Sometimes, employees pay out expenses from their own pockets on behalf of the company. In that situation, you would like to reimburse your employees.

Thanks for RandyW, one of our power users in Sage City, who kindly provides us 2 methods to tackle this entry.

- Setup the employee as a vendor, and enter the purchase and payment like working with any other vendors.

- Setup a new ‘Reimbursement’ income and use it in the employee paycheque.

In the blog today, we will spend more time on method two.

In our example, we have a truck driver who pays the gasoline on behalf of the company when he delivers goods.

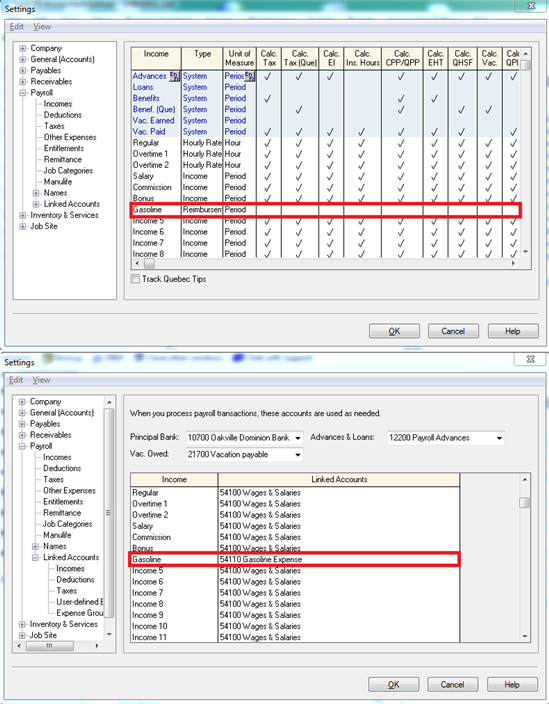

First, we need to setup the reimbursement income by going to Setup, Settings, Payroll, Income. We are going to name the new income gasoline. Do not forget to link the new income with an expense account under Setup, Settings, Payroll, Linked Accounts, Incomes. In our case, we use expense account 54110 – Gasoline Expense

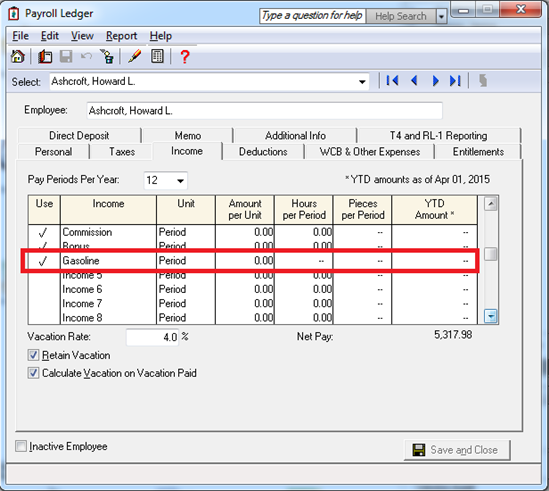

Next, we go to individual employee record, Income tab and make sure there is a check mark under the Use column for Gasoline.

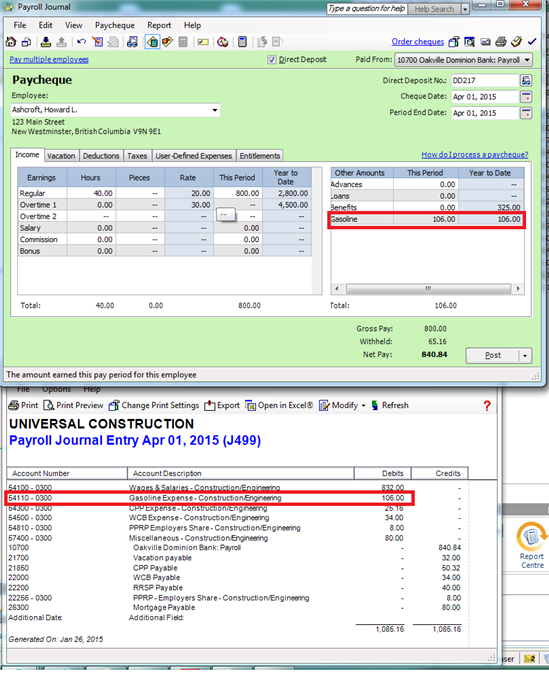

Then, we can start doing the paycheque. We are going to put $106 ($100 gasoline + $6 GST) for the gasoline reimbursement. As you can see from the Payroll Journal Entry report, the $106 goes into the Gasoline Expense account.

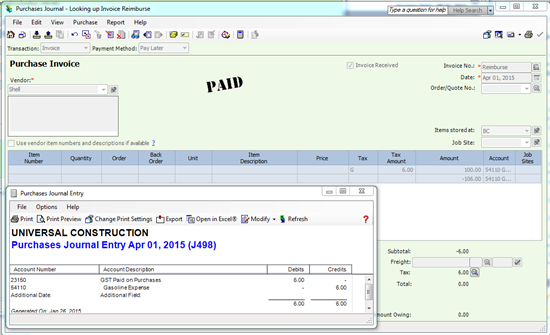

Finally, we need to record the GST. Open the vendor payable invoice and enter the first line as usual. Then, add a last line (no tax code used) with a negative dollar amount for the total of the reimbursement. For both lines, we are going to use the same account, which is 54110 Gasoline Expense. You will end up doing a zero paycheque with GST amount taken away and put it back to the GST Paid on Purchase account.

Top Comments

-

rashelle

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

Comment-

rashelle

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

Children