or moving goods and providing services, to or from the UK, to another EU country. As of 1st January 2021, that is all set to change, and the degree of change will be far greater for businesses based in Great Britain than it will be for Northern Irish businesses due to the Northern Ireland Protocol. But what is the Northern Ireland Protocol? This is part of the Withdrawal Agreement between the UK and EU that aims to avoid a customs border between Northern Ireland and the Republic of Ireland (ROI), whilst maintaining unconstrained access to the rest of the UK market for businesses in Northern Ireland. To find out more on the Northern Ireland Protocol, click here.

For businesses based in Great Britain, January 1st 2021 signifies the date recapitulative statements will either no longer be required or will be phased out. Any exports of goods or services to EU businesses after this date will not require the completion of an ESL. However, for those who still need to account for sales made before this date, they will have until January 21st 2021 to make this final submission. For businesses selling goods from Northern Ireland to EU VAT-registered customers, an ESL submission will still be required.

What are the Intrastat declaration requirements after 1st January 2021? If you’re currently a registered Intrastat business, or in the coming year, you exceed the Intrastat exemption threshold (£1,500,000 for EU imports/ £250,000 for EU exports), then you must continue to submit Intrastat arrivals declarations in 2021 for goods imported into Great Britain from the EU. However, dispatches declarations will no longer be required. Northern Irish businesses moving goods under the Northern Irish Protocol should continue to complete Intrastat arrivals and dispatches declarations as they do today. The only change for businesses in Northern Ireland trading and selling goods with the EU will be the VAT number being communicated to customers on invoices and on the ESL. The previously used ‘GB’ prefix that is placed in front of a business’ VAT number will be replaced with an ‘XI’ prefix instead. Note the ‘GB’ prefix will continue to be used for Goods and Services traded between NI and Non-EU countries as well as services to EU countries.

For those needing to check VAT details for British businesses, they will no longer be able to use the EU VIES service. Instead, a new VAT checker app is being released by HMRC in 2021. This will be similar to VIES and allow users to check the GB VAT details on the.GOV website. Northern Irelands ‘XI’ VAT numbers will continue to be checked using VIES.

Please review the following impact summary of the changes discussed in this blog;

|

Topic |

Businesses based in Great Britain |

Businesses based in Northern Ireland |

|

EC Sales List (ESL) |

This will no longer be required, effective 01/01/21, final submission for sales before 01/01/21 to be made by 21/01/21 |

ESL will continue to be submitted for goods sold to EU member states under the NI protocol, but not for services |

|

NI VAT Number |

Continue using GB prefix |

“XI” prefix for goods to EU and “GB” prefix for services to EU, “GB” prefix for Goods & Services to and outside the EU |

|

Intrastat |

For goods imported into GB from the EU, Intrastat will be required for the whole of 2021, there will be no Intrastat requirement after 01/01/22 |

Continue to be required until the Northern Ireland Protocol expires (minimum 4 years, earliest 2025) |

|

Checking VAT registrations are valid |

GB VAT registrations will no longer be verifiable on VIES. HMRC to release a new VAT checker app in 2021 |

Continue to use VIES for the XI prefixed VAT registration |

How will this impact Sage X3?

For businesses in Northern Ireland providing goods to EEC consumers, an ESL will still be a requirement, they will therefore continue to enter invoices and credit notes for those transactions and use the VAT 101 report. A new “BP tax rule” parameter will be added to the report, to allow the relevant EEC entry transactions to be filtered by their BP tax rule. This will allow users to enter multiple BP tax rules. Users will need to set up the BP Tax rules and assign them to the BPs correctly for this functionality to filter the criteria accurately.

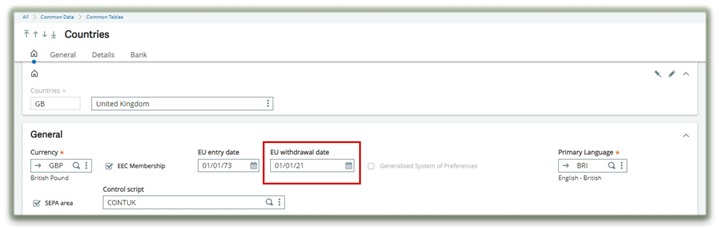

For Intrastat submissions, an "EU withdrawal date" field was added to the country set up for version releases equal and greater than V11P13 and 2019R2 (V12P17). This will be the date considered when filtering for the transactions that must be reported.

The new HMRC VAT checker app will link directly to the.GOV website and will also provide APIs, and once this is available, Sage X3 will be updated as soon as possible with the new service.

For further information on how Brexit will impact Sage X3, please visit the Brexit support hub for Sage X3. The ‘Brexit for the UK’ document can also be found on the online help centre, on the How To tab, under the Legislation section.

For official Brexit guidance, visit the government's Brexit transition page.

For more articles and information on Brexit from Sage, visit our Brexit support hub.

Disclaimer

We always do our best to make sure that the information is correct. Still, as it is general guidance, no guarantees can be made concerning its suitability for your particular needs. The information is valid at the time of presenting and is provided without any warranty of any kind, expressed or implied.