I'm confused about the linked account in credit card.

Your questions are not that clear to show us where you are having problems. Therefore my assumptions and answers here may be wrong.

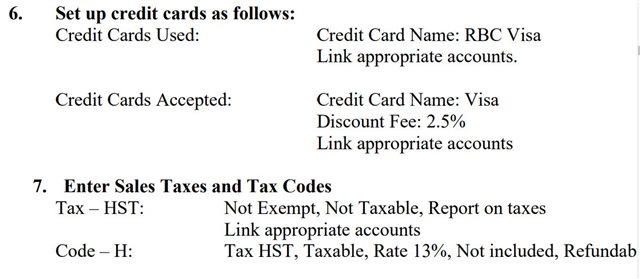

Under Credit Cards Used, I've never entered an Expense Account. If I recall, years ago when I was Beta testing this, the only reason for this linking is to allow the user to enter additional fees and interest at the time of payment. However, because the timing of payments for most people is the statement DUE DATE not the statement END DATE, it forces the interest or other fees to be posted after the statement end date and invalidates the ability to do an account reconciliation because of the dates of entry.

I see nothing wrong with using 2150 as your credit card payable account, it looks like the wizard setup. Each credit card statement should have it's own liability account.

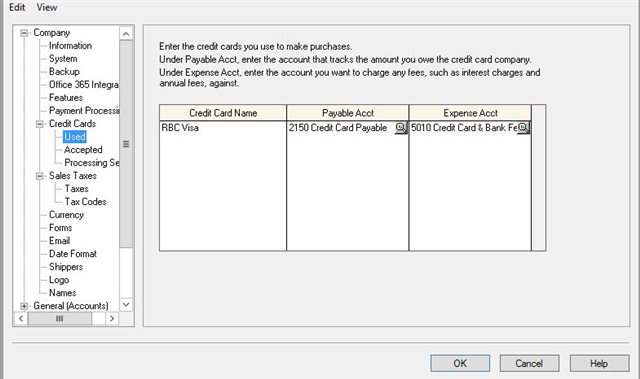

Credit Cards Accepted. I rarely enter a discount fee and Expense Account. The logic here is following the actual or real entries. If you accept a sale for $100 on VISA, what is deposited to your bank account. If it is $100 then entering a discount fee of 2% will enter $98 in your bank account in your books. You will have to do math when you do the bank rec and remember the discount is part of another transaction to match them up, however, I have seen the discount and deposit show in different months, which again causes problems for a bank rec when you push together two real entries in your books. AMEX is one that used to take the discount at the time of deposit but I have heard the discounts these days are not specific percentages, so they may have to be entered as part of the deposit, instead of the receipt.

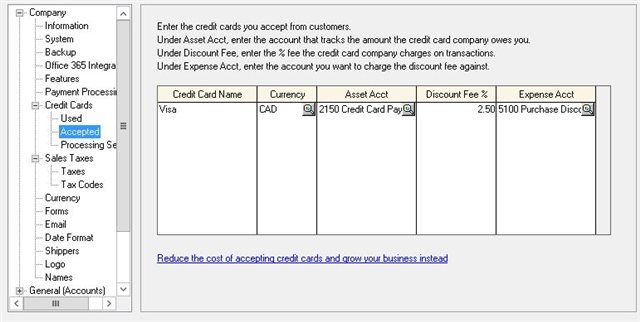

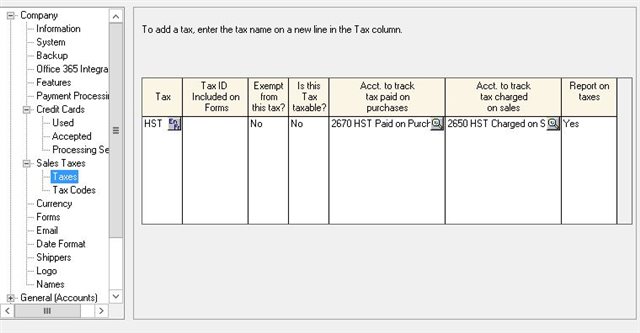

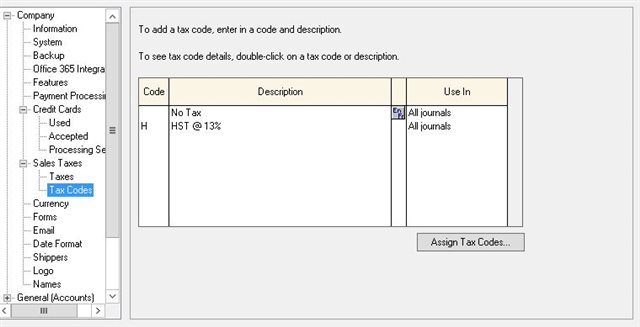

What is your question regarding sales taxes? I see not problem with what you have provided. It looks like what the company startup wizard creates for Ontario. If you need other taxes or tax codes, you can enter them manually following the examples you provided.

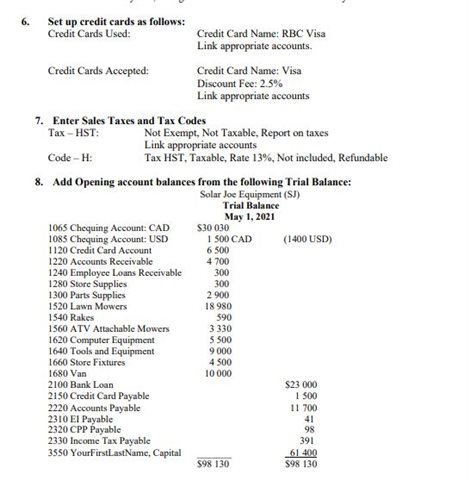

The opening balance issue is related to the basic concept of double-entry bookkeeping. Every Debit must have a corresponding and equal Credit. You entered a number in one account, therefore it must also be entered in one or more other accounts to balance. If you are having problems in the area of entering opening balances in a new company, you should probably say what the problem is. Your description does not clearly indicate what you did and what you are trying to do, though I think I can guess that when you got the dialog in the image, you entered account 1065 which then zeroed the balance of the account (Debits = Credits).

The logic here is that the $30,030 had to come from somewhere. Where did this number come from? Was it on the bank statement, was it a deposit slip?

Normally opening balances are entered from the the closing numbers of the previous bookkeeping system your company used before using Sage 50. If this is a brand new company and there just happened to be one transaction of the money deposited into the bank, then you have to ask "where did the money come from". If it came from the owner/shareholder, then you would use the Due to Shareholders account if it is a corporation or the Owner's Contributions account if it is a proprietorship. If it was a loan from someone or some other company, then you would handle it accordingly to show a loan owing.

Of course, all the above is what I do in real life. Your professor may expect you to be using all the linked accounts and may have already explained whether you are creating a brand new company from it's start or the company is starting to use Sage 50 after the company has already been running.

here is instructions

I can't add amount. can you please help me with that 8 step

Why can't you add the amounts (I assume you are trying to add all of them).

What exactly are the steps needed to add the dollar amounts and which one's have you accomplished so far? I see at least two steps are required before you start using the Setup Guide, Accounts to complete the chart of accounts setup and opening balance entries. Have you performed those setup steps yet?

Yes I done with step 6 and 7

I am only discussing Step 8 because you asked

I can't add amount. can you please help me with that 8 step

What needs to be done before you can add all the numbers in the sample chart of accounts? Specifically something that is not done by the Setup Wizard when setting up a company file (assuming you used the Wizard but your instructions may have been to use your own Chart of Accounts)?

Did you go through all the of the Setup, Settings Menu to see if you have everything you need activated?

So I need to put that amount in a general journal?

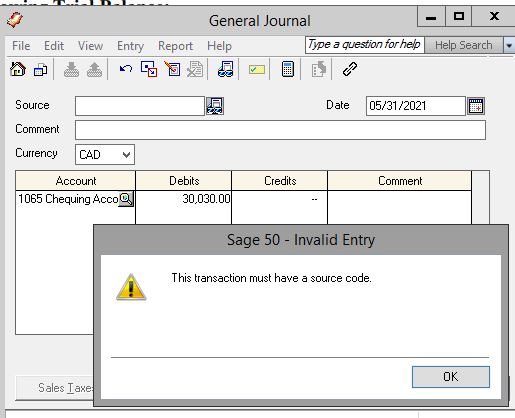

when I put this it's show like this

You can but you don't have to. I referred to

before you start using the Setup Guide, Accounts to complete the chart of accounts setup and opening balance entries.

However, you are still not answering the question. I am trying to get you to work through the logic of setting up a file. There are steps and there are features in the program that help with the steps.

Step: Setting up a basic file - Feature: The Setup Wizard (Create a new company)

Changing the setup - Setup Menu

Adding Dual or Multicurrency to a file - Setup, Settings, Company, Currency

Can you add USD to a file that does not yet have currencies setup? Can you identify which account is for USD? How does the program do it?

Did you complete these steps

required before you start using the Setup Guide, Accounts to complete the chart of accounts setup and opening balance entries

or not?

Double-entry bookkeeping requires a debit and a credit at a minimum.

Sage 50 requires a Source for every general journal entry.

yes I complete those step

In my mind, you have not shown you have

Can you identify which account is for USD? How does the program do it?

Once you have sorted this out, you should be able to complete the chart of accounts setup in either the Setup Guide, Accounts as I suggested or directly in the Chart of Accounts, one account at a time.

I figure it out

thank you so much for your help

You are welcome.

Hey can you help me with this pls it's really urgent

like how do I add 3 weeks on vacation, commission 1% and salary 1900 semi annually

*Community Hub is the new name for Sage City