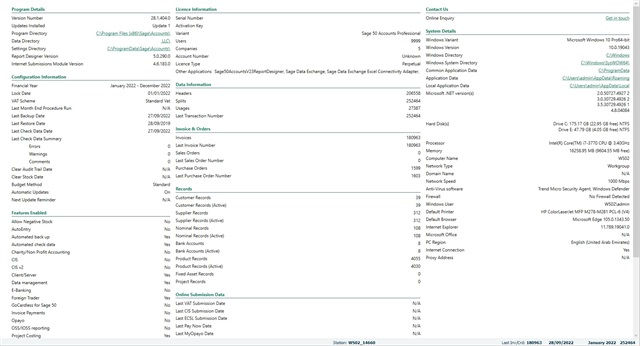

I am running Sage 50 Professional v28.1

While calculating VAT Return, when progress bar reaches to "Validating Audit Trail VAT Values", after about 80% completion on progress bar, Sage is crashing (program closing automatically).

I am able to run VAT return trouble free in other companies including demo data.

I did run CHECK DATA SEVERAL TIMES, maintenance tools. Even re-indexing of all one by one but no luck.

From VAT menu I am able to pull VAT audit trail reports without an error.

But when running VAT return, Sage crashing itself. I am unable to fix and need technical advise.