Hi. Just setting up a new company from Dynamics.

Their year-end is May 31st. In order to have historical transactions, I started the company as of 2019. Entered the GL historical amounts, then entered each month's adjustments for the year 2019~2020.

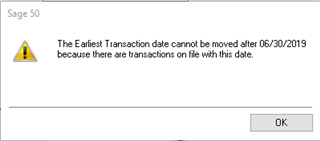

Now I want to put in the historical amounts for the Sub-Ledgers, and it says the following:

I can't put in any of the historical data.

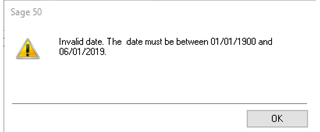

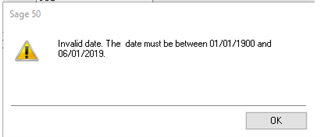

So then I thought I would do a change of fiscal year, and it says I have to put in the historical data.

What should I do? Thought perhaps I could zero out the control accounts, do a year-end, then I would put back in the control amounts,

Would I then be able to put in the historical amounts into the control accounts?

This is quite frustrating. Hope you have a solution for me.