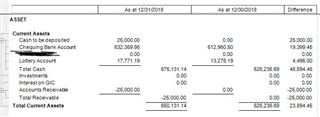

Hi! I am hoping you can help me! I ran a data integrity check before I was going to switch over to a new year and it has detected an error. It is showing -$25,000 in A/R as well as $25,000 as cash to be deposited, on the balance sheet. I have looked everywhere to find this journal entry and can't find anything! I think it is from our HST Adjustment account but I dont see any entries in any of the accounts for this amount. What can I do to clear this from our balance sheet?

Thank you!!