Hi,

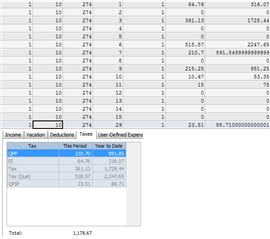

I've recorded a prepayment of $236.47 on a Purchase order, and one Purchase Invoice against it, totalling $108.45.

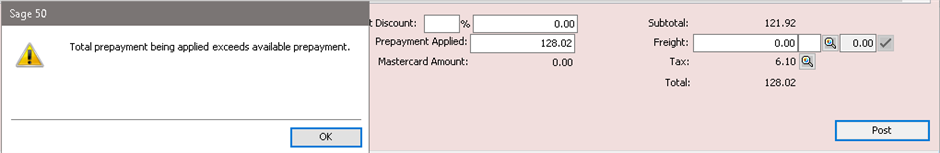

The prepayment balance of $128.02 shows on the aged A/P Payable, in the G/L balance, and on the Purchase Invoice screen when creating a second invoice from the prepayment.

When attempting to post the second invoice I get a message "Total prepayment being applied exceeds available prepayment"

Checking the Journal Entry with control-J shows $128.02 being credited to the prepayment account as expected.

Checking the Payments window shows no remaining prepayment for this vendor either before or after applying the first invoice to the prepayment.

Sage will allow me to apply up to $128.01, leaving $.01 as a payable. I had to over-ride the GST on the first invoice by $.01, so I'm guessing this could be where the calculation of remaining prepayment went wonky.

Is this a known bug?

I'm going to make a backup, then hack this in as a $.01 'pay later' invoice, then see if I can hack *out* the prepayment.