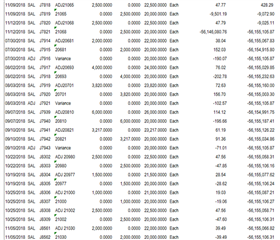

Our year end is March 31 ......and we use average costing of inventory allowing for negative values.

I cannot figure out how to fix this, and it's completely messing with my inventory and financial statements. What is creating this variance line? How do I fix this?