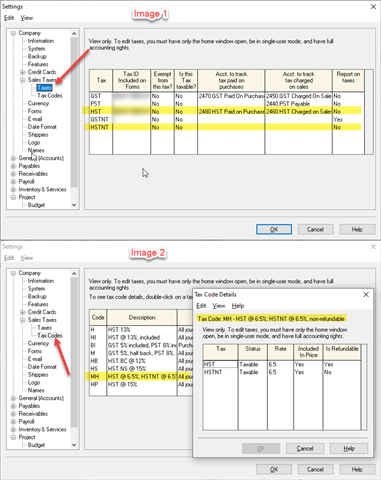

I haven't been claiming and ITC for business meals and travel expenses but I recently learned that I can claim 50% of the HST as and ITC. How do I set this up in Sage to indicate that 13% tax was paid but only 50% of that tax is claimable as and ITC?

Sage 50 Canada

Welcome to the Sage 50 Canada Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Payables and Receivables

HST - partial refund