Hello,

We're using Sage 50c Premium ver. 2021 and have set up our inventory ledger based on FIFO and not allowing negative inventory.

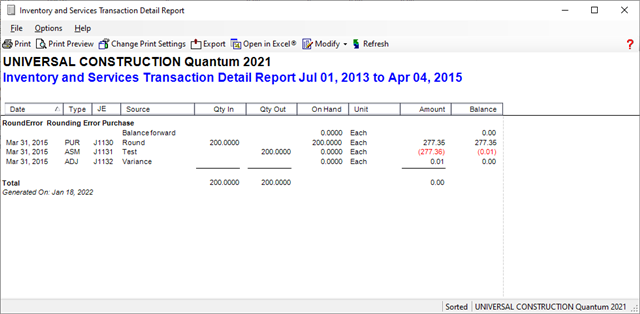

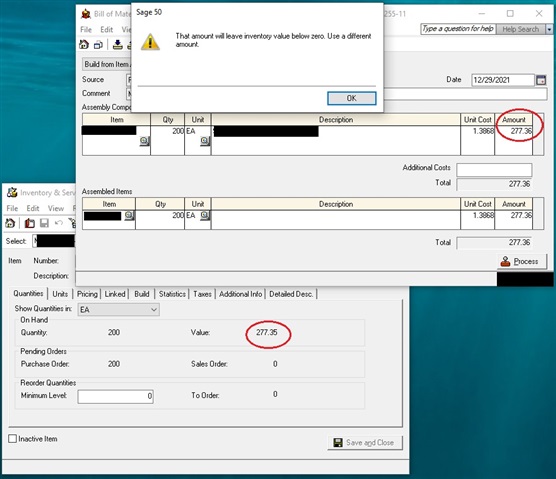

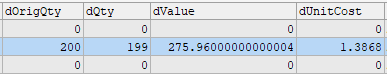

For one particular "Item ABC", we purchased 200 units at USD 1.1 each, and at the exchange rate of 1.2607. The Inventory list shows the Total Value of CAD 277.35.

When this item is called up in the Assembly Journal, Sage displays the Total Amount as CAD 277.36 for 200 units.

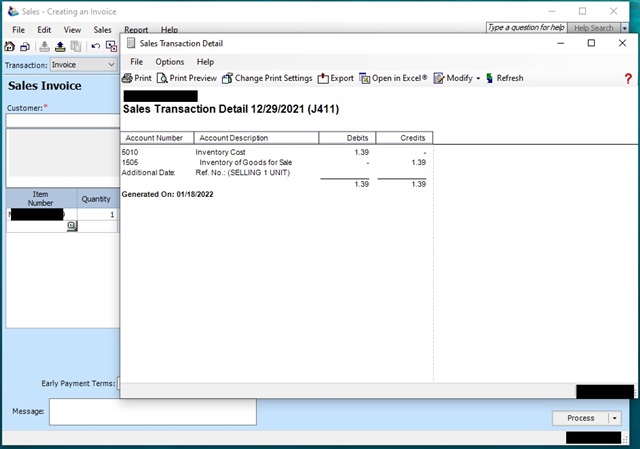

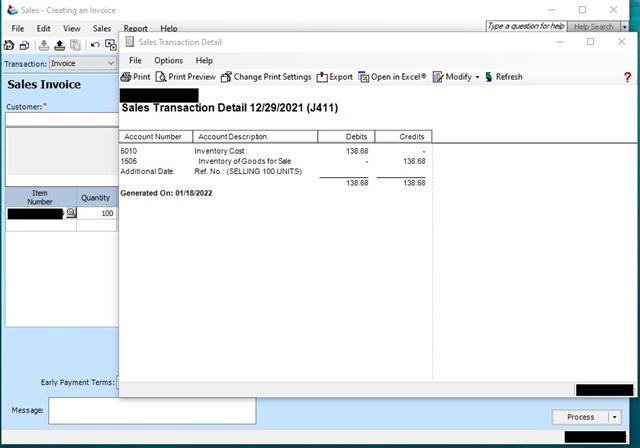

Because of this $0.01 difference, Sage wouldn't let us post the Assembly or Sales transaction using all 200 units as it expects to find CAD 277.36 Total Value and there's only 277.35 in the Inventory record.

Are Sage users expected to manually revalue some individual inventory items via Adjust Inventory if using FIFO costing? That is, for the problem items take all units out, and then put them back with the Total Value expected in the item record, by, in this case, Item Assembly Journal? Wouldn't doing this all the time create other issues to affect costing long term?