Are you using Sage 50 2015 or newer? See KB 10611:

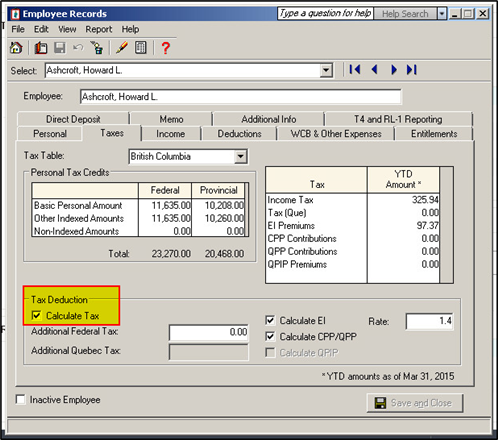

Note: A new feature was added in Sage 50 2015 that allows the calculation of tax to be turned on/off per employee.

To enable tax for one employee:

- Open the employee record.

- Select the Taxes tab

- Make sure Calculate Tax has a checkmark.

- Select the Personal tab

- Verify the Birth Date

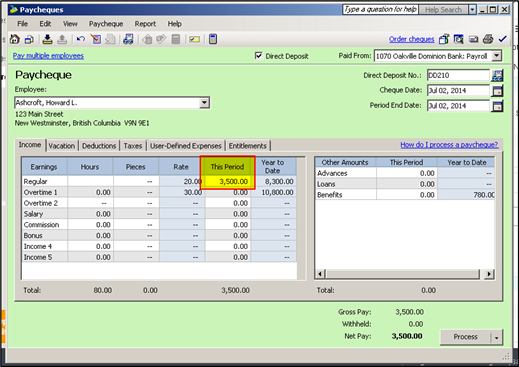

Creating the Paycheque:

- Open the Paycheques journal.

- Create a paycheque as you normally do.

-

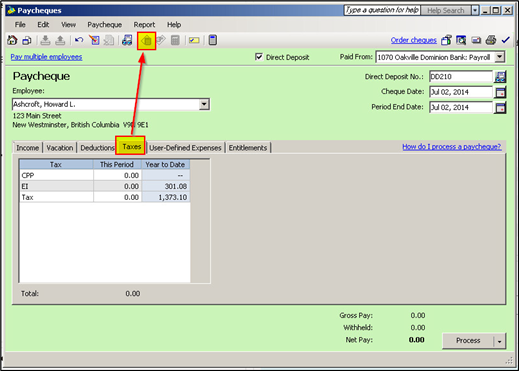

After earning amounts are entered, click on the Taxes tab.

- Verify whether the EI and CPP tax boxes are white or grey.

- If they are grey then automatic calculations are on.

- If they are white (i.e. editable), then Sage 50 is set to calculate manually.

- Select the Calculate taxes automatically icon on the toolbar if not greyed out.

Handy Tips:

- If the Calculate taxes automatically button is greyed out, you may not have access to this feature because of your service plan status. Contact sales at 1-888-261-9610 to purchase a payroll plan.

- If you increase the income, check the taxes. Anytime you modify an already posted cheque, you must also click the icon to recalculate taxes.