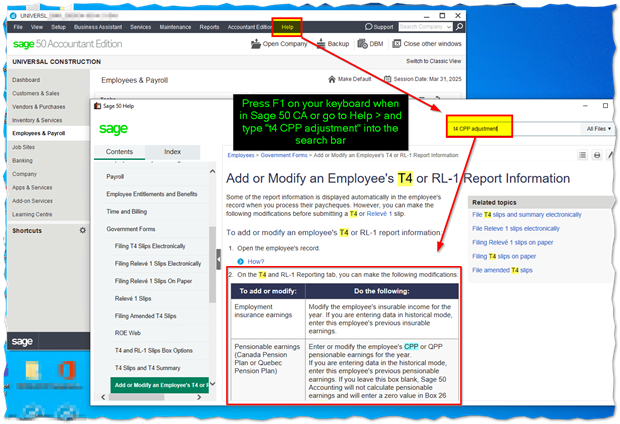

I have a situation where my client issued more paycheques than the bi-monthly payroll and did not adjust for the CPP exemption. As a result, the employee did not contribute sufficient CPP. My question is how can this be adjusted before the T4s are prepared?

Sage 50 Canada

Welcome to the Sage 50 Canada Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Payables and Receivables

Adjusting CPP at year end

How?

How?