With the outbreak of COVID-19, we are focused on the wellbeing of our colleagues, families, customers and communities. Our thoughts go out to you and your families as we all balance navigating the challenging business environment, while taking steps to protect those we care for most.

In response to the impact of COVID-19, the government has announced plans for assisting small business during this extraordinary time. Below you'll find some essential resources for Sage 50 CA users.

Preventing Layoffs: About the Wage subsidy

To help prevent layoffs, the government's Economic Response Plan would provide businesses struggling with the economic impact of COVID-19 with a subsidy equal to 10 per cent of employee wages, up to $1,375 per employee and $25,000 per employer.

"Businesses will be able to benefit immediately from this support by reducing their remittances of income tax withheld on their employees’ remuneration. Employers benefiting from this measure will include corporations eligible for the small business deduction, as well as non-profit organizations and charities.”

We've received questions about whether there will be updates or changes made in Sage 50 CA to apply these changes.

The answer is no changes will be made to the program at this time, but we are monitoring this dynamic situation and will update our stakeholders if this changes. For now, the remittance amounts will need to be manually changed by users. Please contact your accountants or the CRA for steps and FAQ.

Here are some Sage Knowledgebase resources:

|

|

EN |

FR |

|

How to setup Payroll remittance |

||

|

Temporary Wage Subsidy For Employers |

Also see, TaxTemplates.ca's FREE comprehensive spreadsheet for the Temporary Wage Subsidy.

Sage 50 CA: How-to

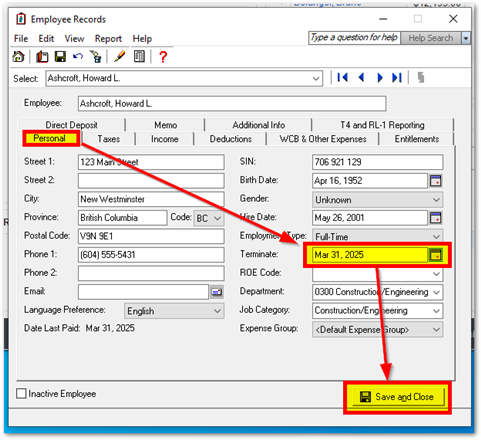

Enter an Employee's Termination Date

Both a termination date and a ROE code (reason for termination of employment) are required to create a Record of Employment.

To enter a termination date in an employee record:

- Open the employee's record.

- In the Home window, click Employees & Payroll on the navigation pane.

- In the Tasks pane, right-click the Employees icon and select Modify Employee from the menu.

- Select an employee from the list and click OK.

- On the Personal tab, enter the last day the employee worked for you in the Terminate box. You can also enter a date in the future if you know when an employee will be terminated.

- Click Save and Close.

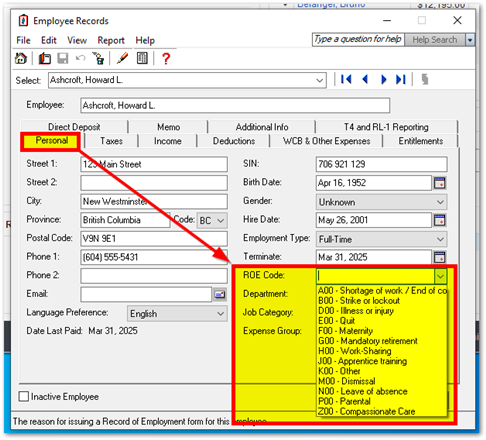

Enter a ROE Code in an Employee Record

Both a termination date and a Record of Employment (ROE) code are required to create a Record of Employment.

To enter a ROE code in an employee record:

- Open the employee's record.

- In the Home window, click Employees & Payroll on the navigation pane.

- In the Tasks pane, right-click the Employees icon and select Modify Employee from the menu.

- Select an employee from the list and click OK.

- On the Personal tab, in the ROE Code list, select a code explaining the reason the employment was terminated. See the Other QnA resources below for tips on what to select.

- Click Save and Close.

How to Create, Print, e-file, Adjust and or Troubleshoot an ROE

|

ROE |

EN |

FR |

|

How to print an ROE and or how to adjust it |

||

|

Terminating an employee |

||

|

How to e-file an ROE? |

||

|

Adjusting ROEs |

||

|

Where can I get ROE blank forms from? |

||

|

I get "not validated" status when trying to submit ROE online |

|

Options for working from home using Sage 50 CA

We've put together a list of tips ranging from setting up your remote employees for success, setting up your remote workstations and software and the helpful cloud connected options available to Sage customers. Visit the post Working remotely for small business owners to read more.

If you have questions about your options when it comes to file sharing on two different locations visit the link the Sage KB 14807 here for details. Please consult your IT technician or Network Administrator for remote access software recommendations that can help your business during this unprecedented time.

Need to issue payments but can't print checks from home?

Consider alternate options like EFT or Bambora. Reach out to our Sage 50 CA sales team at 1-888-261-9610 for more details if you're in need of payment services or payroll module access..

|

|

EN |

FR |

|

How to setup EFT (with video) |

Other Q&A on ROEs, EI & Procedures

REMINDER: When issuing an ROE, do not complete the Block 18 – Comments section.

Any comments will remove the ROE from the automation process and will slow down the claims process.

Q: What is the ROE code for lack of work due to Covid19?

- If employees are sent home because the company is temporarily closing, the reason code on the ROE would be “A” – Shortage of work / End of contract or Season, reference page 5 here for more details.

Q: Our employee returned from an international trip and was quarantined for two weeks. What is the reason code to use on the ROE?

- For an employee who is under quarantine or self-quarantine due to COVID-19, an ROE must be issued with the reason code “D” for illness or injury (there is no specific ROE code for quarantine), reference page 5 here for more details.

Q: We are going to have to close parts of our business because of COVID-19. What code do we use on the ROE?

- If the termination is due to “Shortage of work” use Code “A” Shortage of work, reference page 5 here.

Q: What is the reason code on the ROE for employees who refuse to report to work due to risk of exposure to COVID-19?

- Employers are recommended to use Code N (Leave of absence), reference page 5 here.

Q: Does your Employee not qualify for EI?

- The new Canada Emergency Response Benefit is available for workers who have to stay home because of Covid-19.

Q: Does your business need financial assistance?

- The Covid-19 Emergency Support Benefit is available (for businesses who have to close due to Covid-19).

Q: Do you owe personal taxes this year after filing your return?

- If you file your tax return and owe taxes, you'll have until August 31, 2020 to pay.

More Resources:

- COVID-19 ANSWERS TO EMPLOYER QUESTIONS FROM THE CANADIAN PAYROLL ASSOCIATION

- TaxTemplates.ca's FREE comprehensive spreadsheet for the Temporary Wage Subsidy.

- Federal government COVID-19 tax relief updates

- Canada.ca

Thanks for reading!

For more resources visit: Sage Product Support Resources for help with products in North America

Top Comments