I have a few questions:

At the moment this is how we have been entering our Visa Expenses:

- My boss whose name is AAAAA makes purchases and payments during the month. All those Visa receipts go in a folder until we receive the Visa Statement.

- With the Statement in hand I open an Excel Spread Sheet and enter all the expenses into their respective accounts (this helps me to show the calculation of the tips which are not taxable etc).

- With the Excel printout in hand I then open my Purchase Journal (invoice) as a Pay Later (i find pay later easier to track down) Vendor: Royal Bank Visa - AAAA

- I enter each purchases and payments the same way i see it on the Excel sheet. for example:

CLRA 2016 Membership G 37.50 750.00 5788 Membership

- I do the same for all items on my spread sheet. and POST.

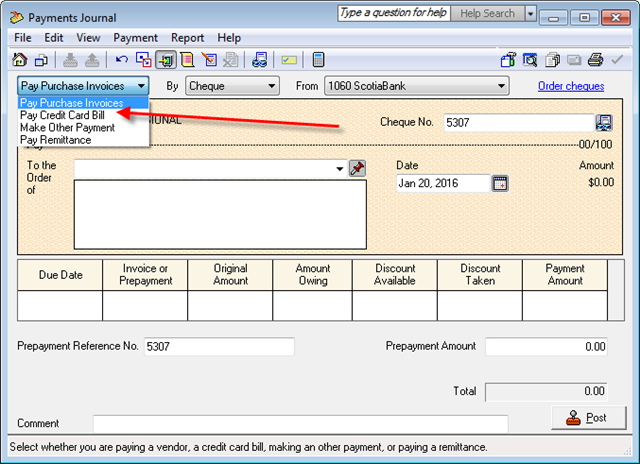

- I then open my Payment Journal (pay purchase Invoice) pay by Cheque from: 1065 Cash - Royal Bank

I do the same thing for Boss BBBBB (Vendor: Royal Bank Visa - BBBBB) and Boss CCCCC (Vendor: Royal Bank Visa - CCCCC)

This would not pose a problem if the only purchases would be from Home Depot or Restaurants as those kind of expenses only need to be tracked by their Expense Account but when it comes to Membership, Training etc (payments we might need to keep track like: when was the last time such and such had training with such and such company etc) it becomes a problem. I have to search through hundreds of Visa Statements.

I want to add the Visa so I can choose pay by : Visa

I believe I can do that this way:

Setup -> Settings -> Company -> Credit Cards -> Used

Where I am stuck is:

- We already have a Visa Account which is called Credit Card Payable 2140 (GFI 2621). This account must have been setup a long time ago but it has never been used. It is not linked to the Credit Card Used Module as mentioned above. Does it look like the correct Account to use?

- As for Expense Acct. I assume this is the account where we track down the credit card fees and interest. In my system there are 3 accounts that fall under General & Admin Expenses:

- 5645 Credit Card Charges (I think this was initially setup for Visa, Amex and MC fees for the Credit Card we ACCEPT) correct me if I'm wrong but I do not believe this is for the annual fees and interest for the Credit Card USED.

- 5690 Interest & Bank Charges (this was randomly used in the past but I think it's more related to the actual BANK fees and interest and NOT the Visa...??)

- 5686 Penalties & Interest (this is where I would add the annual fees and late payment interest charges) Is this the correct account?

If I set this correctly, my question is:

My new steps would be entering my Visa Expenses as I get the RECEIPTS instead of having to wait for the Visa STatement.

- I would set up new Vendors (HOME DEPOT, RONA etc)

- I would open my Purchases Journal and choose the correct Vendor (make it as pay later since i prefer it that way) and post each line to their respective accounts (lab supplies, office supplies etc)

- I would then open my Payment Journal pay by: VISA??? If so, do I keep it from: 1065 CASH Royal Bank or will it be Credit Card Payable account or something else?

This is where I get confused, how do I reconcile the Visa Statement?

I would assume it would NOT be from Bank Account since by using pay by VISA I am technically creating a VISA Bill that will eventually be paid by the BANK once I reconcile the Visa Statement.

I have an other question, I ALWAYS use create "INVOICE" as "Pay Later" in my Purchase Journal. I know there are other Drop Down options but I do not know how they work. Would I be messing up the system if I keep entering my expenses like that or should I choose a different option? I am just scared to mess up everything but I want to do things better.

Please help me, i feel confused and scared to go ahead and add the Pay by Visa feature but I know it would be so much better if i did.

Thank you so much in advance and sorry for the long email

LaChapa